Executive Summary: Volume 1

The first volume of NAWRB’s Women in the Housing Ecosystem Report (WHER) uncovers the state of women’s homeownership by analyzing the overall health of the current market and the obstacles women and minorities face in becoming homeowners. The report provides invaluable resources for single women, mothers and couples who are looking to buy their first home, no matter their financial situation.

We highlight stories from real women about their homebuying experience, from what motivated them to buy a home to how this purchase has changed their perspective on life. Whether or not a woman has children or plans to start a family someday, the desire to have a place of one’s own, to plant one’s roots, to be independent, and to feel safe and free to be oneself—in other words, to have a sanctuary—is prevalent among women as a whole.

Key Findings

Minority Homeownership

The report begins by comparing homeownership rates by race and ethnicity, highlighting minority groups who are closing the gap in terms of homeownership compared to Whites. While the homeownership rate for Asians and Hispanics has grown, Black homeownership rates still fall behind both Whites and other minorities—30.5 percent lower than non-Hispanic whites, 4.6 percentage points lower than Hispanics, and 22 percentage points lower than the national homeownership rate. Contributing factors include low income and credit score levels, low percentage of loan applications, and discriminatory lending practices.

Single Women Outpace Men in Homeownership

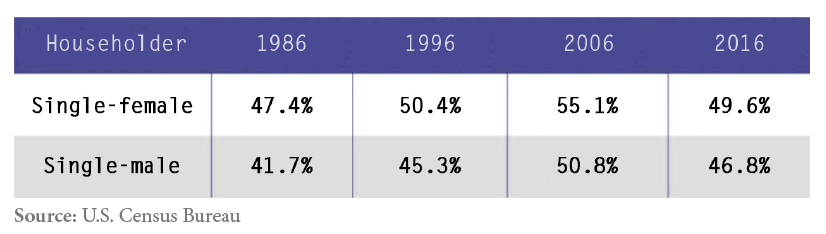

Single women and mothers are attracted to homeownership as a source of stability, a means of wealth-building, a safe place to raise their children and a sanctuary to call their own. According to the U.S. Census Bureau, women have outpaced single men in homeownership for the last thirty years. This report lists some of the factors and trends that have women seeking homeownership, with or without a partner.

More Single Americans are Delaying Marriage

Women, and Millennials in general, are delaying marriage to gain an education and further their careers. U.S. Census Bureau data reveals that one in every five Americans 25 years and older have never been married; in 1960, only 9 percent of Americans occupied this group.

As single women delay marriage to focus on attaining higher education and pursue careers they find satisfying, they in turn build their financial independence. The average annual personal income for college-educated women (who married after age 30) is $50,415, compared with $32,263 for women—of the same age— who have only a high school diploma who married before age 20.

Single Mothers Want a Stable Home for Children

Single women are more likely to raise children on their own than are single men. The Pew Research Center reveals that single-mother households outnumber single-father households by more than three times. Single women may seek homeownership more than single men because they desire stable homes to raise children. Most, if not all, parents, including single women with lower incomes, wish to have a stable home in a safe and supportive community to raise their families.

Women Buyers as Investors

Women entrepreneurs wanting to start lucrative businesses are drawn to the housing ecosystem. Women are building long-term wealth by managing businesses and investing in real estate. The 2012 Survey of Business Owners revealed that the percentage of women-owned businesses has increased about 7 percent for all firms, 2 percent for real estate and leasing firms, and 3 percent for finance and investment firms. The increase of women entrepreneurs in the industry will affect housing development as more women increase their buying power and become homeowners.

Obstacles for Women: Gender Gap, Wage Gap, “Pink Tax,” Career Advancement, and Student Loan Debt

Women are earning less than men for the same jobs, currently 80 cents for every dollar men earn. Women also face a persistent gender gap in the workforce, and find difficulties returning to the workforce when having children. As consumers, they are subject to a “pink tax” on hygiene products and higher lifetime medical expenses, and struggle with more debt than men.

According to the American Association of University Women (AAUW), women carry more student loan debt than men, which equates to almost two-thirds of the $1.3 trillion outstanding loan debt in the U.S. Female undergraduates take on more debt in a year their male counterparts: 44 percent compared to 39 percent. Millennial women face a heavier burden than men because they have lower personal income but with similar loan debt levels.

Other variables that contribute to higher loan debt for women include college major, occupation and working hours. Also, women often take about two years longer than men to pay off their undergraduate loans. These loan amounts rise if women wish to pursue post-graduate education.

This year has seen improvements in homeownership rates for the nation and within several minority groups. The U.S. Census Bureau’s Quarterly Residential Vacancies and Homeownership for Second Quarter 2017 revealed that the homeownership rate is 63.7 percent, which is 0.8 percentage points higher than the rate in the second quarter 2016. This is also a slight increase from the first quarter rate of 63.6 percent.

Current homeownership rates by state are close in percentage to the national rate, although California, at 53.8 percent, trails behind other heavily-populated states. Florida’s homeownership rate is 63.6 percent, Washington is at 64.7 percent and Texas leads with 66.4 percent.

According to Harvard University’s State of the Nation’s Housing 2017 report, there has been growth in household formation within the last decade, rising 960,000 to 1.2 million annually between the years 2013 to 2015. The millennial generation and minorities have contributed to the increase in household formation, and will continue to do so in the future. Although the percentage of adults ages 18-34 living with family in 2015 was at an all time high, at 35.6 percent, the millennial generation composed 7.6 million new households between 2010-2015. As more members of this group reach their early 30s, they are most likely to live independently, which will cause a surge in the household growth in the future.

By 2025, household growth is projected to reach 13.6 million, with minorities driving almost 75 percent of this increase. Hispanics alone are expected to account for a third. As the white population increases slowly, the report predicts that minorities will account for over 90 percent of household growth between 2025-2035.

