Real estate agents with busy schedules can probably relate to daytime sleepiness. When they’re in the field, it is imperative stay alert and ready to work.

Know an Incredible Woman Preserving the

Quality of Life During COVID-19?

Submit your story today!

Read More

Consulting & Branding Opportunities

Grant your business access to insider,

proven knowledge to improve the quality of your procured

services and maximize business performance.

If you need D&I

Contact Us!

A Team Focused on Bring Diversity and Inclusion to Every Level

Learn More

#1 Top Real Estate Influencer

Desiree Patno

Diversity & Inclusion, Quality of Life, Know the Rules of the Game ®

Your Next Event

Grow Your Business

NAWRB: An SBA Resource

NAWRB is listed as a women-owned business resource for the SBA.

Check It Out

NAWRB Aging Population

Help Protect Elders

from Financial Abuse

Over $36.5 billion a year is lost annually in the U.S.

Prevent Financial Abuse

Women's Homeownership:

Dream. Stability. Sanctuary.

Life often presents us

with unplanned disruptions.

AI Technology

with

a Human Touch

Is

The Perfect Balance

NAWRB Women's Global Resource Center

A women’s depository for vendors & clients to grow their diverse spend & increase women’s employment at all levels within the housing ecosystem.

Category Archives: Small Business

Reasons Why There Are So Few Women In Venture-Backed Businesses

Did you know that women-led, venture-backed organizations bring in 12 percent more money than companies led by men? Despite this fact, only 2.7 percent of venture-backed businesses have a woman CEO. Think about that.

SBA Announces Matchmaking Events through American Supplier Initiative

The U.S. Small Business Administration (SBA) has announced matchmaking events throughout 2015 which will expand the American Supplier Initiative. Created in 2012, the American Supplier Initiative supports American manufacturing by investing in the small businesses that comprise America’s suppliers.

U.S. Senator Maria Cantwell Introduces Legislation S. 2693 – The Women’s Small Business Ownership Act of 2014

Bill would improve access to lending, business training and federal contracting for women-owned businesses

Senator: ‘This legislation will help break through the 21st Century glass ceiling’

WASHINGTON, D.C. – U.S. Senators Maria Cantwell, Chairwoman of the Senate Committee on Small Business and Entrepreneurship, joined Senators Ben Cardin (D-MD), Jeanne Shaheen (D-NH), Kirsten Gillibrand (D-NY), Tammy Baldwin (D-WI), and John Walsh (D-MT) in introducing legislation this week aimed at giving women entrepreneurs equal treatment when it comes to starting and growing their own businesses.

The “Women’s Small Business Ownership Act of 2014” (S. 2693) would improve access to lending and increase business counseling and training services for women entrepreneurs, and give women-owned businesses the same level of access to federal contracts as other disadvantaged groups.

“Women make up half of the population, and we have a lot of ideas that could become great products and spur our economy,” Cantwell said. “This legislation will help ensure women entrepreneurs get the right tools they need to turn those ideas into new businesses and create jobs.”

The legislation adopts recommendations from a recent Senate Small Business Committee report that showed significant barriers for women looking to start or grow their own business. The report highlighted how women-owned businesses represent a $3 trillion economic force and support 23 million jobs, but still face significant barriers compared to their male-owned counterparts.

Women entrepreneurs account for just $1 out of every $23 in small business lending, despite representing 30 percent of all small companies. They are also more likely to be turned down for loans or face less favorable terms than men, according to the July 23 report, 21st Century Barriers to Women’s Entrepreneurship.

To address those gaps, the legislation would:

- Expand and improve the U.S. Small Business Administration (SBA) Microloan and Intermediary Lending programs to reach more women borrowers who need up to $50,000, as well as reauthorize the SBA Intermediary Lending program – now a pilot program – to provide more women access to loans between $50,000 and $200,000. The legislation would allow Microloan lenders to increase lending capacity from $5 million to $7 million and improve the program to better meet borrowers’ needs through more flexible terms and expanded technical assistance. Women often face difficulty in getting right-sized loans that fit their needs, according to the report, and this will help fill a gap not met by traditional private lending. The Microloan program targets new and early-stage small businesses as well as borrowers with limited credit history who can’t receive financing from a traditional lending institution.

