Mel Watt, Director of the Federal Housing Finance Agency (FHFA), is facing mounting pressure regarding his decision to lift a temporary suspension on allocating funds to the national Housing Trust Fund (HTF) and Capital Magnet Fund (CMF). With the lifted suspension, 4.2 basis points of each dollar of the unpaid principal balance for new business purchases from Fannie Mae and Freddie Mac will be diverted towards the funds.

Mel Watt, Director of the Federal Housing Finance Agency (FHFA), is facing mounting pressure regarding his decision to lift a temporary suspension on allocating funds to the national Housing Trust Fund (HTF) and Capital Magnet Fund (CMF). With the lifted suspension, 4.2 basis points of each dollar of the unpaid principal balance for new business purchases from Fannie Mae and Freddie Mac will be diverted towards the funds.

Enacted in the summer of 2008, the Housing and Economic Recovery Act of 2008 (HERA) created the HTF and CMF. According to Housing and Urban Development (HUD), HTF “is a new affordable housing production program that will complement existing Federal, state and local efforts to increase and preserve the supply of decent, safe, and sanitary affordable housing.” Extremely low- and very low-income households are eligible for the program. Updated income limits for extremely low- and very low-income households for each county in the U.S. can be found on HUD’s website.

The HTF works by providing funds to eligible state and state-designated entities for activities that include real property acquisition, relocation assistance, demolition, and site improvements. In regards to eligible households, assistance can appear in the form of deferred loan payments, grants, interest subsidies, and equity investments.

Similar to the HTF, the CMF promotes affordable housing but utilizes Community Development Financial Institutions (CDFIs) and non-profit housing developers as the vehicles for creating inexpensive housing options. The CMF can also use funds for community facilities and economic development projects that encourage affordable housing. As a competitive grant program, the CMF is unique in that it was created to increase investments and attract private capital.

Although HERA established the allocation of funds to the HTF and CMF, it was temporarily suspended when the Government-Sponsored Enterprises (GSEs) were placed into conservatorship under the FHFA. The steep financial woes generated by the subprime mortgage crisis led to the eventual conservatorship decision.

Fast-forward to December 2014, Watt wrote a separate letter to the respective CEOs of Freddie Mac and Fannie Mae that explicitly called for the termination of the suspension on allocating funds to the HTF and CMF in order to help bolster affordable housing.

According to 12 U.S.C. § 4567 (b), the suspension was due to allocations violating one or more of the following:

- Contributing or would contribute to the financial instability of Fannie Mae/Freddie Mac.

- Causing or would cause Fannie Mae/Freddie Mac to be classified as undercapitalized.

- Preventing or would prevent Fannie Mae/Freddie Mac from successfully completing a capital restoration plan.

Watt’s decision and his reasoning is the epicenter for the arguments of both proponents and opponents. In his letters to Freddie Mac and Fannie Mae, Watt used four main reasons to support his decision which is summarized below:

- The decision to temporarily suspend allocations was a product of the circumstances at the time. Currently, those circumstances have changed.

- Financial operations have stabilized to a reasonable level. In addition, allocations and set aside would not be a contributing factor to financial instability of the GSEs in question.

- 12 U.S.C. § 4567 (b)(2) and (3) are no longer applicable. These sections refer to the classification as undercapitalized and the successful completion of a capital restoration plan. Currently, the capital classifications are suspended under the FHFA and the GSEs in question are not seeking to complete a capital restoration plan. Both GSEs have entered into Senior Preferred Stock Purchase Agreements (SPSPA) to avoid receivership.

- Since 2012, the GSEs have not endured profit levels that are anticipated to be sustainable. However, projections reveal that they will maintain profitability in the future. The decision to resume allocating funds can always be reversed or updated based upon the financial situation.

Login

Login

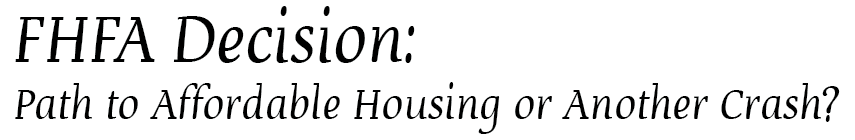

Members of Congress retiring this year fall into two general camps: those who are genuinely tired and those who are tired of partisan gridlock. A growing number of “retirements” are the results of frustration, discontent, and political reality – forced decisions rather than ready to quit working. Many are pragmatists –Republican and Democrat – who are tired of Washington gridlock and polarization.