Minority Homeownership

This year (2018) marks the 50th anniversary of the Fair Housing Act. Initially passed in 1968, the act intends to promote equality in the housing sector by prohibiting discrimination on the basis of race, color, national origin, religion, sex, disability or familial status. The homeownership gap between whites and some minorities has narrowed in recent years. The homeownership rate for both Asians and Hispanics increased by 5 percent in 2016, to 55.5 percent and 46 percent, respectively. This narrowed the gap between these groups and the white homeownership rate by 2.8 percent. Moreover, Asians and Hispanics have increased their share in home buying activity, from 1 out of 7 in 2001, to 1 out of 5 in 2015.

Despite this encouraging improvement, the homeownership rate between whites and Blacks have only widened. Over the last 12 years, the homeownership rate for Blacks fell to 42.2 percent, while the white homeownership rate rose to 71.9 percent in this same period. In 2016, the gap between these two groups widened by 2.3 percentage points to 29.7 percent. Even more troubling, the gap is also increasing between the black homeownership rate and those of other minorities. The black homeownership rate is 30.5 percent lower than non-Hispanic whites, 4.6 percentage points lower than Hispanics, and 22 percentage points lower than the national homeownership rate.

Contributing Factors to Low Black Homeownership Rates

The reasons behind the fall of black homeownership are complicated. An article by Scotsman Guide on this phenomenon points to various studies that have shown that this group has lower credit scores, lower incomes and lower education levels than whites, compared as a whole. Although other sources point to the fact that education levels are on the rise: according to the U.S. Census Bureau, the number of African American college students was 2.9 million in 2016, an increase from 306,000 in 1964.

Rolf Pendall, Co-Director of the Metropolitan Housing and Communities Policy Center, adds that African American households have continually faced illegal and legal discrimination in the housing market, especially in mortgage lending, over the last 75 years. The Pew Research Center reports that, in 2015, African Americans accounted for less than 4 percent of conventional loan applications, and they were denied loans at a higher rate than any other ethnic group.

This low percentage of loan applications, as well as the low homeownership rate, may be due to the fact that African Americans are wary of applying for home loans due a history of being the target of predatory lending practices decades ago. For instance, some were presented with exotic home loans that removed the equity from their homes and left them vulnerable to foreclosure during the market crash.

Income and Poverty Levels in the United States

In 2016, we saw a slight rise in income levels across household types and poverty levels on a slow decline. Recent U.S. Census Bureau data reveals that the median household income level was $59,039, a 3.2 percent increase from 2015—the second consecutive annual increase. Between 2015 and 2016, the real median household income of married couples increased by 1.6 percent, while the income for single female householders increased by 7.2 percent.

Women also increased their earnings in relation to men’s by 1.1 percent; the female-to-male earnings ratio is now 0.805. This is the first annual increase of the female-to-male earnings ratio since 2007, almost a decade!

Minority householders also had an increase in median income levels, for the second year in a row. The income for non-Hispanic whites increased by 2.0 percent, 5.7 percent for African Americans and 4.3 percent for those of Hispanic-origin. The median income percentage change of Asian households was not statistically significant during this time period.

There were 40.6 million people in poverty in 2016, this is 2.5 million fewer than in 2015, and 6.0 million fewer than two years ago. The official poverty rate also declined to 12.7 percent, down by 0.8 percentage points from the previous year. According to 2016 Census Bureau data, 26.6 percent of families with a single female householder, with no husband present, are below the poverty level rate—twice the poverty rate of single male householders, with no wife present. Moreover, female householders have 42.1 percent of the children under 18 years old in poverty and 49.1 percent of the children under 6 years of age in poverty. Overall, female householders make up 51.2 percent of all families below the poverty line.

To facilitate the further decline of poverty rates, the housing market and policymakers will have to assist in helping low-income households find affordable home to provide stability and generate economic wealth.

Poverty and Housing

Harvard’s State of the Nation’s Housing 2017 reports that low-income households, those earning under $15,000 a year are unable to afford a vast majority of rental units, let alone houses, especially in metro areas. A National Low Income Housing Coalition study found that for every 100 low-income renters—those earning 30 percent of the area median income—there are only 35 rental units which they can afford, though they are in inadequate conditions, and are not occupied by higher income households. When we consider metropolitan areas, the number of such rental units drops to 20 for every two low-income renters.

With low inventory of rental units that are affordable and in adequate condition, low-income households are forced to live in units that are potentially unsafe. Harvard’s report reveals that between 2000 and 2015, the measure of the poor population living in high-poverty neighborhoods increased from 43 percent to 54 percent. This can have hazardous consequences, including long-term damage, on the health of low-income household owners and their families.

WISEPlace — “A Community of Housing and Hope for Women”

“Women, Inspired, Supported, Empowered” provides the acronym and driving force of WISEPlace, an organization committed to helping women overcome unemployment and homelessness by “providing safe, affordable transitional housing, healthy meals, financial-empowerment curriculum and employment assistance,” as well as personalized counseling from its management. Their facilities include a Hotel for Women, “a 30-bed transitional housing shelter for single women,” which opened its doors in 1987.

In late October of 2017, the 18th Annual WISEPlace “A Home for the Holidays” took place in Orange, CA, celebrating the success stories of women creating better lives. Featuring an evening of entertainment with a dinner and live auction, “A Home for the Holidays” inspired attendees by depicting the change we can create when we utilize our power and help others. The event offered individual tickets, table packages, donations, advertising options and sponsorship opportunities. All proceeds raised went to WISEPlace’s program assisting women residents in their journey to self-sufficiency.

NAWRB was in attendance and witnessed the wonderful teamwork that makes the program possible every year. We were represented by our CEO and President Desirée Patno who attended the event with Kellie Aamodt, Vice President of Sales, West Region, UPS.

