With almost 8 million women-owned businesses in the U.S., more female entrepreneurs are making an impact and growing at a rapid pace. However, some women are struggling to obtain the funds needed to start and maintain a successful business.

Know an Incredible Woman Preserving the

Quality of Life During COVID-19?

Submit your story today!

Read More

Consulting & Branding Opportunities

Grant your business access to insider,

proven knowledge to improve the quality of your procured

services and maximize business performance.

If you need D&I

Contact Us!

A Team Focused on Bring Diversity and Inclusion to Every Level

Learn More

#1 Top Real Estate Influencer

Desiree Patno

Diversity & Inclusion, Quality of Life, Know the Rules of the Game ®

Your Next Event

Grow Your Business

NAWRB: An SBA Resource

NAWRB is listed as a women-owned business resource for the SBA.

Check It Out

NAWRB Aging Population

Help Protect Elders

from Financial Abuse

Over $36.5 billion a year is lost annually in the U.S.

Prevent Financial Abuse

Women's Homeownership:

Dream. Stability. Sanctuary.

Life often presents us

with unplanned disruptions.

AI Technology

with

a Human Touch

Is

The Perfect Balance

NAWRB Women's Global Resource Center

A women’s depository for vendors & clients to grow their diverse spend & increase women’s employment at all levels within the housing ecosystem.

Category Archives: Finance

New Research Shows Funding Challenges Persist for Women-Owned Businesses

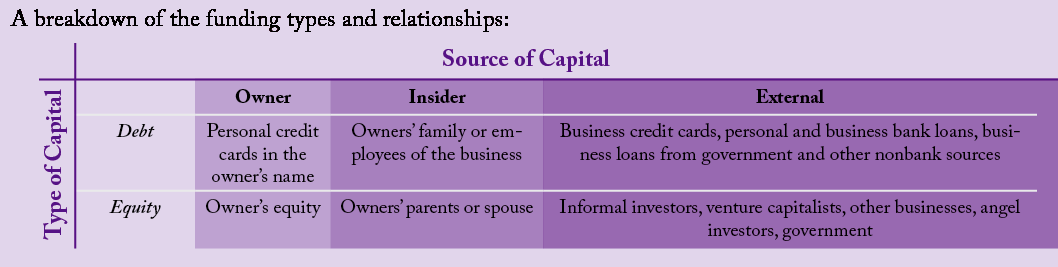

The National Women’s Business Council (NWBC) released a new research report outlining the differences between men and women business owners, regarding the scale of business growth, amount and sources of financial capital, and the relationship between the two. Unfortunately, the statistics on funding for women-owned businesses, whether it concerns bank loans, angel investments, or VC funding continue to discourage. As the government’s only independent voice for women entrepreneurs, the NWBC’s two-fold mission is to conduct and support groundbreaking research that provides insight into women business enterprises from startup to success, and to share the findings to incite constructive action and policy. To that end, the NWBC saw the need tackle the thorny issue of funding and women owned businesses once again. The NWBC just released a new research report looking at current trends in female entrepreneurship and funding with an eye towards spurring discussion and finding solutions. Here are some of the most salient highlights from their work:

Access to Capital and Women Entrepreneurs

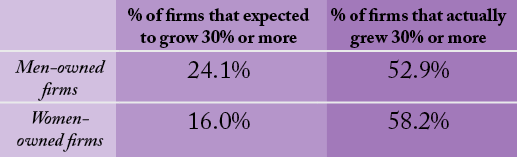

Access to capital continues to be a major issue for all, but especially for women entrepreneurs. The NWBC research suggests there is a direct correlation between access to capital, and company growth in terms of employment for both men- and women- owned businesses: women-owned firms exceeded their growth expectations, while men-owned firms had much greater growth in revenue.

Men-owned firms used significantly more capital than women, particularly with respect to equity from external sources such as venture capitalists and angel investors. Only 20% of all angel-backed companies were women-led in 2013. The NWBC’s research concludes high growth women-owned firms may be an underutilized tool for economic growth; increased access to capital is important because more money for the business will undoubtedly maximize their potential to contribute to the economy.

Overcoming The Fear Factor

When it comes to broadening the pathway to success for women business owners, women who are sole owners should consider finding a business partner who has previous startup experience. The NWBC’s research findings suggest firms with team ownership and/or owners with previous startup experience typically have higher amounts of capital and were more likely to have high growth potential. This research also revealed women-owned firms were also less likely to apply for credit when needed because they feared being turned down.

