The recently released Emerging Trends in Real Estate 2016 report from PricewaterhouseCoopers (PwC) and the Urban Land Institute (ULI) suggests that established hubs like New York and Washington, D.C. are losing steam, and developing cities in quieter markets may well be on their way to becoming the next great American metropolises. Continue reading

Know an Incredible Woman Preserving the

Quality of Life During COVID-19?

Submit your story today!

Read More

Consulting & Branding Opportunities

Grant your business access to insider,

proven knowledge to improve the quality of your procured

services and maximize business performance.

If you need D&I

Contact Us!

A Team Focused on Bring Diversity and Inclusion to Every Level

Learn More

#1 Top Real Estate Influencer

Desiree Patno

Diversity & Inclusion, Quality of Life, Know the Rules of the Game ®

Your Next Event

Grow Your Business

NAWRB: An SBA Resource

NAWRB is listed as a women-owned business resource for the SBA.

Check It Out

NAWRB Aging Population

Help Protect Elders

from Financial Abuse

Over $36.5 billion a year is lost annually in the U.S.

Prevent Financial Abuse

Women's Homeownership:

Dream. Stability. Sanctuary.

Life often presents us

with unplanned disruptions.

AI Technology

with

a Human Touch

Is

The Perfect Balance

NAWRB Women's Global Resource Center

A women’s depository for vendors & clients to grow their diverse spend & increase women’s employment at all levels within the housing ecosystem.

Category Archives: Housing

House Passes TRID Grace Period Bill

There is no question about it; the TILA-RESPA Integrated Disclosure (TRID) rule transforms the way business is done in the mortgage industry. After multiple postponements, TRID was officially implemented on October 3 with the assurance from the Consumer Financial Protection Bureau (CFPB) that there would be an informal grace period carried out at least through the end of the year for lenders attempting to comply in good faith with TRID regulations. Continue reading →

A Day Away from TRID

The TILA-RESPA Integrated Disclosure (TRID) rule consolidates four mortgage forms into two; the RESPA Good Faith Estimate and Initial Truth-In Lending disclosure have been combined to create the Loan Estimate form, and the RESPA HUD-1 and the Final Truth-In Lending Disclosure now comprise the Closing Disclosure. Continue reading →

The Need for Inclusionary Housing

As the improving economy allows American cities to renovate and rebuild, existing home prices consequently rise, and in many cities flagrantly price out low-income families. This phenomenon has led to segregated communities, and has behooved inclusionary measures to ensure integration in American neighborhoods. Continue reading →

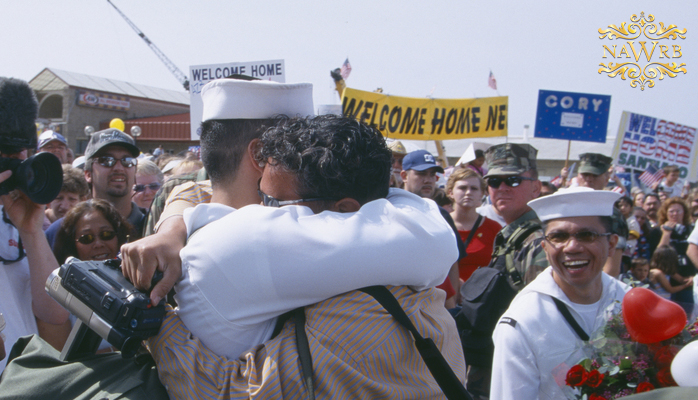

Military Lending Final Rule

Last week, the Department of Defense (DOD) issued a final rule modifying regulations set forth in the Military Lending Act (MLA). Passed by Congress in 2006, the MLA was created to protect active duty service members and their families from elevated interest rates in credit transactions, limiting the Military Annual Percentage Rate (MAPR) to 36 percent. The rule provides additional protections to military members from numerous credit products that the existing regulations do not address. Continue reading →

HUD and FHA Encourage Home Inspections

It is a good time to be an American consumer. Last decade’s housing bubble left behind a collapsed market and millions of disheartened and mistreated homebuyers. If the current effort to protect consumers suggests anything, it’s that if a phenomenon like the housing crisis occurs again, it will not be as a result of inattention or irresponsibility from the housing sector. Continue reading →

Single-Family Home Rental Sector

In its aftermath, the American housing bubble left millions of discarded single-family homes. Slowly but surely, these homes have come off the market in the past few years. Some were bought, and countless others were purchased by investors and put out to rent. Currently, the number of homes for sale in the United States is dwindling considerably, and developers have turned to creating entire neighborhoods of single-family homes not to sell, but to rent. Continue reading →

Home Sharing: Cut Costs and Gain Companionship

With the booming sharing economy, most people are familiar with popular home sharing sites such as Airbnb which offers temporary housing in widespread locations. But let’s take it to another level: permanent home sharing. Continue reading →

Mother Nature: Droughts and Floods

If you look back on the last decade, a lot has been written about global warming and how Earth is shifting. With flooding occurring in some parts of the country and droughts in others, it is a crucial time to remain attune to earth’s changes. Regardless of your beliefs on global warming, an increasing amount of areas, including entire states, are being affected by the wrath of Mother Nature. Continue reading →

Real Estate Agents and the Senior Citizen Homeowner

The population of seniors in the United States is increasing rapidly due to the aging baby boomer generation, and some cities are experiencing more rapid growth than others. It is therefore important for real estate agents to be aware of these locales, and understand the best ways to sell to senior citizens. Continue reading →

Login

Login