“It was a privilege to be able to participate in this brilliant event and program,” stated Desirée Patno, NAWRB CEO and President. “Women need to support one another and together strengthen our relationships, especially with the high poverty levels that women experience. This is a great reminder of all we can accomplish when we put our vision and passion into practice with effective collaboration.”

“WISEPlace is one of the few places where an unaccompanied homeless woman can go to put her life back together,” stated Kathleen Davis Bowman, Executive Director, WISEPlace. “Together with their personal hard work, we are able to change the trajectory of their lives from homeless and hopeless to self-sufficient and confident. Homeless women have unique needs and are particularly vulnerable, and women just seem to understand too well how truly frightening homelessness would be. We are excited at the prospect of sharing our very unique programming with the women of NAWRB, and look forward to a partnership in solving the issue of homelessness for the 1 in 4 homeless adults that are unaccompanied women.”

With their passion and hardwork, WISEPlace has transformed the lives of more than 7,500 women since its inception in 1924, and they continue to change the lives of about 90 women each year.

A Woman’s Home is More Than Just a Home- It’s Her Sanctuary!

Increase in single homebuyers in the United States

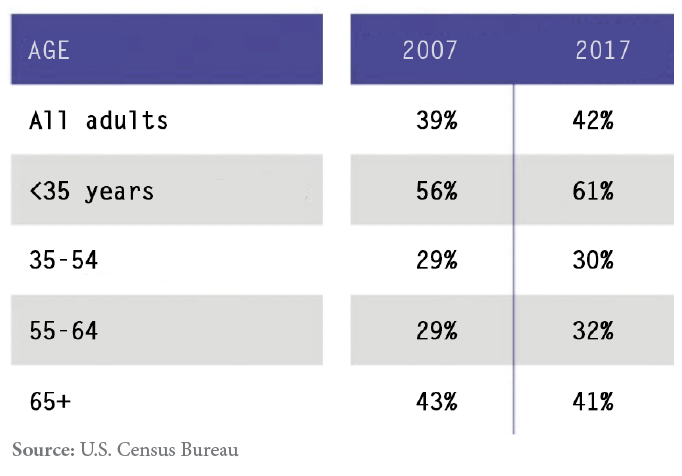

Single Americans are not waiting for marriage to reap the benefits of owning a home. Unmarried men and women comprised 59.8 million households in 2016, just about 47.6 percent of households across the nation. In 2017, the share of adults living without a spouse or partner increased to 42 percent from 39 percent in 2007. What are we to make of this increase?

Two demographic trends have influenced this development of more people living alone, reports the Pew Research Center. First, as mentioned earlier, the number of married adults has fallen. According to 2016 U.S. Census Bureau data, 45.2 percent of Americans ages 18 and older are unmarried. This amounts to over 110 million people. Of these, women make up 53.2 percent.

Second, the number of adults living with a romantic partner has grown. Although the share of U.S. adults living with a partner has grown, this has not counterbalanced the decrease in marriage—one in every five Americans 25 years and older has never been married, compared to just 9 percent in 1960—which has caused an increase of “unpartnered” Americans. See the chart below for a percentage of adults living without a partner or spouse, by age:

The median household income of married or cohabitating adults is $86,000, compared to the $61,000 household income for adults living without a partner or spouse. “Unpartnered” adults are also over twice as likely to be living in poverty (17% vs. 7%).

Pew researchers emphasize that “unpartnered” adults are “disproportionately” young, as 28 percent of them live with either a parent or grandparent. This reflects the trend among the young generation to postpone marriage later than their elders.

College-educated women benefit from delaying marriage

The benefits for delaying marriage in the United States vary by class, according to a University of Virginia report. College-educated women have largely benefitted from marrying later; other demographics, however, may have trouble adjusting to this shifting trend in marrying age.

The benefits for delaying marriage in the United States vary by class, according to a University of Virginia report. College-educated women have largely benefitted from marrying later; other demographics, however, may have trouble adjusting to this shifting trend in marrying age.

Women who marry older make more money per year than women who marry young, amounting to a 56 percent difference. The average annual personal income for college-educated women (who married after age 30) is $50,415, compared with $32,263 for college-educated women who married before age 20.

Best cities for single women homebuyers

Owners.com recently ranked the best cities for single women to own their own homes. The analysis ranked the top 50 metropolitan cities in the country based on the following factors: percentage of single women homeowners; housing affordability; median female income (based on average of $39,586); violent crime rate; average cost of dinner for two; and walkability and transit scores.

Cincinnati was ranked as the top city in the homebuying market for single women. It had the most affordable average home value at $158,100. Coincidentally, it is also a top city for jobs based on pay, open positions and career satisfaction. Albany, NY has the highest share of single women homeowners at 18.1 percent, and Hartford, CT had the highest average home value at $245,900.

Below is a list of the top ten ranked cities for single women to buy their first homes, based primarily on income and average home value:

1. Cincinnati

• % of single women homeowners: 15.2

• Average home value: $158,100

• Median female income: $40,392

2. Kansas City, Missouri-Kansas

• % of single women homeowners: 16.5

• Average home value: $162,000

• Median female income: $40,098

3. Dallas

• % of single women homeowners: 13.7

• Average home value: $169,000

• Median female income: $40,484

4. Albany, NY

• % of single women homeowners: 18.1

• Average home value: $189,100

• Median female income: $42,921

5. Atlanta

• % of single women homeowners: 15

• Average home value: $181,700

• Median female income: $40,472

6. Milwaukee

• % of single women homeowners: 16.9

• Average home value: $190,000

• Median female income: $40,910

7. Hartford, Connecticut

• % of single women homeowners: 16.2

• Average home value: $245,900

• Median female income: $50,795

8. Minneapolis

• % of single women homeowners: 15.1

• Average home value: $226,300

• Median female income: $45,970

9. Raleigh-Durham, North Carolina

• % of single women homeowners: 16

• Average home value: $204,100

• Median female income: $41,311

10. Chicago

• % of single women homeowners: 15.9

• Average home value: $218,900

• Median female income: $43,217

11. Philadelphia; 12. Boston; 13. Washington, DC; 14. Portland, OR.; 15. Seattle; 16. Denver; 17. Sacramento; 18. NYC; 19. LA; 20. SF

Why single women gravitate towards homeownership

A home is a woman’s sanctuary, a place to call her own and an invaluable asset that cements one’s professional progress and economic foundation. Homeownership provides a better life for women and their families, as well as a stable location for home-based women entrepreneurs to grow their businesses.