Anecdotally, many successful business owners were rejected repeatedly by banks before ultimately obtaining a loan. It is important for women to ask, and to keep asking. From the standpoint of risk aversion, a number of studies have similarly identified the fear of failure as a major impediment to the launch and growth of women-owned firms. For example, at NWBC’S March 2014 public meeting, Divya Nag—one of STEM’s youngest woman entrepreneurs—discussed Stanford’s StartX accelerator. She noted that only 5% of founding teams with women reapply when rejected as compared to 65% for all-male founding teams. The NWBC concludes that it is essential that entrepreneurs believe in their product, be able to communicate how it fulfills an unmet need in the market and continue to tell that story despite rejection.

Beyond the Boys Club: Reasons Men Receive More Capital

Research and other supporting research show, men and women approach debt differently, including the application process. Since women had lower growth expectations than men, it is possible they pursue less capital at the outset. Also women  are more likely to have characteristics that are associated with lower amounts of capital in general—these include less previous industry experience, less previous startup experience, and lower credit scores, being a sole owner, and being home-based. However, these trends occur even among women-owned firms with high growth potential. One of the biggest differences seen was with regards to the amount of outside equity used. The presence of women is notoriously low on the investment side, e.g. as angel investors. Increasing women’s presence on the investment side (e.g. as angel investors) might help ameliorate some supply-side issues.

are more likely to have characteristics that are associated with lower amounts of capital in general—these include less previous industry experience, less previous startup experience, and lower credit scores, being a sole owner, and being home-based. However, these trends occur even among women-owned firms with high growth potential. One of the biggest differences seen was with regards to the amount of outside equity used. The presence of women is notoriously low on the investment side, e.g. as angel investors. Increasing women’s presence on the investment side (e.g. as angel investors) might help ameliorate some supply-side issues.

The Role of the Banks, Incubators and Accelerators

There is substantial opportunity for financial institutions to ramp-up their efforts to target and increase lending to women entrepreneurs. The NWBC concludes that one particularly effective strategy to maximize the potential of high growth oriented women entrepreneurs would be incentivizing accelerators and incubators to address the specific needs of and support women entrepreneurs. In addition to financial resources, this would allow women to get the tangible startup experience they need, the help with the business growth planning process and offer the added benefit of social networking—possibly resulting in team ownership.

Tackling the Problem on Both Fronts

Ultimately, it looks like there is both a demand-side and supply-side issue. It’s important for women business owners with high growth potential to set themselves up for success financially—but also for institutions and individuals offering financing to work with growth-oriented women to maximize their potential. The NWBC would like to see more women entering the investment side, as angel investors or as part of a screening committee at a venture capital fund.

There is no doubt that great strides have been made in the women’s entrepreneurship movement, but there is clearly more work to do. Change or action doesn’t happen without impetus. If we continue to build on the progress that has already been made women, women-business owners and the economy as a whole will benefit tremendously.

“New Research Shows Funding Challenges Persist for Women-Owned Businesses” was originally published on ProjecteEve.com.

The National Women’s Business Council continues to be a leading voice in advancing the women’s entrepreneurship agenda with a strong focus on providing key insights and solutions to increasing economic gains for women business owners. The NWBC has identified four priorities: Access to Capital, Access to Markets, Job Creation & Growth, and Data Collection. The NWBC will be highlighting the challenges and opportunities for women entrepreneurs through several research efforts, including: undercapitalization as a contributing factor to business failure; Supplier Diversity Initiatives and Supply Chain Analysis; and Women’s participation in accelerators and incubators.

Are you following the NAWRB Financial Fitness Road Show?

NAWRB partnered with the U.S. Small Business Administration (SBA) Santa Ana District Office to present the Women in Housing Financial Fitness Road Show in July at the Lutron Experience Center in Irvine, CA.

NAWRB’s Inaugural Women in Housing Financial Fitness Road Show is a first-of-its-kind, breakthrough program for women in all industries within the housing economy. More than just tools to navigate women’s existing business through the changing terrain, the Women in Housing Financial Fitness Road Show reached an entire new level. Utilizing a specialized hybrid of women in housing and women in government outreach, women can take advantage of NAWRB’s Fast Track niche. By connecting women with federal and local programs, set-asides, funding options and contracting opportunities available to grow their businesses both vertically and horizontally, women in housing will have the awareness to sustainable growth and live beyond commission-to-commission.

