Bill would improve access to lending, business training and federal contracting for women-owned businesses

Senator: ‘This legislation will help break through the 21st Century glass ceiling’

WASHINGTON, D.C. – U.S. Senators Maria Cantwell, Chairwoman of the Senate Committee on Small Business and Entrepreneurship, joined Senators Ben Cardin (D-MD), Jeanne Shaheen (D-NH), Kirsten Gillibrand (D-NY), Tammy Baldwin (D-WI), and John Walsh (D-MT) in introducing legislation this week aimed at giving women entrepreneurs equal treatment when it comes to starting and growing their own businesses.

The “Women’s Small Business Ownership Act of 2014” (S. 2693) would improve access to lending and increase business counseling and training services for women entrepreneurs, and give women-owned businesses the same level of access to federal contracts as other disadvantaged groups.

“Women make up half of the population, and we have a lot of ideas that could become great products and spur our economy,” Cantwell said. “This legislation will help ensure women entrepreneurs get the right tools they need to turn those ideas into new businesses and create jobs.”

The legislation adopts recommendations from a recent Senate Small Business Committee report that showed significant barriers for women looking to start or grow their own business. The report highlighted how women-owned businesses represent a $3 trillion economic force and support 23 million jobs, but still face significant barriers compared to their male-owned counterparts.

Women entrepreneurs account for just $1 out of every $23 in small business lending, despite representing 30 percent of all small companies. They are also more likely to be turned down for loans or face less favorable terms than men, according to the July 23 report, 21st Century Barriers to Women’s Entrepreneurship.

To address those gaps, the legislation would:

- Expand and improve the U.S. Small Business Administration (SBA) Microloan and Intermediary Lending programs to reach more women borrowers who need up to $50,000, as well as reauthorize the SBA Intermediary Lending program – now a pilot program – to provide more women access to loans between $50,000 and $200,000. The legislation would allow Microloan lenders to increase lending capacity from $5 million to $7 million and improve the program to better meet borrowers’ needs through more flexible terms and expanded technical assistance. Women often face difficulty in getting right-sized loans that fit their needs, according to the report, and this will help fill a gap not met by traditional private lending. The Microloan program targets new and early-stage small businesses as well as borrowers with limited credit history who can’t receive financing from a traditional lending institution.

- Allow sole-source contracting for federal contracts awarded through the Women-Owned Small Business Federal Contract program, which would put women-owned businesses on equal footing with other disadvantaged groups in the contracting process. The legislation would change current law, and aims to help the federal government meet its goal of awarding 5 percent of contracts to women-owned businesses – a goal that has never been reached since it was established by legislation 20 years ago. When this goal is not reached, women-owned companies miss out on $4 billion in federal contracting opportunities each year.

- Increase funding for the Women’s Business Center program to expand and improve counseling and training services to reach more women entrepreneurs, especially in low-income areas. The program, overseen by SBA’s Office of Women’s Business Ownership, issues grants to nonprofits that provide these services. The centers assist 150,000 clients annually, and helped women to access more than $25 million in capital in fiscal year 2013. The centers help address the unique challenges women entrepreneurs face, such as less capital to invest and responsibility for child care or elder care. The legislation would reauthorize the program through 2019 and nearly double the annual funding authorization. It also would establish clear metrics to measure each center’s success.

- Require data on women-owned small businesses by establishing a 2015 deadline for an SBA study to identify industries in which women-owned small businesses are under-represented. The original deadline was 2018.

“Small businesses are at the heart of America’s economic engine. We need to ensure that our women entrepreneurs have the right tools available to help them succeed,” Cardin said. “I’m proud to support the Women’s Small Business Ownership Act, which gives women a fair shot at helping improve our economy and strengthen the middle class through small business ownership.”

“Small businesses are at the heart of America’s economic engine. We need to ensure that our women entrepreneurs have the right tools available to help them succeed,” Cardin said. “I’m proud to support the Women’s Small Business Ownership Act, which gives women a fair shot at helping improve our economy and strengthen the middle class through small business ownership.”

“Women are an essential part to growing our economy and creating jobs, but they are wholly underrepresented as business owners and contract and loan recipients,” Shaheen said. “By addressing the challenges women entrepreneurs and business owners face, we will give women, job seekers and our economy the tools they need to grow and succeed.”

“Our economy desperately needs to grow more small business start-ups,” Baldwin said. “This legislation invests in job creation, supports our American entrepreneurial spirit, and will help strengthen the economic security of women and their families.”

“This bill will ensure that women entrepreneurs have access to capital and opportunity,” Walsh said. “By making sure today’s leaders have the resources to start their own businesses, we will encourage the next generation of entrepreneurs to pursue their goals, strengthening Montana’s economy and creating jobs.”

“Small businesses are the backbone of our economy and the most powerful job creators we have,” Gillibrand said.“And the fact is, women are increasingly the new family breadwinner. Women are the primary income earner for a growing share of homes across America. The key to a growing economy, and the key to an American middle class that is built to thrive in the 21st century is women. When we equip more working women with the tools and the opportunities to achieve their best in the economy, and their best for their family, that’s when America’s middle class will thrive again. Without a doubt, if given a fair shot, women will be the ones who ignite our economy and lead America’s middle class revival.”