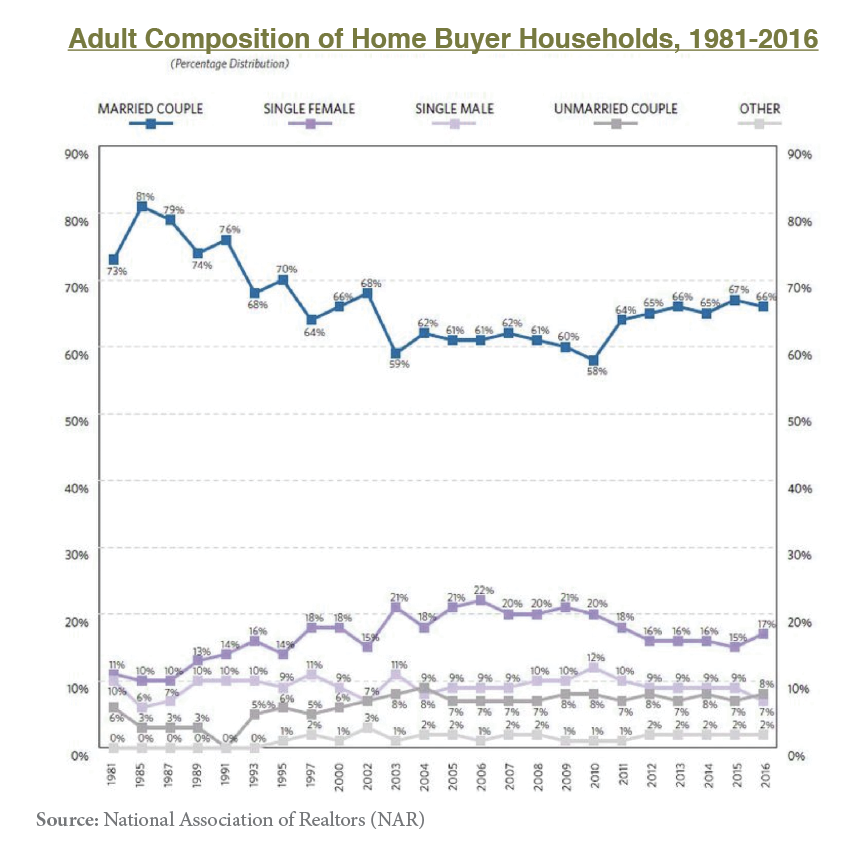

Although women have been ahead of men in NAR’s data since 1981, the gap has widened even further in recent years, said Jessica Lautz, NAR’s managing director of survey research and communications. Property values and mortgage lending imploded after the 2008 financial crisis, and low interest rates have made lending more appealing to new, more frugal buyers.

Single mothers want a stable home for their children: Single women are also more likely than single men to parent on their own, Lautz noted, and therefore likelier to seek stable housing for raising children. There were 9.5 million single-mother households in 2012, more than four times the 2.2 million single-father households, according to the U.S. Census Bureau.

Homeownership helps wealth building: “A mortgage can provide financial security. I think women, even with lower incomes, want a place where they can have roots and really own a place. The psychological desire to do that is great,” says Lautz, NAR Managing Director.

Differences by gender in single homeownership and home values

Women buy homes at later age than men and for lower prices: When single women do buy their first homes, they do so at an older age, 34, than men, 31, according to NAR research from last year. And women are buying at a lower average price: $173,000 compared with $190,600.

Single women have “slightly higher foreclosure rate than men”: 73 per 10,000 vs. 70 per 10,000, Daren Blomquist, a senior vice president with ATTOM Data Solutions, said. One reason may be that men’s properties involved larger initial sales and appreciated faster than women’s.

“There’s a domino effect,” Blomquist said. “Because of the wage gap, you see women having to purchase lower-value homes, and they’re more open to risk when they do. Typically what causes a foreclosure is some kind of shock, like a job loss. If you have a lower-value home that’s appreciating less quickly, you have less of a cushion than someone who has seen their value appreciate more.”

Differences in Buying for Single Women and Couples

Couples, married or unmarried, normally have more buying power than single homebuyers because they have two sources to pull from that could go toward mortgage payments. According to 2016 NAR data, married couples have the highest income of around $99,200, compared to single women or men and unmarried couples. Stringent lending standards make it more difficult for singles applying for loans with one income.

Dependence on a primary income is not deterring single women from buying homes. NAR reports the percentage of single women homebuyers increased from 15 percent to 17 percent from 2015 to 2016. Moreover, single women are buying more homes than single men—17 percent compared to 7 percent

Homebuying Process for Single Women

• Single women are independent, thus all home buying decisions—including where to live, how much of a mortgage payment they can afford, how to decorate their house, etc.—will be made by them. These will most likely be working women, so they will have limited time to dedicate to searching for a home.

• They are interested in buying a home as a means of wealth-building. They are taking the necessary steps to ensure their financial security in the future, whether or not they have a partner.

• As a single woman, size may not be as important as location and affordability. Some women are interested in owning a home to get a pet. Houses with a sizable backyard will be important for women with a furry companion.