Morgan Stanley hosted the Road Show and provided its wealth of knowledge to attendees. Vivian Afriyie, a Morgan Stanley Wealth Advisor, opened the event in dramatic fashion showcasing assets explaining the often missed difference between asset-based loans, traditional income, and credit-based loans. Morgan Stanley has crucial experience, having just closed a 150 million dollar commercial real estate loan in 6 weeks. “Bringing the shock treatment with our takeaways from $25,000 SBA business loans to the $200 million dollar Morgan Stanley Diversified Securities for clients, really ignited the awareness in the room,” stated Desirée Patno, CEO and Founder of NAWRB.

The excitement for the event is rapidly growing as respected agents, suppliers, and other professionals in the housing industry look forward to learning the opportunities and resources available to them on behalf of multiple federal agencies and organizations.

The Women in Housing Financial Fitness Road Show is the first in a series of nationwide road shows that will travel to major cities. Do you want to attend this dynamic Road Show or have it travel to a city near you? Contact Roadshow@NAWRB.com for more information on being a part of the movement to bring awareness, opportunities and access to women in housing.

Rise in VA Home Loans Stimulates Housing Market

A rise in the use of VA home loans is improving the housing market and the ability of veterans to obtain home loans. Veterans who would not previously qualify for a home loan are utilizing the many benefits stipulated in the VA program.

The “Ability to Repay Rule”

With more aggressive lending compliance standards and regulations in 2014, lenders have been scrambling to implement internal systems in order to comply. Every real estate professional should understand the central issue that will impact their clients who obtain loans at the closing table: the “Ability to Repay” Rule (ATR).

With more aggressive lending compliance standards and regulations in 2014, lenders have been scrambling to implement internal systems in order to comply. Every real estate professional should understand the central issue that will impact their clients who obtain loans at the closing table: the “Ability to Repay” Rule (ATR).

The momentum behind ATR is to reduce systemic fraud, reduce borrower litigation in order to correct faulty lender underwriting guidelines, and protect local markets from predatory lending or price fixing. Earlier this year, JPMorgan and Bank of America initiated lawsuits against the national title insurance underwriters for their local agents’ failure to identify fraud. Whether this failure was due to compliancy or complicit behavior is no longer relevant in the new lending era of Dodd-Frank. Higher standards make each participant vigilant on compliance and identifying fraud with more checks and balances from the loan processor to the closing table. It is now the agent’s duty to determine if the ATR rule and the supporting paperwork are correct. Every aspect of the loan is now scrutinized, even the title insurance underwriter, closing office, and closing attorney.

Furthermore, the Ability to Repay (ATR) rule is ambiguous. The rule itself doesn’t have a specific set of percentages or dollar guidelines. It requires the lender to make a reasonable, good faith determination—before and when a loan is consummated—that the consumer has the assets needed to repay the loan. Specifically, buyers should be prepared with paperwork to support their loan request and these documents must have 3rd party verification. To assist loan transactions, the Consumer Financial Protection Bureau (CFPB), which was formed under Dodd-Frank in 2010, states that creditors generally must consider eight underwriting factors and generally use reasonably reliable third party records to verify the information when implementing the ATR Rule. These factors are:

- Current or reasonably expected income or assets

- Current employment status

- The monthly payment on the covered transaction

- The monthly payment on any simultaneous loan

- The monthly payment for mortgage related obligations

- Current debt obligations, alimony, and child support

- The monthly debt to income ratio or residual income

- Credit history

Lenders will be presumed to have complied with ATR if they issue a Qualified Mortgage. Real estate professionals should be on the lookout for these indicators to verify their clients are receiving a Qualified Mortgage when at the closing table:

- No excess upfront points and fees (currently used is

3% of mortgage value) - No toxic loan features (such as interest only, negative

amortization, or loan term longer than 30 years) - Cap on debit to income ratio (current standard is 43%

except for government affordability standards) - No balloon payments

One such new “checks” at the closing table are 3rd party verification services. For the first time in my 18 years as a real estate attorney, my office was required to go through a 3rd party vetting process prior to the lender sending over a title request on a loan. It was an interesting process performed by The Title Attorney Support Team/ Q&A Department of a servicer. The lender’s name was withheld and the request only identified the property, not the borrower. Disclaimers were pronounced advising that this was not a request to prepare a title package for closing but a verification of my company’s authenticity and HUD compliance practices. My underwriter was contacted to confirm my license and I was required to produce references. This entire process took approximately one week.

Moving forward, expect to see more 3rd party vendors being used to verify the borrower’s information, property details and closing transaction procedures. Lenders now view the closing agents as the front lines to verify if a transaction is legitimate under the ATR and with a wave of 2014 lawsuits against title insurance underwriters for their agents’ failures, I think the trend of passing compliance issues onto the local closing table will continue.

