The Senate has rejected a Consumer Financial Protection Bureau (CFPB) bill that would have made it easier for consumers to sue financial institutions in court. Historically, banks and credit card companies have included arbitration clauses in their financial contracts, preventing people from grouping their resources in class-action lawsuits; the Senate’s ruling enables the continuation of this practice.

Know an Incredible Woman Preserving the

Quality of Life During COVID-19?

Submit your story today!

Read More

Consulting & Branding Opportunities

Grant your business access to insider,

proven knowledge to improve the quality of your procured

services and maximize business performance.

If you need D&I

Contact Us!

A Team Focused on Bring Diversity and Inclusion to Every Level

Learn More

#1 Top Real Estate Influencer

Desiree Patno

Diversity & Inclusion, Quality of Life, Know the Rules of the Game ®

Your Next Event

Grow Your Business

NAWRB: An SBA Resource

NAWRB is listed as a women-owned business resource for the SBA.

Check It Out

NAWRB Aging Population

Help Protect Elders

from Financial Abuse

Over $36.5 billion a year is lost annually in the U.S.

Prevent Financial Abuse

Women's Homeownership:

Dream. Stability. Sanctuary.

Life often presents us

with unplanned disruptions.

AI Technology

with

a Human Touch

Is

The Perfect Balance

NAWRB Women's Global Resource Center

A women’s depository for vendors & clients to grow their diverse spend & increase women’s employment at all levels within the housing ecosystem.

Tag Archives: finance

Teaming with NAWRB in Procurement Contracting

NAWRB’s procurement contract bidding schedule is brimming with opportunities across the housing ecosystem, from executive coaching and asset management to construction and technology. With all of the Requests for Proposals (RFP) we receive, utilizing the power of teaming with other professionals and companies has been an effective tool to help satisfy contract demands while positioning others to capitalize on their unique capabilities.

California Passes 12-Week Family Leave for Small Businesses

California Governor Jerry Brown has signed the New Parent Leave Act (SB 63) enabling 2.6 million small business workers to take 12 weeks of unpaid family leave without having to worry about losing their jobs. The new bill will go into effect on January 1, 2018.

Increasing the Odds: Building the Female Executive

If you have had the privilege of meeting with senior managers at mortgage and finance companies, you will notice they are overwhelmingly filled with middle-aged, white men. According to Catalyst, women currently hold only 5.8 percent of CEO positions at S&P 500 companies. This tells us that despite all of the progress, women simply have not shattered the glass ceiling.

The fact remains, when it comes to hiring for executive-level positions, the pool of experienced and qualified candidates with relevant experience is predominantly male. This is not to say that women are not just as capable, but if 95 percent of the qualified applicant pool is male, the chances of hiring a female for that role are strikingly low, thus creating a perpetual cycle of hiring men.

To move more women into higher roles, companies need to foster an environment of promoting from within and effectively “break” this continuous cycle. Companies sometimes fail to see the proven talent right before them in their eagerness to bring in someone from the outside with a prior comparable title. Board members usually receive outside candidates with similar experience well because they seem like the right fit on paper. The reality is that after the initial announcement to the company and circulation in industry periodicals, no one ever remembers these prior titles and companies measure performance by innovation rather than a candidate’s prior job history.

The responsibility to foster an environment that promotes from within falls on each of our shoulders. We need to encourage growth from within our own companies, encourage hiring managers and those in decision-making positions to look within the company and allow capable, promising employees the chance to advance from within. To drive this growth, we need to prepare the next generation of executive women to challenge experienced male candidates.

To be a capable candidate for an executive role requires having a clear vision of your goals and career path. Planning will help you to avoid many costly detours along the way and improve your chances of arriving at your final destination.

Career goals are different from performance goals at work and they are certainly not a New Year’s Resolution, which is good, because hardly anyone achieves those! Unlike performance goals—which are usually SMART (Specific, Measurable, Achievable, Relevant and Time Bound)—career goals should be HARD (Heartfelt, Animated, Required and Difficult). Goals need to be difficult enough to propel one forward, making traction toward the final destination.

It is important to remember that you will never achieve a goal you don’t set, yet the majority of the population does not have written goals. The mere act of writing down goals will set you apart from peers. However, setting the goal is just part of the battle.

According to statistics from Workboard, 93 percent of the workforce cannot translate their goals into actions, and only 7 percent of people know what they need to do to execute a goal. Similar statistics from Inc. indicate only 8 percent of the population can achieve a goal they set annually—this does not even speak to goals that span the course of decades.

How can women best position themselves to reach their career goals? In addition to their HARD career goals, they must select the right mentor. Sharing goals with a mentor can help maintain focus and develop the roadmap needed to execute your vision. The right mentor is vital to developing the skills needed to translate goals into action and continue career growth, particularly for women who are at a disadvantage.

In identifying a mentor, it is arguable that women are far more successful when mentored by other women. Women are known for their ability to relate to an audience. It is important to have a mentor who can help you grow to find your own voice and present ideas in a way that is confident, persuasive and natural. Women mentored by other women can better find a delivery method that is their own because they share common strengths and understandings. Bottom line: women need to find their own voice and they will not find it if trying to sound like a man.

My advice to women is not to let life pass by. Take control and propel forward into that dream job with confidence and the necessary skills. When doing so, do not forget that you would not be as strong without a community of supportive women, each of which have a duty help mentor the next generation.

