Last month you read about all the fantastic resources available to you through the U.S. Small Business Administration (SBA) and its resource partners, including SCORE. This month we delve deeper into how SCORE assists entrepreneurs like you in starting and growing business enterprises every day all across the country.

Started in 1964, SCORE (Service Corps of Retired Executives) is a nonprofit association dedicated to helping small businesses get off the ground, grow and achieve their goals through education and mentorship. Celebrating its 50th anniversary this year, SCORE has assisted over 10 million of America’s entrepreneurs in that time. As a national organization, SCORE is comprised of over 11,000 volunteers available at 320+ locations throughout the country and online. In 2013, the work of SCORE’s volunteer mentors and small business clients resulted in 38,630 new businesses started and 67,319 new jobs created in the U.S.

SCORE accomplishes these results through a variety of methods including educational workshops, webinars, and helpful online resources, but the real value that sets it apart from other organizations is free, personalized, one-on-one mentoring by business experts who have truly “been there and done that.” SCORE’s brigade of 11,000+ volunteer mentors is made up of men and women who are both retired and currently working, with experience in a huge variety of industries and fields. And true to the organization’s motto, SCORE mentors are there to assist “For the Life of Your Business” – from concept to creation, through growth and even eventual exit.

SCORE accomplishes these results through a variety of methods including educational workshops, webinars, and helpful online resources, but the real value that sets it apart from other organizations is free, personalized, one-on-one mentoring by business experts who have truly “been there and done that.” SCORE’s brigade of 11,000+ volunteer mentors is made up of men and women who are both retired and currently working, with experience in a huge variety of industries and fields. And true to the organization’s motto, SCORE mentors are there to assist “For the Life of Your Business” – from concept to creation, through growth and even eventual exit.

With 320+ chapters, many with their own additional branch locations, and a robust online educational offering, SCORE seeks to serve entrepreneurs through whichever information outlet is most convenient for them. One chapter in particular located in Orange County, California was recently named the 2013 SCORE Chapter of the Year for its commitment to excellence in serving entrepreneurs.

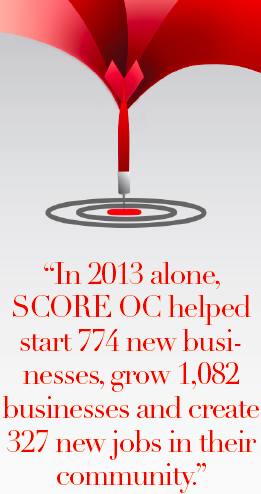

SCORE Orange County (OC) consistently serves the highest number of clients of all the SCORE chapters across the nation. In 2013 alone, SCORE OC helped start 774 new businesses, grow 1,082 businesses and create 327 new jobs in their community. But this chapter succeeds in much more than volume alone – a culture of innovation is their hallmark, driving continual expansion and improvement in services, bringing more and more clients into their educational and mentoring services.

One of the most groundbreaking developments to come out of Orange County is the concept of the CEO Forum program. These forums consist of monthly half-day collaborative meetings of small business owners that are facilitated by SCORE mentors. SCORE OC hosts seven of these ongoing forums with over 80 small business owners, and the concept has now been successfully replicated in a number of other SCORE chapters, including Minneapolis and San Diego.

SCORE OC has also made it a priority to effectively serve female entrepreneurs by hosting bi-monthly Women in Business Breakfasts that facilitate learning and networking, as well as annual Women Business Owners Conferences. The annual conference is a fantastic opportunity for female business owners to hear from knowledgeable speakers, learn from successful peers and network with others.

In fact, SCORE OC has been so successful in helping local businesses start and grow that two of their small business clients were chosen from nominees across the country to be honored with national SCORE awards in August of 2013.

ViArch Integrated Solutions, a leading provider of automated precision measurement and control solutions, was named the 2013 SCORE Outstanding Minority-Owned Small Business award winner. Owners Angela and Eric Jones teamed up to start their business in April of 2008. They both had the technical know-how to achieve great results for their prospective clients in the aerospace industry, but needed help with their marketing and sales tactics. They worked with SCORE OC mentor John Pietro to create a thorough and thoughtful plan to keep their enterprise on track towards their goals. Angela reflects on the start of their business saying, “We spent a lot of wasted effort reacting to issues we could have anticipated and addressed ahead of time, had we only done a bit of planning at the start. After working with SCORE Orange County, we gained critical business knowledge and management skills, and are in a better position to plan and strategize as well as operate our business effectively going forward. Compared to the alternative, I much prefer having a ‘map’ directing us where we are going, with a plan for addressing hurdles when they arise.”ViArch now boasts an impressive list of clients including The Boeing Company.