- Allow sole-source contracting for federal contracts awarded through the Women-Owned Small Business Federal Contract program, which would put women-owned businesses on equal footing with other disadvantaged groups in the contracting process. The legislation would change current law, and aims to help the federal government meet its goal of awarding 5 percent of contracts to women-owned businesses – a goal that has never been reached since it was established by legislation 20 years ago. When this goal is not reached, women-owned companies miss out on $4 billion in federal contracting opportunities each year.

- Increase funding for the Women’s Business Center program to expand and improve counseling and training services to reach more women entrepreneurs, especially in low-income areas. The program, overseen by SBA’s Office of Women’s Business Ownership, issues grants to nonprofits that provide these services. The centers assist 150,000 clients annually, and helped women to access more than $25 million in capital in fiscal year 2013. The centers help address the unique challenges women entrepreneurs face, such as less capital to invest and responsibility for child care or elder care. The legislation would reauthorize the program through 2019 and nearly double the annual funding authorization. It also would establish clear metrics to measure each center’s success.

- Require data on women-owned small businesses by establishing a 2015 deadline for an SBA study to identify industries in which women-owned small businesses are under-represented. The original deadline was 2018.

“Small businesses are at the heart of America’s economic engine. We need to ensure that our women entrepreneurs have the right tools available to help them succeed,” Cardin said. “I’m proud to support the Women’s Small Business Ownership Act, which gives women a fair shot at helping improve our economy and strengthen the middle class through small business ownership.”

“Small businesses are at the heart of America’s economic engine. We need to ensure that our women entrepreneurs have the right tools available to help them succeed,” Cardin said. “I’m proud to support the Women’s Small Business Ownership Act, which gives women a fair shot at helping improve our economy and strengthen the middle class through small business ownership.”

“Women are an essential part to growing our economy and creating jobs, but they are wholly underrepresented as business owners and contract and loan recipients,” Shaheen said. “By addressing the challenges women entrepreneurs and business owners face, we will give women, job seekers and our economy the tools they need to grow and succeed.”

“Our economy desperately needs to grow more small business start-ups,” Baldwin said. “This legislation invests in job creation, supports our American entrepreneurial spirit, and will help strengthen the economic security of women and their families.”

“This bill will ensure that women entrepreneurs have access to capital and opportunity,” Walsh said. “By making sure today’s leaders have the resources to start their own businesses, we will encourage the next generation of entrepreneurs to pursue their goals, strengthening Montana’s economy and creating jobs.”

“Small businesses are the backbone of our economy and the most powerful job creators we have,” Gillibrand said.“And the fact is, women are increasingly the new family breadwinner. Women are the primary income earner for a growing share of homes across America. The key to a growing economy, and the key to an American middle class that is built to thrive in the 21st century is women. When we equip more working women with the tools and the opportunities to achieve their best in the economy, and their best for their family, that’s when America’s middle class will thrive again. Without a doubt, if given a fair shot, women will be the ones who ignite our economy and lead America’s middle class revival.”

The Women’s Small Business Ownership Act has received strong support from key stakeholders including Women Impacting Public Policy, the Association for Enterprise Opportunity, the Association of Women’s Business Centers, U.S. Black Chambers, Inc., the U.S. Hispanic Chamber of Commerce, the National Venture Capital Association, and 32 community development organizations from 20 states.

-Press Release from U.S. Senate Committee on Small Business & Entrepreneurship

Emerging Mortgage Trends of 2014

It’s no secret that trends within the mortgage and lending industries can fluctuate significantly from quarter to quarter. Countless factors such as the economy, new legislation, and changing demographics can impact these shifts. With the ever-changing financial landscape, we have pinpointed the most current and prevalent mortgage and lending trends of 2014.