You can never substitute passion with hard work but you can use hard work to succeed with your passion.

—

Renee Marie Smith, Esq., Author of the My Guru book Series

Visit us at:

www.smithtitleservices.com

and www.mygurupublishing.com

Emerging Mortgage Trends of 2014

It’s no secret that trends within the mortgage and lending industries can fluctuate significantly from quarter to quarter. Countless factors such as the economy, new legislation, and changing demographics can impact these shifts. With the ever-changing financial landscape, we have pinpointed the most current and prevalent mortgage and lending trends of 2014.

Mortgage Volume Drops

Mortgage loan volumes have experienced a consistent drop across all lenders throughout 2014. In the first quarter, lenders made a total loan volume of $226 billion, an all-time low amount that hasn’t been achieved since 1997. One of the largest lenders, Wells Fargo, took the hardest hit with a 67% drop in originated residential mortgages.

Mortgage loan volumes have experienced a consistent drop across all lenders throughout 2014. In the first quarter, lenders made a total loan volume of $226 billion, an all-time low amount that hasn’t been achieved since 1997. One of the largest lenders, Wells Fargo, took the hardest hit with a 67% drop in originated residential mortgages.

One explanation for the steady decline in mortgage volume is due to the Federal Reserve’s mission to taper stimulus cash. As a result of the tapering, interest rates rose by a percentage point. The rise in interest rates has caused more people to become weary of refinancing which is correlated to the drop in mortgage volumes.

Rise in All-Cash Purchases

One variable has contributed significantly to the drop in the nation’s total loan volume: all-cash purchases. With rising interest rates, all-cash purchases have become a major contender among transactions in the housing economy. Interest rates are hardly the only reason though. Older generations are downsizing their current homes in favor of smaller homes. The switch to smaller homes has made all-cash purchases more feasible for the baby boomer generation.

Foreign investors buying property in the United States have also resulted in a large percentage of all-cash purchases. Buyers from China alone have spent $22 billion on properties in the United States. Foreign buyers tend to be members of the upper middle class and upper class of their respective countries. Waning economies and volatile political regimes have fueled many international buyers to make all-cash housing purchases in the more stable environment of the United States.

In the first quarter of 2014, all-cash purchases accounted for a record high of 43% of transactions. This trend in conjunction with tighter lending standards has predictably led to less lending. As far as domestic purchases are concerned, the all-cash trend could prove to be a temporary fixture as some lenders have joined a movement to lower lending standards. Lenders anticipate that looser lending standards will create a shift from skyrocketing all-cash purchases to more loans.

Paperless Options

Processes within the mortgage industry require a great deal of paperwork, as many people know. It is not unusual for cumbersome paperwork to prolong the process of closing a mortgage and processing miscellaneous loans. Although some measures have been taken to reduce waste, the U.S. Small Business Administration (SBA) and Fannie Mae are taking it a step further by implementing new programs and initiatives.

Maria Contreras-Sweet—24th Administrator of the SBA—recently announced an SBA agenda filled with new initiatives at the Center for American Progress in Washington, D.C. One such initiative includes the introduction of digital processes in favor of traditional yet time-consuming faxes and paperwork. The SBA will usher in a new era filled with electronic signatures and the ability to upload and generate documents. The switch is projected to save not only thousands of dollars but hours of time.

Fannie Mae has joined the digital trend and has commissioned a team to tackle common problems within the mortgage industry. The team identified a lack of electronic processes as the source of many issues within the industry. They found multiple solutions to amend the issue and say as much as $1 billion can be saved with electronic processes. The Consumer Financial Protection Bureau (CFPB) has also taken steps to evaluate what must be done to make an electronic switch. Although it could take years to apply the findings of both groups, it is clear that industries are finding the need to adapt to rapidly evolving technology.

The Decline of Negative Equity

Multiple reports have found that the percentage of total negative equity has decreased in the first quarter of 2014. CoreLogic reported 12.7% of mortgaged homes in the first quarter of 2014 as having negative equity which translates to almost 6.3 million homes nationwide. This statistic sharply contrasts to the 19.8% found in the first quarter of 2013 with 9.7 million homes ‘underwater.’

Nevada—the state with the highest incident of negative equity in residential properties—experienced a 16% drop in the amount of residential properties with negative equity when compared to the first quarter of 2013. Negative equity is forecasted to further decline as the year progresses and home prices steadily increase.

