- Men tend to start businesses with twice as much capital as women, $135,000 vs. $75,000.

- The biggest difference in amount of capital between men and women was with regard to outside equity, in which women receive only 2% of total outside funding compared to men, who receive 18%.

- Women were more likely to be discouraged from applying for loans due to fear of denial – and justifiably so: in 2008, women-owned businesses were much more likely to have their loan applications denied than their male counterparts.

- Women entrepreneurs tend to raise smaller amounts of capital to finance their firms and are more reliant on personal, rather than external, sources of financing as compared to male entrepreneurs.

- Entrepreneurs should consider founding businesses with other people. According to the study, many investors are reluctant to fund a single business owner because of the difficulty for one person to scale a business. Additionally, they should also complete a cost-benefit analysis of what equity financing can do, carefully weighing the upside (financial, social, and human capital) of external equity with the downside (less control of the company’s future).

For Funders, the study recommends increasing outreach to find women entrepreneurs with investment-ready firms. Similarly, they should increase the number of women on the financing and investment side, such as angel investors, members of a venture capital pitch committee, and in other roles.

- For the Entrepreneurship Ecosystem, the study recommends encouraging women to participate in STEM fields prior to entrepreneurship. Although women are on par with men regarding educational attainment, previous research indicates that women are less likely to have degrees in STEM fields – and these fields are more likely to offer opportunities for growth-oriented entrepreneurship. Additionally, business programs focused on women and women-led and –owned businesses should be established and strengthened, including accelerator and incubator programs, equity financing programs, and business mentorship and training programs that target women-owned firms with high-growth potential.

- A recently published SBA Advocacy study, Understanding the Gender Gap in STEM Fields Entrepreneurship, backs up the last set of recommendations, finding that women who attended universities with industry-funded research and development are more likely to start an entrepreneurial venture. It also found that women are just as likely as men to be entrepreneurs when their first postdoctoral job is in a STEM industry.

Last, but certainly not least, women should think bigger and bolder by foregoing the notion that business debt is bad.

Login

Login

Dr. Bonnie Schnitta is the founder and CEO of SoundSense, LLC, a turnkey acoustical consulting and engineering company that also offers a complete line of acoustic products, experienced installation crews, and construction consulting.

Dr. Bonnie Schnitta is the founder and CEO of SoundSense, LLC, a turnkey acoustical consulting and engineering company that also offers a complete line of acoustic products, experienced installation crews, and construction consulting.

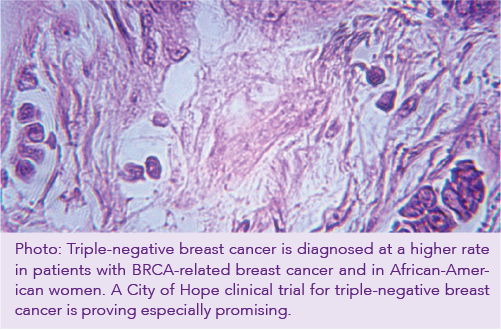

City of Hope researchers are fighting back by studying these cancers, in hopes of discovering more effective treatments.

City of Hope researchers are fighting back by studying these cancers, in hopes of discovering more effective treatments. “We are learning that triple-negative breast cancer consists of at least a half-dozen subtypes, each of which may require personalized therapies,” says Somlo.

“We are learning that triple-negative breast cancer consists of at least a half-dozen subtypes, each of which may require personalized therapies,” says Somlo.