Mortgage Volume Drops

Mortgage loan volumes have experienced a consistent drop across all lenders throughout 2014. In the first quarter, lenders made a total loan volume of $226 billion, an all-time low amount that hasn’t been achieved since 1997. One of the largest lenders, Wells Fargo, took the hardest hit with a 67% drop in originated residential mortgages.

Mortgage loan volumes have experienced a consistent drop across all lenders throughout 2014. In the first quarter, lenders made a total loan volume of $226 billion, an all-time low amount that hasn’t been achieved since 1997. One of the largest lenders, Wells Fargo, took the hardest hit with a 67% drop in originated residential mortgages.

One explanation for the steady decline in mortgage volume is due to the Federal Reserve’s mission to taper stimulus cash. As a result of the tapering, interest rates rose by a percentage point. The rise in interest rates has caused more people to become weary of refinancing which is correlated to the drop in mortgage volumes.

Rise in All-Cash Purchases

One variable has contributed significantly to the drop in the nation’s total loan volume: all-cash purchases. With rising interest rates, all-cash purchases have become a major contender among transactions in the housing economy. Interest rates are hardly the only reason though. Older generations are downsizing their current homes in favor of smaller homes. The switch to smaller homes has made all-cash purchases more feasible for the baby boomer generation.

Foreign investors buying property in the United States have also resulted in a large percentage of all-cash purchases. Buyers from China alone have spent $22 billion on properties in the United States. Foreign buyers tend to be members of the upper middle class and upper class of their respective countries. Waning economies and volatile political regimes have fueled many international buyers to make all-cash housing purchases in the more stable environment of the United States.

In the first quarter of 2014, all-cash purchases accounted for a record high of 43% of transactions. This trend in conjunction with tighter lending standards has predictably led to less lending. As far as domestic purchases are concerned, the all-cash trend could prove to be a temporary fixture as some lenders have joined a movement to lower lending standards. Lenders anticipate that looser lending standards will create a shift from skyrocketing all-cash purchases to more loans.

Paperless Options

Processes within the mortgage industry require a great deal of paperwork, as many people know. It is not unusual for cumbersome paperwork to prolong the process of closing a mortgage and processing miscellaneous loans. Although some measures have been taken to reduce waste, the U.S. Small Business Administration (SBA) and Fannie Mae are taking it a step further by implementing new programs and initiatives.

Maria Contreras-Sweet—24th Administrator of the SBA—recently announced an SBA agenda filled with new initiatives at the Center for American Progress in Washington, D.C. One such initiative includes the introduction of digital processes in favor of traditional yet time-consuming faxes and paperwork. The SBA will usher in a new era filled with electronic signatures and the ability to upload and generate documents. The switch is projected to save not only thousands of dollars but hours of time.

Fannie Mae has joined the digital trend and has commissioned a team to tackle common problems within the mortgage industry. The team identified a lack of electronic processes as the source of many issues within the industry. They found multiple solutions to amend the issue and say as much as $1 billion can be saved with electronic processes. The Consumer Financial Protection Bureau (CFPB) has also taken steps to evaluate what must be done to make an electronic switch. Although it could take years to apply the findings of both groups, it is clear that industries are finding the need to adapt to rapidly evolving technology.

The Decline of Negative Equity

Multiple reports have found that the percentage of total negative equity has decreased in the first quarter of 2014. CoreLogic reported 12.7% of mortgaged homes in the first quarter of 2014 as having negative equity which translates to almost 6.3 million homes nationwide. This statistic sharply contrasts to the 19.8% found in the first quarter of 2013 with 9.7 million homes ‘underwater.’

Nevada—the state with the highest incident of negative equity in residential properties—experienced a 16% drop in the amount of residential properties with negative equity when compared to the first quarter of 2013. Negative equity is forecasted to further decline as the year progresses and home prices steadily increase.