More Elderly with Debt

Elderly Americans carry more mortgage debt throughout their retirement years. An overwhelming amount of senior citizens—those 65 and older—not only have increased mortgage debt but increased credit card debt. The latest statistics provided by the Consumer Financial Protection Bureau (CBPB) reveal that from 2001 to 2011, the amount of elderly  homeowners with mortgage debt increased by 2.3 million. Rising home values and the trend of people purchasing their first homes in the latter half of their lives all contribute to the increase in mortgage debt.

homeowners with mortgage debt increased by 2.3 million. Rising home values and the trend of people purchasing their first homes in the latter half of their lives all contribute to the increase in mortgage debt.

Purchases that contribute to credit card debt appear to be directly related to the relaxed lifestyle most people envision in their retirement years. The idea of retirement for many evokes thoughts of traveling, trying new hobbies, and enjoying leisure time in general. The top expenses among the senior citizen demographic include new automotives, recreational items such as technology gadgets and camping supplies, and miscellaneous purchases for pets.

Experts stress that aging generations must account for a shift in expenses as they reach their retirement years. For example, medical expenses will become a larger factor in a retirees’ budget than compared to someone in pre-retirement years. Experts stress that with careful planning and well-thought spending plans, the growing trend could lessen in the future.

The Borrower Effect: Impacts & Implications of 2014 Loan Limits

The Great Depression left the United States with widespread unemployment and financial collapse. Two million construction workers were out of work. Home mortgages were typically short-term loans that were limited to 50% LTV. In 1934, the National Housing Act created the Federal Housing Administration (FHA) to improve housing conditions and provide a more accessible housing finance system to rejuvenate and stabilize the broader housing finance market that was then only serving borrowers with means. Today’s FHA is still focused on stabilizing the broader housing markets by ensuring that properly documented and qualified borrowers, including those in the low to median income ranges, and in some cases, those adversely affected by and recovering from the recent economic crises, can systematically access affordable mortgage financing, purchase good, safe homes priced at or below the median income.

The end of 2013 marked the expiration of the emergency legislation implemented during the economic crisis from which the US is only now recovering. In similar fashion to the Depression era emergency legislation initially creating the FHA, the Economic Stabilization Act (ESA) of 2008, now expired, and it’s successor, the Housing and Economic Recovery Act of 2008 (HERA) both included provisions to stabilize the broader housing markets when the US housing market had been once again roiled by a severe national economic crises.

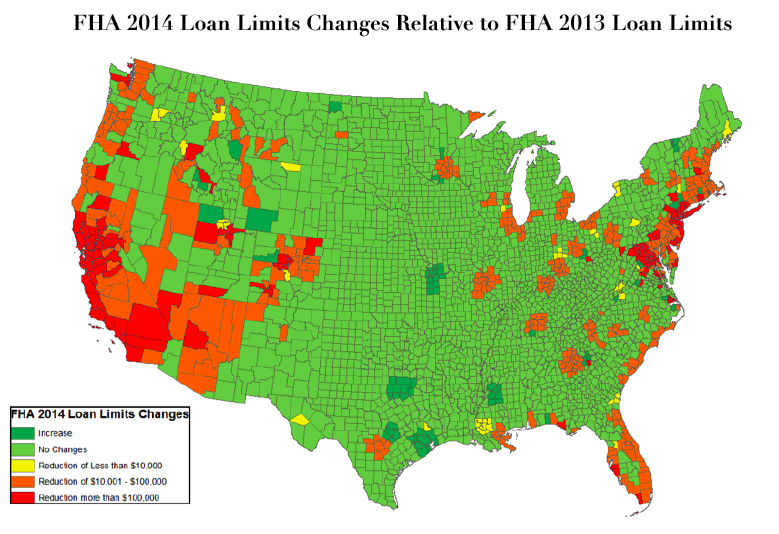

ESA increased the national FHA loan ceilings nationwide and allowed the highest cost markets to hold a $729,750 loan limit to maintain housing finance liquidity. Now, the HERA regulations reduce the national loan ceilings in approximately 20% of the more than 3,200 counties for which FHA establishes loan limits, adjusting for median house price corrections and recovering markets. Under HERA, the highest cost markets now have a loan limit of $625,500 – a reduction of $104,250.

Tom Clifford, Branch Manager of New American Funding in Paulsbo, Washington shared, “Yes, we have been affected by the FHA loan limit reductions in Washington State. Our county limits decreased from $475,000.00 to $307,000.00. The larger challenge however, is the drastic increase in the monthly MIP (mortgage insurance premium) making it a monumental challenge for median income homebuyers to afford FHA financing with home prices stabilizing and or increasing.” Clifford goes on say that “Realtors are telling their buyers that FHA financing is not a viable option any longer and steering them away, which has not been the case in years/decades past.”

