Thank you to everyone who attended our NAWRB Women’s Economic Growth, Investments & Homeownership event in Irvine, CA on April 30th! A splendid, energetic group of potential homebuyers and real estate professionals gathered at the Lutron Training Center to hear invaluable information about how to serve women and veteran markets, acquiring capital investment opportunities and leveraging current trends in women’s homeownership.

Our expert speakers included Desiree Patno, CEO & President of NAWRB, Than Le, Mortgage Loan Officer of NeighborWorks Orange County, and Dolores White, OC Chapter Secretary of Veterans Association of Real Estate Professionals (VAREP). Key topics included Best Practices for Leveraging Women’s Homeownership, Know Your Value: In Both a Personal and Professional Environment; Transitioning to Business Ownership; What I Wish I Knew – Investment Opportunities and Access to Capital; and Personal and Professional Branding and Its Impact.

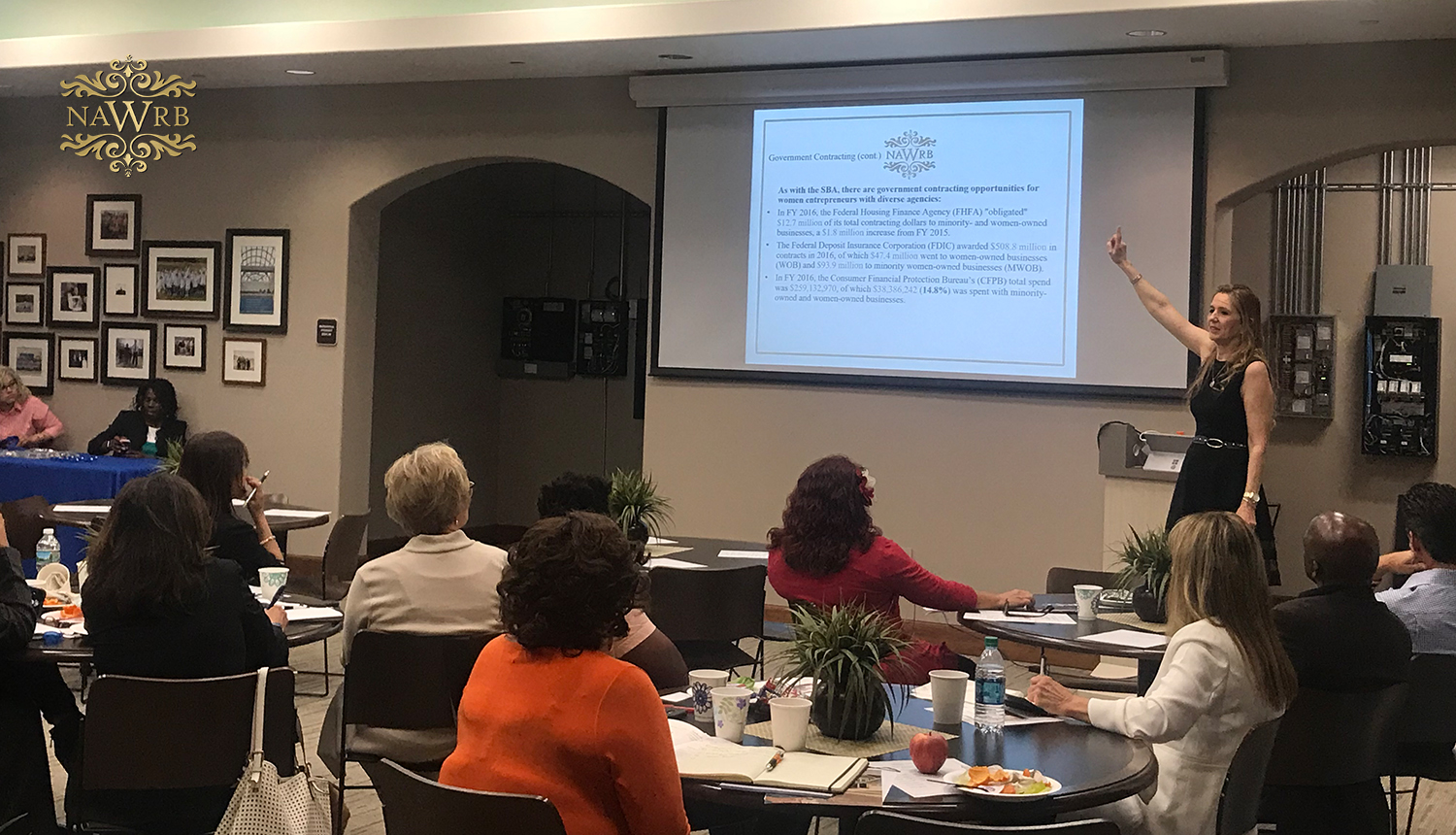

Desiree Patno began the event by sharing her professional journey in the housing ecosystem, and discussing the mission and various initiatives of NAWRB. Afterwards, she shared her insight and data regarding women’s economic growth, investments and homeownership. From women- and minority-owned to veteran- and LGBT-owned certification, leveraging business classifications can help you seize opportunities for advancement, including with the government.

Certifying one’s business can give yourself an advantage in the contracting arena, solidify your presence in the diversity and inclusion space, and maximize your appeal to companies looking to work with women- or minority-owned businesses.

In May 2017, the U.S. Small Business Administration (SBA) announced that the federal government awards $19.67 billion in federal small business contracts to women-owned small businesses. Certified businesses also have access to a variety of capital and investment opportunities, from banks to venture capital dollars.

According to Bloomberg, women make 85 percent of all purchasing decisions—and 91 percent of new home purchasing decisions—in the U.S. Desiree shared the importance of marketing to women in order to capitalize on women’s purchasing decisions. Businesses should take care to represent today’s women in their marketing, and portray them accurately. Diversifying your representation of women and maximize your engagement in the market.

Women face unique obstacles to achieving homeownership that professionals need to be aware of to serve their clients. Women face a persistent gender wage gap (typically earning 80 cents for every dollar men earn), lack of mentorship and advancement opportunities, a “pink tax”, student loan debt and higher mortgage rates than their male counterparts.