• Stringent lending standards make it more difficult for singles applying for loans with one income. Dependence on a primary income is not deterring single women from buying homes. NAR reports the percentage of single women homebuyers increased from 15 percent to 17 percent from 2015 to 2016. Moreover, single women are buying more homes than single men—17 percent compared to 7 percent.

Homebuying Process for Single Mothers

• Single mothers will be working with a limited income, and saving money will be difficult because of child-related expenses.

• Mothers want a stable home to raise their children, so they are looking for a property they can afford in the long-term.

• Single mothers will prefer a location in a safe, supportive community with a low crime rate and reputable education system. They also want nearby infrastructure and basic amenities like shopping centers, hospitals and parks.

• Single women, especially those with families, will be attracted to owning a home that makes their lives easier and makes them feel safe. After all, your home should be the place you feel most safe.

• Smart home technology is becoming popular for all buyers, but it could be especially important and appealing to single mothers; the technology includes security alarms, intercom systems, carbon monoxide detectors and nightlights.

• Working mothers, like other single women, have limited time on their hands. However, single mothers are crunched even more for time—being a mother is another job in itself.

Homebuying Process for Couples

• Homebuyers will make joint decisions with their partners, considering their future goals and those of their spouse.

• Whether or not these couples plan to have children (if they do not already have them) will affect how big of a house they want.

• Couples will have to decide with their partners who will own the home and claim title. What they choose will affect the logistics of property division down the road.

• Couples, married or unmarried, normally have more buying power than single homebuyers because they have two incomes; according to 2016 NAR data, married couples have the highest income ($99,200) among homebuyers, compared to single women or men and unmarried couples.

Advice for Single Women Buyers

Buying your first home is an important and worthwhile investment, not only for your future wealth, but for your personal stability and growth. Take these steps when purchasing your first home:

1. Check your Credit: Review your credit record and pay down debt

2. Consider Costs: Think of costs beyond purchase price and mortgage closing costs. These may include association fees, property taxes, utilities, maintenance and insurance.

3. Have Enough Savings: Make sure you have enough savings for long-term homeownership. This will amount to six months’ worth of income saved for all costs.

4. Don’t Look Alone: Have your family or friends join you as a supportive soundboard when you make the big decision.

5. Think Ahead: When looking at homes, think about what changes may happen in the future, such as a job relocation or finding a partner. Your home can be turned into an investment property down the road.

Resources for Single Women and Single Mothers

Single women, including single mothers, have many assistance programs to help them in the homebuying process. Programs are offered by the Federal Housing Authority (FHA), and at the local and state level. Mortgage Credit Certificates (MCCs) and Individual Development Accounts (IDAs) are also at their disposal.These programs can help single mothers buy homes and assist in the down payment regardless if they have a low income or poor credit history.

• FHA: They offer programs for first time buyers (or those who haven’t owned a home in 3 years). Their FHA home loans, for instance, only require a 3.5 percent down payment.

• Local and State: State and local government programs are available for low- to moderate-income buyers. Most can be found at the local level in designated cities, counties and neighborhoods. To find one near you, visit the Down Payment Resource Index.

• The states with the most programs include California (380); Florida (238); Texas (181); and Maryland (84).

• To find housing assistance resources by state, go to HUD’s online directory.

• MCCs: First-time buyers who meet income-eligibility requirements can receive tax credits which offset some mortgage interest expense by allowing them to withhold less tax from their paycheck. These are offered by state and local governments.

• IDAs: Organizations offering IDAs help people with limited incomes—earning no more than 200% of the Federal Poverty Income level—save for a downpayment by matching their savings. In 2016, the Poverty Income level for a family of four was $24,300. Savings can be as low as $25, and can be matched as high as 8:1.

• Search your demographic: There are loans available for certain niches of homebuyers that may apply to you. Some loans, for example, focus on union members, emergency workers, teachers, college graduates or veterans.

Advice for Couples Buying Together

In a recent trend, couples are opting to purchase a house together before tying the knot. A study by Coldwell Banker reports that one in 4 couples between the ages of 18 and 34—the age range of the Millennial generation—bought a house together before getting married.

A poll by Time MONEY of 500 Millennials found that 40 percent think it’s “a good idea” for couples to buy a home before marriage. Moreover, 37 percent think this purchase should happen before the wedding.

Just like married couples, unmarried couples enjoy the benefit of having two incomes to go toward purchase price, mortgage payments and other bills and fees. However, buying a home as a couple is a complicated process, which becomes even more difficult in the event of a break up. The following are financial tips for unmarried couples looking to purchase a home together, recommended by Time.

• Compare Your Credit: Purchasing a home as an unmarried couple is often equated to a business deal. Homebuyers should talk to each other about their credit scores because this will impact the ability to obtain a mortgage and interest rates. While creditors view married couples as a single unit, unmarried couples are assessed as individuals when applying for a loan together. Consider the potential benefits and risks of having one person apply for the loan as opposed to both partners.

• Open a Joint Bank Account: Setting up a joint bank account can be useful for payments related to your home. Each partner can set up automatic monthly deposits into the account from their individual bank accounts.

• Managing Costs: When two people cosign on a mortgage, one partner is liable for the debt in case the other cannot make payments, such as an unexpected illness and injury or job loss. With this in mind, make sure to choose a home with a mortgage you can possibly cover with on income.

Testimonials from Real Single Women Homebuyers

Single women homeowners pursue homeownership for various reasons, but they all relate to the desire for freedom—in where they want to live and how they want to live. Below are testimonials from real women who made their dreams of homeownership a reality, all on their own:

Hilary Sutcliffe, 35 years old, bought her first home near upstate New York: “I didn’t need to wait until marriage to buy. I had the money, so I thought, what am I going to do with it? The mortgage, with taxes and insurance, is comparable to rent. And there’s a freedom to owning. I can paint my walls hot pink if I want.”

