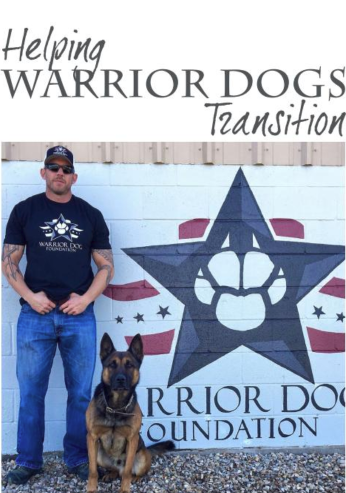

I was asked to speak about the amazing Warrior Dog Foundation of which I am honored to serve on their Board of Directors at the recent Five Star Conference. We live free because of the sacrifices of those with two feet and the ones with paws.

The Warrior Dog Foundation is dedicated to serving the special operations K-9 community. The K-9’s deployed with these special forces are of the top tier in the working dog world. They are expected to perform in the most austere of environments and face conditions that most humans cannot survive.

The Warrior Dog Foundation was founded by former Navy SEAL Mike Ritland. We believe Special Operation Forces (SOF) and law enforcement K9s deserve the highest level of care in retirement. We bridge the gap between service and retirement for these K9s. Once these retired warriors have completed their service and, for whatever reason, are unable to continue on with their handler, the Warrior Dog Foundation helps transition these K9 heroes from an operational environment into our state-of-the-art kennel facility. We then ensure the care of each individual K9 with dignity and grace, including both mental and physical rehabilitation for the rest of their lives with the goal to rehome, if possible.

The K9 warriors at the Warrior Dog Foundation are the top tier in the working-dog world. They perform in the most austere of environments and face conditions that most human beings cannot imagine. These K9’s are vital to the success of every mission. We strive to educate the public on the importance of K9s in combat and law enforcement, and showcase the level of sacrifice these dogs give in support of our troops and communities.To quote our founder, Mike Ritland, “These dogs are not only our best friends, they embody what’s best about us—the courage, loyalty, and heart of true warriors.”

To learn more about the Warrior Dog Foundation and our retired K9 heroes individual stories, please, visit our website at www.warriordogfoundaiton.org or email any questions to info@warriordogfoundation.org.

Laura Dietz

Broker/Owner

Summit Realty/ Merlin Enterprises, Inc.

Login

Login

The excitement was palpable as attendees filtered into the Hilton Orange County/Costa Mesa and settled into their seats next to future strategic partners and collaborators. Desirée Patno, NAWRB CEO and President, kick-started the event by recognizing the hard work that went into making the conference possible and the professionals who made time in their busy schedules to be a part of the diversity and inclusion (D&I) movement.

The excitement was palpable as attendees filtered into the Hilton Orange County/Costa Mesa and settled into their seats next to future strategic partners and collaborators. Desirée Patno, NAWRB CEO and President, kick-started the event by recognizing the hard work that went into making the conference possible and the professionals who made time in their busy schedules to be a part of the diversity and inclusion (D&I) movement.