More Elderly with Debt

Elderly Americans carry more mortgage debt throughout their retirement years. An overwhelming amount of senior citizens—those 65 and older—not only have increased mortgage debt but increased credit card debt. The latest statistics provided by the Consumer Financial Protection Bureau (CBPB) reveal that from 2001 to 2011, the amount of elderly  homeowners with mortgage debt increased by 2.3 million. Rising home values and the trend of people purchasing their first homes in the latter half of their lives all contribute to the increase in mortgage debt.

homeowners with mortgage debt increased by 2.3 million. Rising home values and the trend of people purchasing their first homes in the latter half of their lives all contribute to the increase in mortgage debt.

Purchases that contribute to credit card debt appear to be directly related to the relaxed lifestyle most people envision in their retirement years. The idea of retirement for many evokes thoughts of traveling, trying new hobbies, and enjoying leisure time in general. The top expenses among the senior citizen demographic include new automotives, recreational items such as technology gadgets and camping supplies, and miscellaneous purchases for pets.

Experts stress that aging generations must account for a shift in expenses as they reach their retirement years. For example, medical expenses will become a larger factor in a retirees’ budget than compared to someone in pre-retirement years. Experts stress that with careful planning and well-thought spending plans, the growing trend could lessen in the future.

In Which Dimension is Credit Constrained?

The year 2014 is sure to be another eventful one in mortgage finance. A litany of new regulations are prepared to be implemented, the economy is projected to improve, driving mortgage rates higher, and demand to refinance loans is expected to decline further. The overall size of the mortgage market, in dollar terms, is anticipated to be significantly smaller than in 2013. In light of these market conditions, one of the most discussed issues right now is the availability of credit for mortgage borrowers – is mortgage credit availability too tight? The importance of this question cannot be understated, particularly because of the impending implementation of the Qualified Mortgage (QM) standard and the mortgage market’s determination of the types of credit it will offer to borrowers.

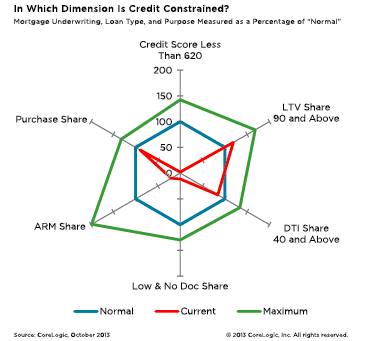

Whether credit is too tight or too loose is an especially hard question to answer because there is no one single measure of credit availability. Nonetheless, it is possible to look at a variety of measures that collectively influence a borrower’s access to credit: borrower credit worthiness, loan-to-value (LTV) ratios, debt-to-income (DTI) ratios, the level of documentation, the propensity of adjustable rate (ARM) loans and the share of purchase-money loans.

To answer the question of whether each of these credit measures is too loose or too tight requires a determination of what would constitute a “normal” level of availability. For example, the average credit score of all originated first-lien purchase loans in October 2013 was 749. The average credit score over the year before the Federal Reserve announcement encouraging the use of ARMS in February 2004, and subsequently raising the federal funds rate, was 710. In percentage terms, this is only a 5-percent difference. The average doesn’t show us that the share of originated first-lien purchase loans in October 2013 with credit scores below 620 (typically ineligible under GSE guidelines) was 0.3 percent, but averaged 29 percent over the year before the Fed announcement. Credit to borrowers with low FICO scores was normally available prior to the beginning of the housing boom (as marked by the Fed announcement), but clearly is not currently. For each measure of credit availability, it is much more insightful to compare the share of the riskiest subset of the entire measure’s distribution to that same share prior to the housing bubble. Credit availability in each measure represents the extent to which lenders originate loans to the riskier subset of the distribution.