Members of Congress retiring this year fall into two general camps: those who are genuinely tired and those who are tired of partisan gridlock. A growing number of “retirements” are the results of frustration, discontent, and political reality – forced decisions rather than ready to quit working. Many are pragmatists –Republican and Democrat – who are tired of Washington gridlock and polarization. Two: After spending two years working with his counterpart—Chairman of the Committee on Ways and Means Dave Camp (R-MI)—to develop a set of principles to guide comprehensive tax reform, Senator Baucus’ departure from Congress effectively doomed any chance for tax reform in the Senate. Not long thereafter, Chair Camp announced that he too would retire from Congress at the end of this year. So, not only do both of their retirements put tax reform on hold for the foreseeable future, but the institutional knowledge and intimate understanding of the intricacies of the U.S. tax code will no longer be around. Some would argue that’s a good thing.

Two: After spending two years working with his counterpart—Chairman of the Committee on Ways and Means Dave Camp (R-MI)—to develop a set of principles to guide comprehensive tax reform, Senator Baucus’ departure from Congress effectively doomed any chance for tax reform in the Senate. Not long thereafter, Chair Camp announced that he too would retire from Congress at the end of this year. So, not only do both of their retirements put tax reform on hold for the foreseeable future, but the institutional knowledge and intimate understanding of the intricacies of the U.S. tax code will no longer be around. Some would argue that’s a good thing. Two other races that could decide the balance of power in the Senate next year feature two strong women. In Georgia, a number of Republican hopefuls, including three sitting Congressmen, are gearing up for a primary battle to replace retiring Senator Saxby Chambliss (R-GA). On the Democratic side, Michelle Nunn, daughter of longtime Georgia Senator Sam Nunn Jr. (D-GA), is likely to capture the nomination and could emerge victorious, according to Christina Bellantoni, a former political editor for PBS NewsHour.

Two other races that could decide the balance of power in the Senate next year feature two strong women. In Georgia, a number of Republican hopefuls, including three sitting Congressmen, are gearing up for a primary battle to replace retiring Senator Saxby Chambliss (R-GA). On the Democratic side, Michelle Nunn, daughter of longtime Georgia Senator Sam Nunn Jr. (D-GA), is likely to capture the nomination and could emerge victorious, according to Christina Bellantoni, a former political editor for PBS NewsHour. Committee Chairs usually spend years getting to know the inner workings of the issues under their Committee’s jurisdiction, building a knowledge base accumulated over years of hearings on particular issues. We know how this impacted the prospects of comprehensive tax reform. One of the staunchest proponents for comprehensive climate change legislation (Rep. Waxman) will depart this year. Two of the most respected Armed Services Committee Chairs (Sen. Levin and Rep. McKeon) will depart. Chairs of Committees that oversee healthcare, workforce and labor policies, regulation of natural resources, among many other will all leave at the end of this year. Incoming Committee Chairs, whoever they may be, will have a lot of learning to do come January 2015.

Committee Chairs usually spend years getting to know the inner workings of the issues under their Committee’s jurisdiction, building a knowledge base accumulated over years of hearings on particular issues. We know how this impacted the prospects of comprehensive tax reform. One of the staunchest proponents for comprehensive climate change legislation (Rep. Waxman) will depart this year. Two of the most respected Armed Services Committee Chairs (Sen. Levin and Rep. McKeon) will depart. Chairs of Committees that oversee healthcare, workforce and labor policies, regulation of natural resources, among many other will all leave at the end of this year. Incoming Committee Chairs, whoever they may be, will have a lot of learning to do come January 2015.

Lourdes Martin-Rosa is the American Express OPEN Advisor on Government Contracting and has 20 years of experience in the federal procurement arena. She helps small businesses get contract ready and achieve contract success. For more information, visit:www.openforum.com/governmentcontracts.

Lourdes Martin-Rosa is the American Express OPEN Advisor on Government Contracting and has 20 years of experience in the federal procurement arena. She helps small businesses get contract ready and achieve contract success. For more information, visit:www.openforum.com/governmentcontracts.