Orange County’s second national award winner caters to a slightly different clientbase: pet lovers! Dog is Good, a pet-themed retail operation in Los Alamitos, took home the 2013 SCORE Outstanding Veteran-Owned Small Business award. Owners Jon and Gila Kurtz knew being entrepreneurs was in their blood. In 2005 the couple recognized a void in the pet marketplace and seized the opportunity to start their own business. By 2008, Jon (an active captain in the U.S. Navy) and Gila (a professional dog trainer) began designing and selling dog-themed apparel at small retail events such as charity dog walks and fundraisers. Eventually they began selling their products in retail stores in Orange County and Los Angeles County. By the end of 2009, their revenues had nearly quadrupled, and sales have grown every year since then. When Jon and Gila needed help taking their business to the next level they turned to SCORE OC and met with Tom Patty, a marketing expert and SCORE mentor, who helped them focus their message to keep it centered on their core audience. With these defined goals in mind, the Kurtzes have begun licensing other products and are now branching into cat and horse products as well.

ViArch Integrated Solutions and Dog is Good are just two of the 10 million small business owners who have benefited from working with SCORE mentors over the past 50 years. And SCORE Orange County is just one chapter of more than 320 across the country that is dedicated to helping small businesses start and grow. With free expert business advice just a click or call away, why not take advantage of the wisdom and insight a SCORE mentor can bring to your business? Get started at www.score.org or by calling 1-800-634-0245.

Login

Login

“Some companies don’t meet SCV’s investment threshold, but still have great potential, so we created REach to help them accelerate into the Real Estate Industry with mentoring, exposure, access to investment opportunities, and guidance on how to target this crazy industry,” says Constance.

“Some companies don’t meet SCV’s investment threshold, but still have great potential, so we created REach to help them accelerate into the Real Estate Industry with mentoring, exposure, access to investment opportunities, and guidance on how to target this crazy industry,” says Constance.

The bulk sale-to-rental model provides a long-term rental income stream as well as the opportunity for appreciation. Consider the fact that these bulk sales are contributing to an inventory shortage on the open market, which means the model itself is ensuring faster appreciation as home prices increase due to limited supply. Many argue that this win-win for investors is a no-win for prospective homeowners, especially those who are rapidly getting priced out of the market. And those who get priced out of the market most likely end up renting, further feeding into the bulk sale investor’s win-win scenario.

The bulk sale-to-rental model provides a long-term rental income stream as well as the opportunity for appreciation. Consider the fact that these bulk sales are contributing to an inventory shortage on the open market, which means the model itself is ensuring faster appreciation as home prices increase due to limited supply. Many argue that this win-win for investors is a no-win for prospective homeowners, especially those who are rapidly getting priced out of the market. And those who get priced out of the market most likely end up renting, further feeding into the bulk sale investor’s win-win scenario.

The discussion focused primarily on the changes and impacts to properties and communities, the reduced volume of REO properties, and current opportunities for expansion of businesses for brokers, especially for diverse and women-owned businesses. There were specific questions about how women entrepreneurs may register as Diverse Suppliers with the GSEs, and Desirée Patno clearly explained the requirements and the process to take advantage of Diverse Supplier registrations. Since the passage of Dodd-Frank Section 342, which established the Office of Minority and Women Inclusion (OMWI), there is an increased commitment to minority and women inclusion in the regulated entities and beyond. This was interesting to the group, as the volume of REOs has dramatically reduced in all markets across the United States.

The discussion focused primarily on the changes and impacts to properties and communities, the reduced volume of REO properties, and current opportunities for expansion of businesses for brokers, especially for diverse and women-owned businesses. There were specific questions about how women entrepreneurs may register as Diverse Suppliers with the GSEs, and Desirée Patno clearly explained the requirements and the process to take advantage of Diverse Supplier registrations. Since the passage of Dodd-Frank Section 342, which established the Office of Minority and Women Inclusion (OMWI), there is an increased commitment to minority and women inclusion in the regulated entities and beyond. This was interesting to the group, as the volume of REOs has dramatically reduced in all markets across the United States.

It has long been said that imitation is the sincerest form of flattery. At City of Hope, researchers are implementing this concept of imitation—of making one thing similar to another—in a leading-edge approach to treating difficult cancers.

It has long been said that imitation is the sincerest form of flattery. At City of Hope, researchers are implementing this concept of imitation—of making one thing similar to another—in a leading-edge approach to treating difficult cancers.

In 2015, we are committed to building on this important work and acting on the lessons learned with impactful

In 2015, we are committed to building on this important work and acting on the lessons learned with impactful

The Council urged the implementation of an annual Survey of Business Owners and called on the Consumer Financial Protection Bureau to begin collection of data on demand for small business credit.

The Council urged the implementation of an annual Survey of Business Owners and called on the Consumer Financial Protection Bureau to begin collection of data on demand for small business credit. The data and methodology will be established in January 2015.

The data and methodology will be established in January 2015.