In the chart, each axis represents a different measure of credit availability. The inner hexagon crosses each axis at a value of 100, which is the reference point for the normal value for the measure illustrated on that axis, based on the average over the year preceding the Fed announcement in February 2004. For example, as described above, the share of first-lien purchase loans in October 2013 with credit scores below 620 was 0.3 percent, but averaged 29 percent over the year before the Fed announcement. Therefore, relative to a normal share of 29 percent, indexed to 100 and represented in the “normal” hexagon, the “current” unbalanced hexagon clearly shows the constrained availability of credit to low credit score borrowers. For each measure, the “current” and “maximum” unbalanced hexagons represent the deviation from normal for each measure both currently and at the loosest since the start of the housing bubble, respectively.

Immediately apparent from this chart is that credit availability is tight for two important underwriting criteria – credit scores and documentation levels. Low-credit-score loans are not being originated relative to the height of the expansion of credit or even at the normalized level of availability. Additionally, access to no- and low-documentation loans is significantly constrained relative to the height of expanded credit or the normalized level of availability. Underwriting eligibility in the current market requires good credit and the ability to fully document your loan.

Also interesting to note is that the shares of high-LTV and DTI lending are very close to normal. Both measures expanded availability during the housing boom. High-LTV lending currently remains modestly loose relative to normal and high-DTI lending is modestly tight relative to normal. The share of ARM loans being originated is currently much more restricted than normal, as many subprime ARM loan products are no longer available.

Looking at the share of the riskiest subset of an entire measure’s distribution compared to the share prior to the housing bubble for multiple measures gives more insight into the answer to the pressing question of whether credit is too loose or too tight. Right now, credit is tight for low credit score borrowers, those who don’t want to or can’t fully document their loans, or who would like an ARM product. For many, the choice to document or select an ARM product is not necessarily an impediment to credit availability, but for those with low credit scores there are fewer options.

—

Mark Fleming

Chief Economist

CoreLogic

www.corelogic.com

Congressional Retirement: Is It a Good Thing?

Election Day is November 4, a whopping 6 months – 30 weeks – from now. For most of us, that is an eternity away. For Members of Congress, however, November elections are knocking on the door. It seems absurd, but the evolving dynamics of Congressional races have changed both the way Washington works and the political calculus of elected officials.

Members of Congress retiring this year fall into two general camps: those who are genuinely tired and those who are tired of partisan gridlock. A growing number of “retirements” are the results of frustration, discontent, and political reality – forced decisions rather than ready to quit working. Many are pragmatists –Republican and Democrat – who are tired of Washington gridlock and polarization.

Members of Congress retiring this year fall into two general camps: those who are genuinely tired and those who are tired of partisan gridlock. A growing number of “retirements” are the results of frustration, discontent, and political reality – forced decisions rather than ready to quit working. Many are pragmatists –Republican and Democrat – who are tired of Washington gridlock and polarization.

As of April 15, 2014, 27 Representatives and seven Senators have announced that they will not seek reelection this fall. Another 13 Representatives have announced intentions to seek open Senate seats in their states, opening up their seats. Taken as a whole, about 6 percent of the House and 7 percent of the Senate will not walk the marble halls of Congress next year.

Another interesting aspect of the group of pending retirees is the fact that only two are women – Reps. Michele Bachman (R-MN) and Carolyn McCarthy (D-NY). The 113th Congress is the most diverse Congress in history, with 101 female legislators – 20 Senators and 81 Representatives. With at least 48 vacancies opening up, not including sitting Members of Congress who may lose their reelections, women stand a good chance of increasing those numbers in the coming year.

