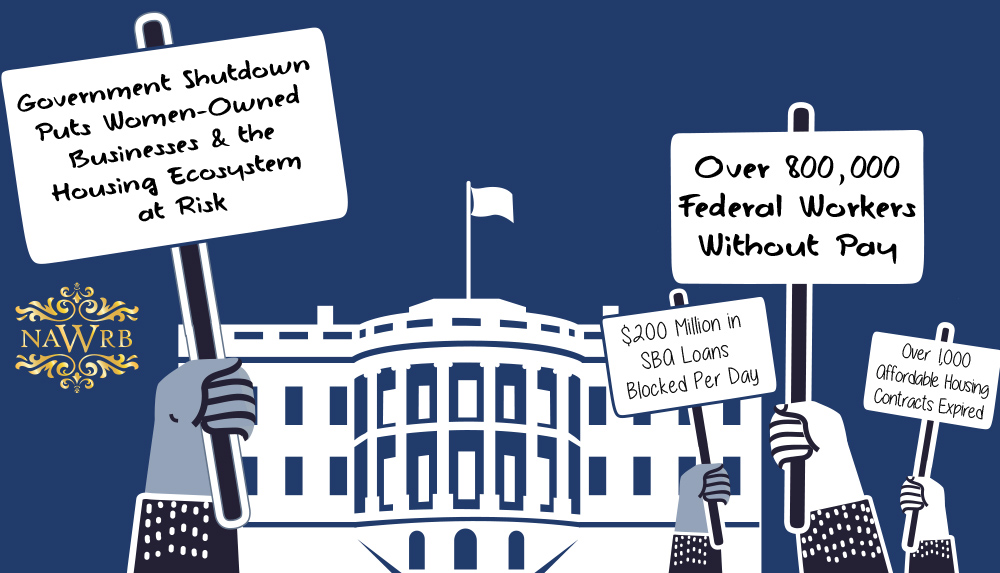

Today marks the 27th day of the partial government shutdown that started on December 22nd, 2018, which is now the longest government shutdown in U.S. history. Many, but not all, government agencies have been affected, causing federal employees to either be furloughed or to work without pay, national parks to close and affordable housing funding has come to a halt, among other effects.

Know an Incredible Woman Preserving the

Quality of Life During COVID-19?

Submit your story today!

Read More

Consulting & Branding Opportunities

Grant your business access to insider,

proven knowledge to improve the quality of your procured

services and maximize business performance.

If you need D&I

Contact Us!

A Team Focused on Bring Diversity and Inclusion to Every Level

Learn More

#1 Top Real Estate Influencer

Desiree Patno

Diversity & Inclusion, Quality of Life, Know the Rules of the Game ®

Your Next Event

Grow Your Business

NAWRB: An SBA Resource

NAWRB is listed as a women-owned business resource for the SBA.

Check It Out

NAWRB Aging Population

Help Protect Elders

from Financial Abuse

Over $36.5 billion a year is lost annually in the U.S.

Prevent Financial Abuse

Women's Homeownership:

Dream. Stability. Sanctuary.

Life often presents us

with unplanned disruptions.

AI Technology

with

a Human Touch

Is

The Perfect Balance

NAWRB Women's Global Resource Center

A women’s depository for vendors & clients to grow their diverse spend & increase women’s employment at all levels within the housing ecosystem.

Tag Archives: SmallBusinesses

SBA Announces Proposed Changes to Small Business Procurement Rules

The U.S. Small Business Administration (SBA) released proposed changes to the small business procurement rules, including several provisions to the National Defense Authorization Acts (NDAA) of 2016 and 2017, and the Recovery Improvements for Small Entities After Disaster Act of 2015 (RISE Act). The new proposed rule is expected to have a substantial impact on small business contracting.

U.S. Small Business Administration Celebrates 65th Anniversary

Monday, July 30th, marked 65 years that the U.S. Small Business Administration (SBA) has been in service for millions of entrepreneurs and small businesses. Founded on July 30, 1953, the SBA has provided small businesses “with access to funding, mentoring, counseling, and when disaster strikes, support to recover and get back to business,” their press release states.

SBA Announces Joint Initiative with United Technologies Corporation

The U.S. Small Business Administration (SBA) released a statement by Administrator Linda McMahon about their new strategic joint initiative with United Technologies Corporation (UTC), a Connecticut-based company. UTC announced that it plans to hire 35,000 new employees, invest $15 billion in the United States over the next five years, and spend $75 billion for its U.S. suppliers, with $19 billion going to small businesses.

SBA Grant Helps Houston Create 300 Small Businesses

The University of Houston has received a $2.3 million continuation grant from the U.S. Small Business Administration (SBA) to help them create 300 new small businesses in Houston, Texas. The recipients of the award—Bauer College’s Small Business Development Center—services around 10,000 businesses a year in 32 counties along the Gulf Coast.

Free SBA HUBZone Webinars for Small Businesses

From February to mid-March, the U.S. Small Business Administration will offer small businesses a free six-part, webinar series to help them utilize its Historically Underutilized Business (HUB) Zone Program. Each webinar will include an hour of important tips on how businesses can grow their bottom line by making the most of their available resources.

Post-Crisis Small Business Bank Lending at a Slow Crawl

A recent report from the U.S. Small Business Administration (SBA)’s Office of Advocacy assesses changes in bank lending to small businesses in comparison to levels during the financial crisis. Following a review of banks of varying sizes and financial health, findings reveal a slow recovery in the small business loan market and a more pronounced growth in the total business loan market.

Login

Login