The Women’s Small Business Ownership Act has received strong support from key stakeholders including Women Impacting Public Policy, the Association for Enterprise Opportunity, the Association of Women’s Business Centers, U.S. Black Chambers, Inc., the U.S. Hispanic Chamber of Commerce, the National Venture Capital Association, and 32 community development organizations from 20 states.

-Press Release from U.S. Senate Committee on Small Business & Entrepreneurship

Login

Login

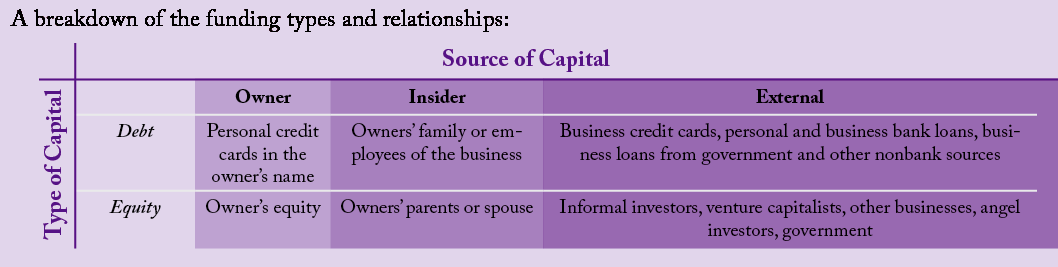

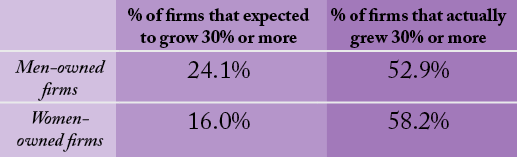

are more likely to have characteristics that are associated with lower amounts of capital in general—these include less previous industry experience, less previous startup experience, and lower credit scores, being a sole owner, and being home-based. However, these trends occur even among women-owned firms with high growth potential. One of the biggest differences seen was with regards to the amount of outside equity used. The presence of women is notoriously low on the investment side, e.g. as angel investors. Increasing women’s presence on the investment side (e.g. as angel investors) might help ameliorate some supply-side issues.

are more likely to have characteristics that are associated with lower amounts of capital in general—these include less previous industry experience, less previous startup experience, and lower credit scores, being a sole owner, and being home-based. However, these trends occur even among women-owned firms with high growth potential. One of the biggest differences seen was with regards to the amount of outside equity used. The presence of women is notoriously low on the investment side, e.g. as angel investors. Increasing women’s presence on the investment side (e.g. as angel investors) might help ameliorate some supply-side issues.

So how did today begin for you? When you woke up did you instantly grab your smartphone, tablet, or notebook? How different was your morning routine 5-10 years ago? Gone are the days of responding to a client’s needs after you get into the office. Some of us may long for those lingering mornings, while others can’t wait to connect, check in, reply, and update our status. No matter your viewpoint, technology is encroaching on our daily lives and it will continue its creep. Clients’ expectations have changed as well. Because there is no stopping this momentum we should view this shift as an opportunity to improve customer service and satisfaction. In order to stay ahead of the competition you must embrace technological advances, discover your “value-added,” and utilize tools that work for you.

So how did today begin for you? When you woke up did you instantly grab your smartphone, tablet, or notebook? How different was your morning routine 5-10 years ago? Gone are the days of responding to a client’s needs after you get into the office. Some of us may long for those lingering mornings, while others can’t wait to connect, check in, reply, and update our status. No matter your viewpoint, technology is encroaching on our daily lives and it will continue its creep. Clients’ expectations have changed as well. Because there is no stopping this momentum we should view this shift as an opportunity to improve customer service and satisfaction. In order to stay ahead of the competition you must embrace technological advances, discover your “value-added,” and utilize tools that work for you. Warning: if you are scared of technology, you are at risk of being left behind. It’s okay to admit that you aren’t the most comfortable or proficient. However, stating that it adds little to no value to you could be detrimental to your long term relevancy in this business. Although an agent’s role in a real estate transaction will not be replaced, technology solutions are subtly altering the process by minimizing your involvement with each step along the way. This is essentially giving you more time to exceed expectations. Don’t waste it. This trend will continue so you need to find ways to remind your clients of your value proposition.