Thank you,

Robyn Markow

AVP Client Relations

Quality Claims Management Corp.

Subcommittee on Housing and Insurance Examines Family Self-Sufficiency Program

Today, the Subcommittee on Housing and Insurance held a hearing to review the Family Self-Sufficiency Program (FSS), a program that helps “enables HUD-assisted families to increase their earned income and reduce their dependency on welfare assistance and rental subsidies.”

More than 40 Percent of Adults Struggle to Make Ends Meet

In their first national survey on financial well-being, the Consumer Financial Protection Bureau (CFPB) has found that over 40 percent of U.S. adults have a hard time making ends meet. Utilizing a 10-question survey, the National Financial Well-Being Survey provides the “first-ever national data directly measuring the financial well-being of U.S. consumers.”

Home Prices Rose 6.3 Percent in the Past Year

According to the Federal Housing Finance Agency (FHFA) seasonally adjusted monthly House Price Index (HPI), U.S. house prices increased .2 percent from June to July 2017. The monthly index calculates home prices by utilizing mortgage information from Freddie Mac and Fannie Mae. From July 2016 to July 2017, house prices in the U.S. climbed 6.3 percent.

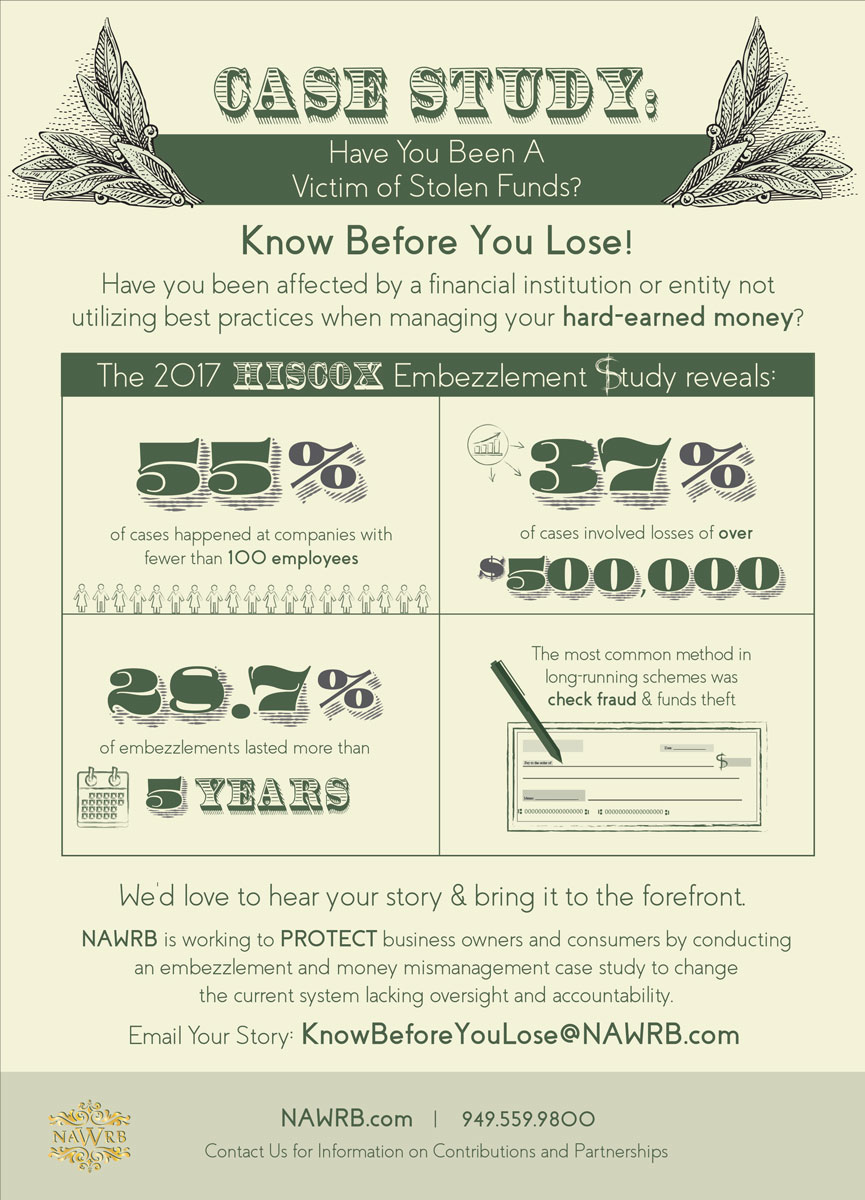

Case Study: Have You Been A Victim of Stolen Funds?

There are few worst feelings than suddenly losing something you worked truly hard on, from an essay to an event or even a personal project. Imagine the hidden danger of losing everything you’ve worked for your entire life, your business, your home, even your retirement fund.

Financial Services Committee to hold Hearing on Equifax Breach

The House Financial Services Committee (FSC) has announced that it will hold a hearing on the Equifax data breach that took place earlier this week. The breach, which was publicized on September 7, could potentially affect 143 million American consumers, as private information such as names, Social Security numbers, birth dates, credit card numbers and more was accessed.

Happy 4th of July from NAWRB!

NAWRB wishes you a happy American Independence Day! From the delicious cookouts and parades to concerts and the lively fireworks at night, the 4th of July is always a day to remember. In commemoration of Independence Day, we’ve compiled interesting facts about the observance and history of the 4th of July.

Login

Login