Nevada Area Sales Manager for New American Funding, Chris Garza, also confirms the lower loan limits “have negatively impacted [Las] Vegas.” In addition to the downward pressure that reduced loan limits are having on the prospective homebuyer’s purchasing power, Garza says that “…Fannie Mae and Freddie Mac having much tougher…credit guidelines,” is also negatively impacting the Nevada market. So let’s unbundle each of these significant changes and the effects they’re having on the housing markets and the borrower’s purchasing power. In both of these high cost markets, the senior mortgage professionals identified three major changes; (1) The HERA implementation lowering the FHA and Conventional (GSE) loan limits; (2) the increased Mortgage Insurance Premiums required to insure the FHA loan product, and (3) the seemingly more restrictive credit environment in which the GSEs are operating.

2014 Loan Limits

On December 6, 2013, HUD announced the new loan limits with the January 1, 2014 effective date. Fortunately, the first-time and affordable homebuyers seeking to purchase homes in markets where the housing costs remain low, did not experience any loan limit changes. Their maximum available loan amounts remained at $271,050.

However, about 652 (20%) of the 3,234 counties for which HUD sets loan limits, will see reductions to their maximum loan amounts as FHA implements the long delayed requirements promulgated by the HERA legislation. These 652 counties are considered “high cost” markets and FHA historically provided for them to have loan limits higher than the median housing price for that county. ESA allowed the ceiling to rise to 125% above median housing price to keep mortgage funds available and sufficient to cover the high house prices created in the advent of the crises. HERA corrects the ceiling in these high-cost markets to 115% of the county’s current median housing price.

It’s important to understand that the emergency legislation deployed through ESA enabled the federal government to fill the housing finance liquidity void created by the mass and abrupt exodus of private sector financing during the U.S. mortgage crisis. Housing is the second largest contributor to our nation’s Gross Domestic Product (GDP), historically comprising 17-20% of GDP and second only to Consumerism, and the federal government could not allow the funding for housing finance to evaporate. This temporary emergency measure was intended to be a short term “plug” and, in 2009 was to be replaced by the more sustainable and permanent HERA, which amended the National Housing Act to tie the FHA’s loan limit “ceiling” and “floor” to the conforming loan limit standard used by Fannie Mae and Freddie Mac.

We can see in the graph above, that as a result of HERA, 183 counties across the US now have loan limits that are lower by a whopping $100,000 or greater!

As you might expect, California felt the heaviest impact of HERA, with 54 counties receiving downward adjustments. In contrast, Texas saw 27 counties receive upward adjustments. While California was the largest issuer of FHA Single Family endorsements in 2013, in both dollar volume ($24.7B) and loan count (89.1MM), only 7.7% of those issuances were above the 2014 loan limits.

Nonetheless, reductions of this nature have constrained the purchasing power of borrowers in the impacted markets, causing them to rethink their home buying strategy and possibly even their timing.

The map above provides a visual depiction of the heavily impacted markets.

Note that the concentration of “reds” and “oranges” are along the coastal regions where population density is higher. Typically, the high and highest cost markets are designated as such as they tend to also be higher job producing markets, which create higher density populations, which in turn create higher housing demands. And as we all know, increased housing demands tend to increase house prices.

So why is all of this important for the real estate professionals working across the housing continuum? The job seekers filling the red and orange landscape fit the traditional first time homebuyer profiles for which the FHA program was developed. 2013 was a very strong recovery year for housing prices, with many markets showing strong improvement. And even though some of these high and higher costs markets were hit so severely during this economic crisis, they had risen so high prior to it, that with the reduced loan limits, their current prices are out of reach for the gainfully employed first-time homebuyer. Legitimate homebuyers who managed to save the 3-3.5% required to buy their entry level home were also located in those 183 counties who’s loan limits were reduced by $100,000 or more. Where do they now derive the additional funds to fill the down payment gap created by the reduced loan limits?

The National Association of Realtors (NAR) reports that in a normal market environment, first-time homebuyers consummate 40% of home sales. By the end of 2013, NAR reported that only 28% of the home sales were to first time homebuyers!

At upwards of 80%, the GSEs and FHA remain the main sources of housing funding. While it’s important to enact the requirements of any final piece of legislation, would it have been truly detrimental to have enacted these particular requirements/corrections in phases? Especially, since it had already been completely delayed 5 years past its legislated enactment date.