Lynnette Bruno, in her late 30’s, bought her dream home in San Francisco for her dream dog:“I always wanted to be a homeowner, and I didn’t care if I had a partner or not. I wanted a backyard so I could have the dog I always wanted.”

Michelle Jackson, a 30-something writer in Denver, did not need a partner to buy her home: “A lot of people in my circle of friends were women purchasing their homes when they got married, but I still felt like I wanted to build my own wealth and buy. If and when I met someone, it’s something that just added to what I bring to the relationship. It didn’t make sense to wait.” After buying her home, “I’m so happy,” Jackson said. “It’s completely changed how I feel connected to the place where I’m living. It’s one of the best things I’ve ever done.”

Rachel Weiss, a Fashion Executive in NYC, felt psychological fulfillment when she bought her one-bedroom home:“I’m in my 40s, and I looked at what my life was like. I’m not married, I don’t have kids. I can live alone, and fabulously. I feel empowered.”

Whether they desire to own a home to: start building their wealth; be close to family and friends; have a stable house to raise their children; have a property fit for pets; renovate and decorate their homes however they want; or feel truly connected to where they live, single women are not waiting for marriage to get these benefits, and they will make necessary sacrifices, whether it means taking a second job or adjusting their budgets to afford a down payment. They are living their single lives fully, and they are empowered.

Whether they desire to own a home to: start building their wealth; be close to family and friends; have a stable house to raise their children; have a property fit for pets; renovate and decorate their homes however they want; or feel truly connected to where they live, single women are not waiting for marriage to get these benefits, and they will make necessary sacrifices, whether it means taking a second job or adjusting their budgets to afford a down payment. They are living their single lives fully, and they are empowered.

Women are Redefining the American Dream

Unmarried women may be likelier than men to seize singledom as a lifestyle, said Bella DePaulo, a professor at the University of California at Santa Barbara and the author of Singled Out. “Despite the stereotypes that insist that women care more about marriage than men do, it may actually be single life that women embrace more than men,” DePaulo said. “Some research suggests that single women are especially unlikely to be lonely—again, contrary to our stereotypes. … I think that buying a home is a way of living your single life fully, rather than seeing your single years as just marking time until you find The One.”

In 2014, for the first time in history, single Americans outnumbered married ones, at 50.2 percent of the population. Rebecca Traister, author of All the Single Ladies (2016), explains that the rise of the single woman is a historical event that “entails a complete rethinking of who women are and what family is and who holds dominion within it.”

Bella DePaulo, a psychologist who presented at the American Psychological Association’s 124th Annual Convention last year, offers an uplifting take on singledom, or coupledom, or whatever kind of “American Dream” you wish to live:

“There is no one blueprint for the good life,” noted the scientist, who has analyzed 814 studies on people who have never married, concluding that any assumption about single people being less happy is largely based on faulty research. “What matters is not what everyone else is doing or what other people think we should be doing, but whether we can find the places, the spaces and the people that fit who we really are and allow us to live our best lives.”

Trends & Analysis

One area in personal finance where women outpace men is homeownership. In fact, the rate of homeownership of single women has been above the rate of homeownership for single men for over thirty years. Currently in the US, single women account for 17 percent of homebuyers, compared to 7 percent of single men. According to Jessica Lautz, Managing Director of NAR, this gap is only getting bigger. What factors are contributing to this trend?

Increase in Single Americans; Millennials are Delaying Marriage

Women, and Millennials in general, are delaying marriage to gain an education and further their careers. U.S. Census Bureau data reveals that one in every five Americans 25 years and older have never been married; in 1960, only 9 percent of Americans occupied this group. Men outnumber women in the group of single Americans in this age bracket—23 percent compared to 17 percent—but single women are beating single men in homeownership.

Single Women are Focusing on Education and Careers; Making More Money

As single women delay marriage to focus on attaining higher education and pursue careers they find satisfying, they in turn build their financial independence. A report by the University of Virginia shows that women who marry older make more money per year than women who marry young; this difference amounts to a staggering 56 percent. The average annual personal income for college-educated women (who married after age 30) is $50,415, compared with $32,263 for women—of the same age— who have only a high school diploma who married before age 20.

Financial Obstacles for Single Women: Gender Gap; Wage Gap; Pink Tax; Career Advancement; and Student Loan Debt

College-educated women still face unique obstacles in attaining wealth, which their male counterparts do not. Women are earning less than men for the same jobs, currently 80 cents for every dollar men earn. Women also face a persistent gender gap in the workforce, and find difficulties returning to the workforce when having children. As consumers, they are subject to a “pink tax” on hygiene products and higher lifetime medical expenses, and struggle with more debt than men.

According to the American Association of University Women (AAUW), women carry more student loan debt than men, which equates to almost two-thirds of the $1.3 trillion outstanding loan debt in the U.S. Female undergraduates take on more debt in a year their male counterparts: 44 percent compared to 39 percent. Millennial women face a heavier burden than men because they have lower personal income but with similar loan debt levels.

Other variables that contribute to higher loan debt for women include college major, occupation and working hours. Also, women often take about two years longer than men to pay off their undergraduate loans. These loan amounts rise if women wish to pursue post-graduate education.

The AAUW states that women are more likely than men to report that education costs influenced their decisions to delay homeownership and take less desirables jobs, or jobs outside of their field. In fact, NAR reports that single women are buying their first homes around age 34, compared to age 31 for single men.

Student loan debt is also affecting entrepreneurship. According to a survey by Gallup and Purdue University, out of 63 percent of Millennials who graduated with student loan debt, 19 percent have delayed starting their own businesses because of their debt. If Millennials have outstanding debt exceeding $25,000, this percentage increases to 25 percent. This is important because entrepreneurship is a tried and true way of building wealth from which women could benefit.