U.S. Census Bureau data from 2016 reveals that 26.6 percent of families with a single female householder, with no husband present, are below the poverty level rate—twice the poverty rate of single male householders, with no wife present. Women’s poverty is an important issue that needs to be addressed in achieving women’s financial independence and increasing homeownership rates.

Dolores White took the stage after Desiree to share the incredible work VAREP does for veterans by providing education and advocating for their benefits and opportunities in the real estate industry. VAREP is a “non-profit 501(c)(3) and HUD-approved housing counseling organization dedicated to increasing sustainable homeownership, financial-literacy education, VA loan awareness, and economic opportunity for the active-military and veterans communities,” their website states.

As the daughter of a veteran, Dolores has a passion for serving and has a personal dedication to her volunteer work. VAREP helps veterans by informing them of their benefits and helping them transition to life after service. A surprising number of veterans are unaware of the benefits at their disposal, which could be costly when they apply for a mortgage loan. In the past, as Dolores mentions, women veterans did not know of such benefits because mortgage lenders neglected to ask them about their military history, most likely due to gender bias.

This organization drove policy change back in 2015 when they advocated for the Federal Housing Finance Agency (FHFA) to develop a new universal loan application dataset that includes information about a borrower’s current or prior military service. As a result of their efforts, Fannie Mae and Freddie Mac adopted this change into their URLA forms.

Thanh Le brought the event home with her engaging discussion of how NeighborWorks Orange County empowers people to build wealth through homeownership. With an emphasis on excellence, innovation, integrity and respect, NeighborWorks Orange County endeavors to achieve their mission to strengthen communities and enhance the residents’ quality of life “by promoting housing opportunities, financial responsibility and civic engagement. Thanh shared incredible personal stories of women and families that have used their program to achieve homeownership.

According to their 2016 Impact Report, the company has empowered 598 people through their education and counseling services for homebuyers, while 133 have benefitted from their home-retention services. NeighborWorks Orange County has helped 179 families become homeowners. In addition, they have over $86 million of indirect investment in Orange County’s economy. Their services have created jobs, mobilized residents and build wealth for their community.

We appreciate everyone who participated in this event, and we look forward to future collaborative events towards increasing women’s economic growth and gender equality. In case you missed it, watch the video below for the event highlights.

Login

Login