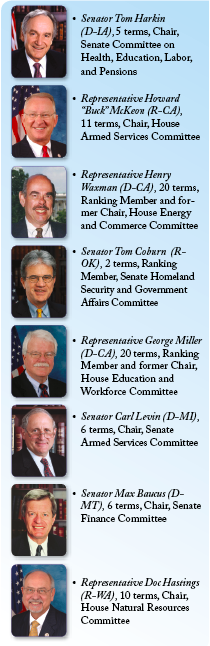

Retirements of 6 or 7 percent do not seem particularly high or out of the norm, especially when compared to previous Congresses. According to Roll Call, an average of 22 Representatives retire each year, a number not too far off from this year’s 27 announcements. So why is there this impression that everyone is quitting? It is not the numbers, but rather, who has announced they will not run for reelection – some of Congress’ biggest names are calling it quits this year, including:

Let’s take a look at one particularly illustrative example of how one Senator leaving Congress can have far-reaching consequences. Earlier this year, Senator Max Baucus (D-MT) – already said to be mulling retirement – was confirmed to serve as President Obama’s Ambassador to China. On the one hand, after serving nearly 40 years in Congress, most recently as Chair of the Senate’s Finance Committee, one might assume that this was a fitting cap to a long legislative career. However, the implications of his retirement from the Senate were in fact far-reaching.

One: It precipitated a round of musical chairs, as Senator Ron Wyden (D-OR) assumed the Chairmanship of the Finance Committee, allowing Senator Mary L. Landrieu (D-LA) to leave her post as head of the Committee on Small Business and Entrepreneurship and take Senator Wyden’s old job as Chair of the Senate Energy and Natural Resources Committee. That in turn allowed Senator Maria Cantwell (D-WA) to relinquish her Chairmanship of the Indian Affairs Committee in favor of the Senate Committee on Small Business and Entrepreneurship. Replacing Senator Cantwell at Indian Affairs is Senator Jon Tester (D-MT).

Two: After spending two years working with his counterpart—Chairman of the Committee on Ways and Means Dave Camp (R-MI)—to develop a set of principles to guide comprehensive tax reform, Senator Baucus’ departure from Congress effectively doomed any chance for tax reform in the Senate. Not long thereafter, Chair Camp announced that he too would retire from Congress at the end of this year. So, not only do both of their retirements put tax reform on hold for the foreseeable future, but the institutional knowledge and intimate understanding of the intricacies of the U.S. tax code will no longer be around. Some would argue that’s a good thing.

Two: After spending two years working with his counterpart—Chairman of the Committee on Ways and Means Dave Camp (R-MI)—to develop a set of principles to guide comprehensive tax reform, Senator Baucus’ departure from Congress effectively doomed any chance for tax reform in the Senate. Not long thereafter, Chair Camp announced that he too would retire from Congress at the end of this year. So, not only do both of their retirements put tax reform on hold for the foreseeable future, but the institutional knowledge and intimate understanding of the intricacies of the U.S. tax code will no longer be around. Some would argue that’s a good thing.

Not only do retirements affect who chairs Committees, but the Republicans in Congress instituted “term limits” in 1994. Looking for a way to rotate Committee leadership, then-Speaker Newt Gingrich (R-GA) adopted a rule that Committee Chairs could only serve in that capacity for a total of three terms in Congress, even if it was spent in the minority. Senate Republicans adopted similar rules allowing for six years as Chair. Democrats in Congress did not. Even if the Chair of a powerful Committee does not retire from Congress, once his or her time is up, there is not much of an incentive to hang around if your status in Congress goes back to just being a rank-and-file member of the Committee. This may have heavily influenced Chair Camp’s decision to leave Congress.

Three: His retirement has the potential to upend Democratic control of the Senate. Senator Baucus was well-liked by his constituents and consistently received strong support back home in Montana, winning his last re-election battle in a landslide victory. He received 73% of the vote and carried every county in the state. With no incumbent on the ticket in Montana, most political observers are listing Montana as either “toss up” or “lean republican.” With one-third of Senate seats up for election each year, retirements this cycle could determine which party controls the Senate starting in January 2015.

Two other races that could decide the balance of power in the Senate next year feature two strong women. In Georgia, a number of Republican hopefuls, including three sitting Congressmen, are gearing up for a primary battle to replace retiring Senator Saxby Chambliss (R-GA). On the Democratic side, Michelle Nunn, daughter of longtime Georgia Senator Sam Nunn Jr. (D-GA), is likely to capture the nomination and could emerge victorious, according to Christina Bellantoni, a former political editor for PBS NewsHour.