Homeownership Provides Women a Source of Wealth-Building

Despite these obstacles, single women are gravitating toward homeownership because it is also a dependable source of wealth-building. Mortgages can provide women with financial security, and mortgage lending is becoming more attractive to those with a modest personal income. As Lautz notes, the stock market crash almost ten years ago caused property values and mortgage lending to collapse. The resulting low interest rates, however, have made lending more appealing to cautious buyers.

Single Women Buy Homes at Lower Prices than Single Men

Single women, among this group of frugal buyers, often buy homes for lower prices. NAR reports that single women buy homes at an average price of $173,000, while single men are purchasing homes at around $190,600. Because of the wage gap, women are having to buy lower value homes than men, but doing so leaves women at risk. If an unexpected shock happens in a woman’s life, such as a job loss, she will be vulnerable to foreclosure.

Women have a slightly higher foreclosure rate than men. As Daren Blomquist, a senior vice president with ATTOM Data Solutions, explains, this can be explained by the fact that men are buying their homes at higher prices, causing them to appreciate faster. In contrast, when women buy homes at lower prices, they appreciate less quickly, leaving them with less “cushion” in case of emergency.

Single Mothers Want a Stable Home for Children

Single women are more likely to raise children on their own than are single men. The Pew Research Center reveals that single-mother households outnumber single-father households by more than three times. Single women may seek homeownership more than single men because they desire stable homes to raise children. Most, if not all, parents, including single women with lower incomes, wish to have a stable home in a safe and supportive community to raise their families.

Whether or not a woman has children or plans to start a family someday, the desire to have a place of one’s own, to plant one’s roots, to feel free to paint one’s walls with neon pink and green stripes, and to feel safe and free to be oneself—in other words, to have a sanctuary—is prevalent among women as a whole.

Women Buyers as Investors

Women entrepreneurs wanting to start lucrative businesses are drawn to the housing ecosystem. Women are building long-term wealth by managing businesses (even from out of their homes) and investing in real estate. The 2012 Survey of Business Owners revealed that the percentage of women-owned businesses has increased about 7 percent for all firms, 2 percent for real estate and leasing firms, and 3 percent for finance and investment firms. The increase of women entrepreneurs in the industry will affect housing development as more women increase their buying power and become homeowners.

Real estate investment, with its potential high returns, offers women a great way to boost their income stream. Women business owners will often begin investing in real estate once they accrue enough capital, while some are able make real estate investment their primary source of income.

Popular methods of investment include “flipping homes” for profit and buying properties to rent out. According to a 2017 Realty Shares report, while only 15 percent of Americans currently invest in real estate, 68 percent (about two-thirds) of women believe flipping a home is a good way to make money. Most women between the ages of 35 and 44 agree at 76 percent. Seventy-two percent of Millennial women between the ages 18 and 34 also think investing in real estate is a good source of income.

Other ways in which women are increasing their purchasing power include the attainment of higher-level employment throughout various industries in the housing ecosystem, as small business owners, senior executives, high net worth individuals and more. However, there is still unconscious biases in the workplace that need to be addressed to further diversity in boardrooms and in the C-suite. These obstacles are especially formidable for women of color affected by the intersection of gender and race, who achieve advancement at lower rates than women of other ethnicities and races.

In the next volume of this report, we will look at the advancements women professionals have made as entrepreneurs and in varying levels of the corporate ladder, and how ultra-high net worth women are investing their money and contributing to the economy.

Policy Suggestions & Resources

To make sure that the needs of women’s economic growth are met through policy decisions, NAWRB regularly participates in discussion regarding proposed policy and legislation by responding to Requests for Information (RFIs) and Requests for Comments (RFCs). It is important to communicate with policy decision makers to help inform them about issues that they may not be privy to and whom their choices may affect. Our full responses can be viewed at the corresponding government entities’ websites.

We are also committed to informing our network about current resources available to prospective homebuyers, homeowners and business owners. In this section of the report, we emphasize resources that are at the disposal of renters and homeowners, but are easily missed because people simply do not know they are available. These include disaster recovery loans from institutions such as the U.S. Small Business Administration (SBA), which are available to renters and homeowners whether or not they own a business.

1. Federal and Housing Finance Agency (FHFA) Minority and Women Inclusion

In 2017, the FHFA released their Minority and Women Inclusion Amendments Final Rule, following a Notice of Proposed Rulemaking (NPRM) and Request for Comments (RFC) published by the FHFA in October 2016 calling for the public’s input on the proposed changes to their minority and women inclusion amendments.

NAWRB submitted comments in response to this request, offering our thoughts, support and suggestions regarding the proposed changes. The language from our comments were implemented into the FHFA’s publication of their Final Rule, which can be found at www.fhfa.gov.

Full Integration of Diversity and Inclusion (D&I) Efforts

Regulated entities’ D&I efforts should be fully integrated in their operations, rather than isolated efforts. Overall, D&I can reach its greatest potential if entities adopt it in all aspects of their business practices. It is our goal that entities make intense efforts to utilize diversity and inclusion practices within their business, making it second nature as a daily routine. The cascading effort of D&I within a community provides more equality for job opportunities, business ownership, homeownership and wealth growth for future generations.

The regulated entities must be required to incorporate D&I into an existing plan as this would establish a new corporate baseline. As long as D&I is a separate strategic plan, it will be perceived as an afterthought, increasing the possibility of it not being as valued or executed within the entity’s overriding structure.

Mentorship Programs for Women

We believe that training and mentorship programs can be introduced without being a heavy burden on neither the entity nor its employees. Women often start their careers in lower positions and may not be equipped for a higher role in comparison with other applicants. We suggest that entities create mentorship programs to prepare women for their next opportunity.

This will help ensure that women in lower positions have competitive qualifications when they get to the top. Additionally, these programs will help entities recognize women’s skills and abilities, possibly providing a return on investment if the company hires her or promotes her to an executive role.