Brainpower and models much larger and more intense than ours evaluated these changes and made the decision to move forward on all fronts in one swooping, market pervasive move. With the overall economic recovery still progressing very slowly, the recovery in the housing sector still far from “full-steam-ahead”, and the prevailing lack of meaningful private financing, one begins to wonder. Is it possible that all three agencies are repressing “bubble” fears?

Come back next month to get our perspective on drivers and impacts of FHA’s higher MIP and the increasingly “intense” credit mindset in the conventional loan arena.

—

Ingrid Beckles

Founder & CEO of The Beckles Collective, LLC

NAWRB’s Regulatory & Policy Chair

ibeckles@thebecklescollective.com

In Which Dimension is Credit Constrained?

The year 2014 is sure to be another eventful one in mortgage finance. A litany of new regulations are prepared to be implemented, the economy is projected to improve, driving mortgage rates higher, and demand to refinance loans is expected to decline further. The overall size of the mortgage market, in dollar terms, is anticipated to be significantly smaller than in 2013. In light of these market conditions, one of the most discussed issues right now is the availability of credit for mortgage borrowers – is mortgage credit availability too tight? The importance of this question cannot be understated, particularly because of the impending implementation of the Qualified Mortgage (QM) standard and the mortgage market’s determination of the types of credit it will offer to borrowers.

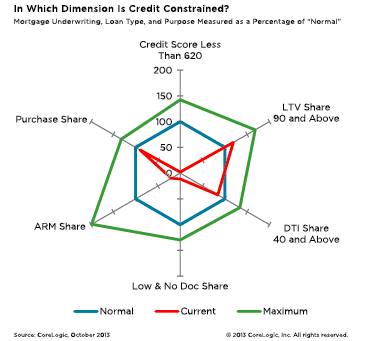

Whether credit is too tight or too loose is an especially hard question to answer because there is no one single measure of credit availability. Nonetheless, it is possible to look at a variety of measures that collectively influence a borrower’s access to credit: borrower credit worthiness, loan-to-value (LTV) ratios, debt-to-income (DTI) ratios, the level of documentation, the propensity of adjustable rate (ARM) loans and the share of purchase-money loans.

To answer the question of whether each of these credit measures is too loose or too tight requires a determination of what would constitute a “normal” level of availability. For example, the average credit score of all originated first-lien purchase loans in October 2013 was 749. The average credit score over the year before the Federal Reserve announcement encouraging the use of ARMS in February 2004, and subsequently raising the federal funds rate, was 710. In percentage terms, this is only a 5-percent difference. The average doesn’t show us that the share of originated first-lien purchase loans in October 2013 with credit scores below 620 (typically ineligible under GSE guidelines) was 0.3 percent, but averaged 29 percent over the year before the Fed announcement. Credit to borrowers with low FICO scores was normally available prior to the beginning of the housing boom (as marked by the Fed announcement), but clearly is not currently. For each measure of credit availability, it is much more insightful to compare the share of the riskiest subset of the entire measure’s distribution to that same share prior to the housing bubble. Credit availability in each measure represents the extent to which lenders originate loans to the riskier subset of the distribution.

In the chart, each axis represents a different measure of credit availability. The inner hexagon crosses each axis at a value of 100, which is the reference point for the normal value for the measure illustrated on that axis, based on the average over the year preceding the Fed announcement in February 2004. For example, as described above, the share of first-lien purchase loans in October 2013 with credit scores below 620 was 0.3 percent, but averaged 29 percent over the year before the Fed announcement. Therefore, relative to a normal share of 29 percent, indexed to 100 and represented in the “normal” hexagon, the “current” unbalanced hexagon clearly shows the constrained availability of credit to low credit score borrowers. For each measure, the “current” and “maximum” unbalanced hexagons represent the deviation from normal for each measure both currently and at the loosest since the start of the housing bubble, respectively.

Immediately apparent from this chart is that credit availability is tight for two important underwriting criteria – credit scores and documentation levels. Low-credit-score loans are not being originated relative to the height of the expansion of credit or even at the normalized level of availability. Additionally, access to no- and low-documentation loans is significantly constrained relative to the height of expanded credit or the normalized level of availability. Underwriting eligibility in the current market requires good credit and the ability to fully document your loan.

Also interesting to note is that the shares of high-LTV and DTI lending are very close to normal. Both measures expanded availability during the housing boom. High-LTV lending currently remains modestly loose relative to normal and high-DTI lending is modestly tight relative to normal. The share of ARM loans being originated is currently much more restricted than normal, as many subprime ARM loan products are no longer available.