Two other races that could decide the balance of power in the Senate next year feature two strong women. In Georgia, a number of Republican hopefuls, including three sitting Congressmen, are gearing up for a primary battle to replace retiring Senator Saxby Chambliss (R-GA). On the Democratic side, Michelle Nunn, daughter of longtime Georgia Senator Sam Nunn Jr. (D-GA), is likely to capture the nomination and could emerge victorious, according to Christina Bellantoni, a former political editor for PBS NewsHour.

Similarly, the Senate race unfolding in Kentucky is drawing a lot of attention. Senate Minority Leader Mitch McConnell (R-KY) will likely face Democrat Allison Lundergan Grimes. Although he is not retiring, he is the senior Republican leader in the Senate. One of the key themes of Ms. Lundergan Grimes’ candidacy is breaking political gridlock in Washington, where a win for her could serve as a referendum on the status quo. Could a win for her serve as a warning shot to sitting Members of Congress?

When the Founding Fathers wrote the Constitution, they were very particular in the design and function of the House and Senate. For one, they certainly believed that turnover in ranks of elected politicians was a good thing. This is why every Member of the House of Representatives must be elected every two years. On the other hand, they purposely designed the Senate so that it would not be subject to the whims of the majority. In fact, James Madison originally proposed Senate terms of seven or nine years to insulate the Senate from what some called the “amazing violence and turbulence of the democratic spirit.”

They compromised on six-year terms on a rotating schedule so that only one-third of Senators stand for election every two years. The system was designed specifically to reduce “Congressional brain drain” and ensures that the Senate operates continuously (it has been since 1789), protecting institutional knowledge.

Committee Chairs usually spend years getting to know the inner workings of the issues under their Committee’s jurisdiction, building a knowledge base accumulated over years of hearings on particular issues. We know how this impacted the prospects of comprehensive tax reform. One of the staunchest proponents for comprehensive climate change legislation (Rep. Waxman) will depart this year. Two of the most respected Armed Services Committee Chairs (Sen. Levin and Rep. McKeon) will depart. Chairs of Committees that oversee healthcare, workforce and labor policies, regulation of natural resources, among many other will all leave at the end of this year. Incoming Committee Chairs, whoever they may be, will have a lot of learning to do come January 2015.

Committee Chairs usually spend years getting to know the inner workings of the issues under their Committee’s jurisdiction, building a knowledge base accumulated over years of hearings on particular issues. We know how this impacted the prospects of comprehensive tax reform. One of the staunchest proponents for comprehensive climate change legislation (Rep. Waxman) will depart this year. Two of the most respected Armed Services Committee Chairs (Sen. Levin and Rep. McKeon) will depart. Chairs of Committees that oversee healthcare, workforce and labor policies, regulation of natural resources, among many other will all leave at the end of this year. Incoming Committee Chairs, whoever they may be, will have a lot of learning to do come January 2015.

I recently spoke with a respected candidate running in a competitive primary race in my home state of Virginia about the decision to run for Congress. The response was simple: “If we want to have bipartisan discussions, if we want to get back to the work of governing, we need to chip away at the system, one District at a time, one state at a time.”

Regardless of the outcome of particular races this November, there will be many new faces in Washington. Change is not a bad thing. There is nothing wrong with a change in leadership. Given the portrayal of Washington in the media over the last couple of years, maybe new faces and fresh blood will rejuvenate a House and Senate, both ailing and unable to govern effectively. Women in Congress will get a better chance at being Committee Chairs and retirements will enable more women to run. They will have big shoes to fill and a lot of work to do, but if you look at it that way, maybe the slew of retirements is a good thing, one Congressional seat at a time.

—

Ann Sullivan

WIPP Government Relations

1156 15th Street, NW, Suite 1100

Washington, DC 20005

202-626-8528

Login

Login