Warning: if you are scared of technology, you are at risk of being left behind. It’s okay to admit that you aren’t the most comfortable or proficient. However, stating that it adds little to no value to you could be detrimental to your long term relevancy in this business. Although an agent’s role in a real estate transaction will not be replaced, technology solutions are subtly altering the process by minimizing your involvement with each step along the way. This is essentially giving you more time to exceed expectations. Don’t waste it. This trend will continue so you need to find ways to remind your clients of your value proposition. them. What works for you? What do you do manually now that you wish you could do digitally? If you are manually doing something that can be automated, you’re wasting time. In today’s robust app marketplaces, you are bound to find a solution that is just right for you and your unique approach to your business. Finding that perfect mobile application that helps you take notes, scan documents outside your office, or generate new leads should be fun and more often than not, free. But stay focused. Remember to choose the apps that will help you accomplish your goals in a manner that works best for you.

them. What works for you? What do you do manually now that you wish you could do digitally? If you are manually doing something that can be automated, you’re wasting time. In today’s robust app marketplaces, you are bound to find a solution that is just right for you and your unique approach to your business. Finding that perfect mobile application that helps you take notes, scan documents outside your office, or generate new leads should be fun and more often than not, free. But stay focused. Remember to choose the apps that will help you accomplish your goals in a manner that works best for you.

More specifically, the Senate report identified critical challenges women confront in three issue areas: access to capital, access to business training and counseling, and access to the federal marketplace. According to the report, women entrepreneurs account for just $1 out of every $23 in small business lending in the United States, despite representing 30 percent of all small companies. Women’s Business Centers (WBCs) provide entrepreneurial and business training to women entrepreneurs (which they do efficiently and effectively at a cost of approximately $137 per entrepreneur) but are stretched extremely thin with most states having just one center with a small staff.Despite a 500 billion dollar a year federal marketplace, women-owned small businesses got only 4.3 percent of federal contracts in FY2013, despite a Congressionally mandated goal of five percent.

More specifically, the Senate report identified critical challenges women confront in three issue areas: access to capital, access to business training and counseling, and access to the federal marketplace. According to the report, women entrepreneurs account for just $1 out of every $23 in small business lending in the United States, despite representing 30 percent of all small companies. Women’s Business Centers (WBCs) provide entrepreneurial and business training to women entrepreneurs (which they do efficiently and effectively at a cost of approximately $137 per entrepreneur) but are stretched extremely thin with most states having just one center with a small staff.Despite a 500 billion dollar a year federal marketplace, women-owned small businesses got only 4.3 percent of federal contracts in FY2013, despite a Congressionally mandated goal of five percent.

NAWRB’s Inaugural Women in Housing Financial Fitness Road Show is a first-of-its-kind, breakthrough program for women in all industries within the housing economy. More than just tools to navigate women’s existing business through the changing terrain, NAWRB’s Women in Housing Financial Fitness Road Show reached a whole new level. Utilizing a specialized hybrid of women in housing and women in government outreach, women can take advantage of our Fast Track niche. By connecting women with federal and local programs, set-asides, funding options and contracting opportunities available to grow their businesses both vertically and horizontally, women in housing will have the awareness to sustainable growth and live beyond commission to commission.

NAWRB’s Inaugural Women in Housing Financial Fitness Road Show is a first-of-its-kind, breakthrough program for women in all industries within the housing economy. More than just tools to navigate women’s existing business through the changing terrain, NAWRB’s Women in Housing Financial Fitness Road Show reached a whole new level. Utilizing a specialized hybrid of women in housing and women in government outreach, women can take advantage of our Fast Track niche. By connecting women with federal and local programs, set-asides, funding options and contracting opportunities available to grow their businesses both vertically and horizontally, women in housing will have the awareness to sustainable growth and live beyond commission to commission. “Thank you for having the vision and for putting it all together! It was a great event!” -U.S. SBA-Santa Ana District Office, Economic Development Specialist Sylvia Gutierrez.

“Thank you for having the vision and for putting it all together! It was a great event!” -U.S. SBA-Santa Ana District Office, Economic Development Specialist Sylvia Gutierrez.

With more aggressive lending compliance standards and regulations in 2014, lenders have been scrambling to implement internal systems in order to comply. Every real estate professional should understand the central issue that will impact their clients who obtain loans at the closing table: the “Ability to Repay” Rule (ATR).

With more aggressive lending compliance standards and regulations in 2014, lenders have been scrambling to implement internal systems in order to comply. Every real estate professional should understand the central issue that will impact their clients who obtain loans at the closing table: the “Ability to Repay” Rule (ATR).

Mortgage loan volumes have experienced a consistent drop across all lenders throughout 2014. In the first quarter, lenders made a total loan volume of $226 billion, an all-time low amount that hasn’t been achieved since 1997. One of the largest lenders, Wells Fargo, took the hardest hit with a 67% drop in originated residential mortgages.

Mortgage loan volumes have experienced a consistent drop across all lenders throughout 2014. In the first quarter, lenders made a total loan volume of $226 billion, an all-time low amount that hasn’t been achieved since 1997. One of the largest lenders, Wells Fargo, took the hardest hit with a 67% drop in originated residential mortgages.

homeowners with mortgage debt increased by 2.3 million. Rising home values and the trend of people purchasing their first homes in the latter half of their lives all contribute to the increase in mortgage debt.

homeowners with mortgage debt increased by 2.3 million. Rising home values and the trend of people purchasing their first homes in the latter half of their lives all contribute to the increase in mortgage debt.