Looking at the share of the riskiest subset of an entire measure’s distribution compared to the share prior to the housing bubble for multiple measures gives more insight into the answer to the pressing question of whether credit is too loose or too tight. Right now, credit is tight for low credit score borrowers, those who don’t want to or can’t fully document their loans, or who would like an ARM product. For many, the choice to document or select an ARM product is not necessarily an impediment to credit availability, but for those with low credit scores there are fewer options.

—

Mark Fleming

Chief Economist

CoreLogic

www.corelogic.com

FHFA Decision: Path to Affordable Housing or Another Crash?

Mel Watt, Director of the Federal Housing Finance Agency (FHFA), is facing mounting pressure regarding his decision to lift a temporary suspension on allocating funds to the national Housing Trust Fund (HTF) and Capital Magnet Fund (CMF). With the lifted suspension, 4.2 basis points of each dollar of the unpaid principal balance for new business purchases from Fannie Mae and Freddie Mac will be diverted towards the funds.

Mel Watt, Director of the Federal Housing Finance Agency (FHFA), is facing mounting pressure regarding his decision to lift a temporary suspension on allocating funds to the national Housing Trust Fund (HTF) and Capital Magnet Fund (CMF). With the lifted suspension, 4.2 basis points of each dollar of the unpaid principal balance for new business purchases from Fannie Mae and Freddie Mac will be diverted towards the funds.

Enacted in the summer of 2008, the Housing and Economic Recovery Act of 2008 (HERA) created the HTF and CMF. According to Housing and Urban Development (HUD), HTF “is a new affordable housing production program that will complement existing Federal, state and local efforts to increase and preserve the supply of decent, safe, and sanitary affordable housing.” Extremely low- and very low-income households are eligible for the program. Updated income limits for extremely low- and very low-income households for each county in the U.S. can be found on HUD’s website.

The HTF works by providing funds to eligible state and state-designated entities for activities that include real property acquisition, relocation assistance, demolition, and site improvements. In regards to eligible households, assistance can appear in the form of deferred loan payments, grants, interest subsidies, and equity investments.

Similar to the HTF, the CMF promotes affordable housing but utilizes Community Development Financial Institutions (CDFIs) and non-profit housing developers as the vehicles for creating inexpensive housing options. The CMF can also use funds for community facilities and economic development projects that encourage affordable housing. As a competitive grant program, the CMF is unique in that it was created to increase investments and attract private capital.

Although HERA established the allocation of funds to the HTF and CMF, it was temporarily suspended when the Government-Sponsored Enterprises (GSEs) were placed into conservatorship under the FHFA. The steep financial woes generated by the subprime mortgage crisis led to the eventual conservatorship decision.

Fast-forward to December 2014, Watt wrote a separate letter to the respective CEOs of Freddie Mac and Fannie Mae that explicitly called for the termination of the suspension on allocating funds to the HTF and CMF in order to help bolster affordable housing.

According to 12 U.S.C. § 4567 (b), the suspension was due to allocations violating one or more of the following:

- Contributing or would contribute to the financial instability of Fannie Mae/Freddie Mac.

- Causing or would cause Fannie Mae/Freddie Mac to be classified as undercapitalized.

- Preventing or would prevent Fannie Mae/Freddie Mac from successfully completing a capital restoration plan.

Watt’s decision and his reasoning is the epicenter for the arguments of both proponents and opponents. In his letters to Freddie Mac and Fannie Mae, Watt used four main reasons to support his decision which is summarized below:

- The decision to temporarily suspend allocations was a product of the circumstances at the time. Currently, those circumstances have changed.

- Financial operations have stabilized to a reasonable level. In addition, allocations and set aside would not be a contributing factor to financial instability of the GSEs in question.

- 12 U.S.C. § 4567 (b)(2) and (3) are no longer applicable. These sections refer to the classification as undercapitalized and the successful completion of a capital restoration plan. Currently, the capital classifications are suspended under the FHFA and the GSEs in question are not seeking to complete a capital restoration plan. Both GSEs have entered into Senior Preferred Stock Purchase Agreements (SPSPA) to avoid receivership.

- Since 2012, the GSEs have not endured profit levels that are anticipated to be sustainable. However, projections reveal that they will maintain profitability in the future. The decision to resume allocating funds can always be reversed or updated based upon the financial situation.

Sallie Krawcheck Empowering Women with New Fund

Sallie Krawcheck Empowering Women with New Fund

On Wednesday, former Citigroup and Bank of America executive Sallie Krawcheck announced the creation of a unique index fund that will promote women within the business world. The first of its kind, the index fund is a result of a partnership between Pax World Management LLC and the company Krawcheck recently purchased, Ellevate. Continue reading →

Login

Login