2. Disaster Loans and Other Resources for Renters and Homeowners

From the hurricanes that hit Texas, Florida and Puerto Rico, to the wildfires and mudslides that devastated parts of California, the past year has been fraught with catastrophic natural disasters which have uprooted countless Americans from their stable lives. All victims of declared natural disasters—businesses, private nonprofits, homeowners and renters—are able to apply for low-interest disaster loans from the U.S. Small Business Administration (SBA) to help them recover. Renters and homeowners do not have to own a business to apply.

SBA Disaster Loans

The SBA offers low-interest disaster loans for businesses, private nonprofits, homeowners and renters who need assistance with uninsured costs. Even those insured for natural disaster damage are encouraged to apply for a SBA Disaster Loan. The SBA can lend you the amount of your total loss, even if you are unsure about how much your insurance will cover.

Resources for Renters and Homeowners

Renters and homeowners are eligible to apply for the SBA’s no cost, low-interest rate disaster loans even if they do not own a business. According to the SBA website, renters and homeowners may borrow up to $40,000 to repair or replace clothing, furniture, cars or appliances.

Homeowners may borrow up to $200,000 to repair or replace their primary residence to pre-disaster condition. Moreover, loans may be increased up to 20 percent of total amount of physical loss to make improvements that lessen the risk of future property damage.

Renters and homeowners can apply for both FEMA assistance and SBA disaster loans simultaneously with zero cost, so do not wait until you get a response from FEMA. You do not have to accept an SBA low-interest rate loan even if you are qualified.

3. Department of Labor (DOL) Research and Evaluation

In 2016, the Department of Labor requested information from the public regarding efforts to improve the quality and use of research and evaluation of the nation’s workforce. NAWRB suggests the following areas of inquiry for the DOL in future research, including gender patterns and pay in occupations and industries, maternity leave, women’s retirement security and harassment of all forms.

Gender Patterns and Pay in Occupations and Industries

The U.S. Census Bureau reports that women’s median income is 80 percent of men’s median income. This is blatant inequality that needs to be addressed and rectified in order to encourage and secure the progress of women in the workforce and in our country. If women earn less than men, have less means and access to resources, how can they be expected to equally traverse the same professional and personal arenas?

In order for women to continue to grow and progress, they need to earn what they deserve, and there needs to be a greater amount of women in C-suite executives roles in companies throughout the U.S. Women are largely overlooked when it comes to executive positions, even though companies with gender diverse boardrooms and executive offices have been proven to outperform firms with male-dominated executive teams. Addressing these problems will prove extremely beneficial to the American workplace; they are worthy focuses of the DOL’s time and resources.

Women’s Retirement Security

Recent reports affirm that women fall short—much more than their male counterparts—of saving the money they need for retirement. There are several contributing factors to this disparity, from women living longer and having higher medical expenses than men to them earning about 80 cents for every dollar a man earns. Everyone should be able to retire with assurance; women’s retirement security is a prevalent issue that needs to be resolved.

Maternity Leave

The importance of established and accepted maternity leave cannot be overstated. Starting a family and having a rewarding career are achievements that can take place simultaneously. The struggle to make this a reality in the American workplace is common. The U.S. offers the least amount of paid leave in the world, and recent studies show women working at companies that offer paid leave often endure inter work environment scrutiny for taking time off.

By helping institute maternity leave into the American workplace, the DOL could create a more inclusive work environment in which women are afforded the freedom—as are men—to work and live without needing to constantly consider whether their gender is placing their career at risk.

Sexual Harassment

Sexual harassment in the workplace continues to be an issue, and even more alarming is that it is predominantly accepted and shrouded in the rare instances when it is exposed. Fortunately with the #MeToo movement, we are seeing more women come forward with their experiences of sexual harassment in the workplace. Not only are women beginning to be heard, but organizations are taking action in response to these reports.

There needs to be a better system for reporting instances of sexual harassment, and the work environments where employees are condemned for voicing these grievances need to be eliminated. We need to hold culprits accountable and protect employees being harassed.

4. National Environmental Policy Act (NEPA) Compliance, Forest Service

In January 2018, the Forest Service agency proposed revisions to its National Environmental Policy Act (NEPA) to improve efficiency of environmental analysis in order carry out its mission of increasing the health and productivity of the nation’s forests, as well as promoting sustainable land use.

NAWRB members are active collaborating partners with green and sustainable corporations and brands, and engaged in the housing ecosystem. NAWRB and Noemi Lujan Perez, Vice President of Government and Media Relations, ECO Diversity Media, co-authored the following comments in response to the agency’s Advanced Notice of Proposed Rulemaking (ANPR) regarding process and analysis requirements; approaches to landscape-scale analysis; actions that should be included in environmental assessments; and ways the agency might expand and enhance environmental review and authorization decisions.

General Comments

The NEPA process as conducted by the Forest Service and other federal agencies would benefit from change to be more efficient and timely to meet NEPA’s objective of facilitating reasonably informed decision making regarding proposed federal agency actions with significant environmental effects.

NAWRB members’ experience reflects that the processing of applications for leases, permits, and other Forest Service authorizations is often delayed because it and other federal licensing or regulatory agencies participate in the NEPA and related permitting processes sequentially rather than simultaneously. Moreover, there is usually not an overall schedule, with enforceable timelines for deliverables from the agencies, that is adopted, or accountability for missing due dates in a project schedule. In addition, some project opponents seek to delay projects through appeals that lack merit.

All of these problems can be remedied or alleviated through updated regulations and other administrative actions. Finally, special attention should be focused on providing CEs for forest and watershed health projects designed to improve water flow and quality, and to implement measures that prevent or reduce the risk of destructive forest fires or insect and disease infestations, or that rehabilitate burned or infested areas.

Login

Login