The National Women’s Business Council (NWBC) released a new research report outlining the differences between men and women business owners, regarding the scale of business growth, amount and sources of financial capital, and the relationship between the two. Unfortunately, the statistics on funding for women-owned businesses, whether it concerns bank loans, angel investments, or VC funding continue to discourage. As the government’s only independent voice for women entrepreneurs, the NWBC’s two-fold mission is to conduct and support groundbreaking research that provides insight into women business enterprises from startup to success, and to share the findings to incite constructive action and policy. To that end, the NWBC saw the need tackle the thorny issue of funding and women owned businesses once again. The NWBC just released a new research report looking at current trends in female entrepreneurship and funding with an eye towards spurring discussion and finding solutions. Here are some of the most salient highlights from their work:

Access to Capital and Women Entrepreneurs

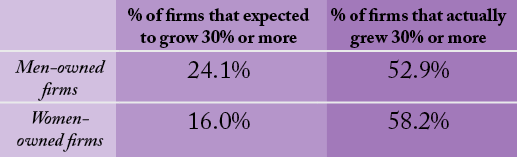

Access to capital continues to be a major issue for all, but especially for women entrepreneurs. The NWBC research suggests there is a direct correlation between access to capital, and company growth in terms of employment for both men- and women- owned businesses: women-owned firms exceeded their growth expectations, while men-owned firms had much greater growth in revenue.

Men-owned firms used significantly more capital than women, particularly with respect to equity from external sources such as venture capitalists and angel investors. Only 20% of all angel-backed companies were women-led in 2013. The NWBC’s research concludes high growth women-owned firms may be an underutilized tool for economic growth; increased access to capital is important because more money for the business will undoubtedly maximize their potential to contribute to the economy.

Overcoming The Fear Factor

When it comes to broadening the pathway to success for women business owners, women who are sole owners should consider finding a business partner who has previous startup experience. The NWBC’s research findings suggest firms with team ownership and/or owners with previous startup experience typically have higher amounts of capital and were more likely to have high growth potential. This research also revealed women-owned firms were also less likely to apply for credit when needed because they feared being turned down.

Anecdotally, many successful business owners were rejected repeatedly by banks before ultimately obtaining a loan. It is important for women to ask, and to keep asking. From the standpoint of risk aversion, a number of studies have similarly identified the fear of failure as a major impediment to the launch and growth of women-owned firms. For example, at NWBC’S March 2014 public meeting, Divya Nag—one of STEM’s youngest woman entrepreneurs—discussed Stanford’s StartX accelerator. She noted that only 5% of founding teams with women reapply when rejected as compared to 65% for all-male founding teams. The NWBC concludes that it is essential that entrepreneurs believe in their product, be able to communicate how it fulfills an unmet need in the market and continue to tell that story despite rejection.

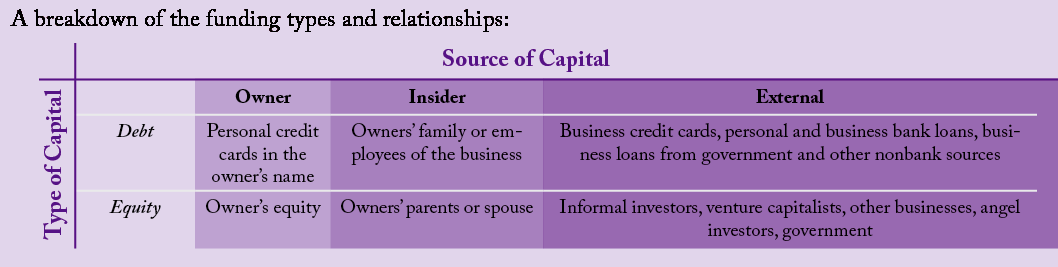

Beyond the Boys Club: Reasons Men Receive More Capital

Research and other supporting research show, men and women approach debt differently, including the application process. Since women had lower growth expectations than men, it is possible they pursue less capital at the outset. Also women  are more likely to have characteristics that are associated with lower amounts of capital in general—these include less previous industry experience, less previous startup experience, and lower credit scores, being a sole owner, and being home-based. However, these trends occur even among women-owned firms with high growth potential. One of the biggest differences seen was with regards to the amount of outside equity used. The presence of women is notoriously low on the investment side, e.g. as angel investors. Increasing women’s presence on the investment side (e.g. as angel investors) might help ameliorate some supply-side issues.

are more likely to have characteristics that are associated with lower amounts of capital in general—these include less previous industry experience, less previous startup experience, and lower credit scores, being a sole owner, and being home-based. However, these trends occur even among women-owned firms with high growth potential. One of the biggest differences seen was with regards to the amount of outside equity used. The presence of women is notoriously low on the investment side, e.g. as angel investors. Increasing women’s presence on the investment side (e.g. as angel investors) might help ameliorate some supply-side issues.

The Role of the Banks, Incubators and Accelerators

There is substantial opportunity for financial institutions to ramp-up their efforts to target and increase lending to women entrepreneurs. The NWBC concludes that one particularly effective strategy to maximize the potential of high growth oriented women entrepreneurs would be incentivizing accelerators and incubators to address the specific needs of and support women entrepreneurs. In addition to financial resources, this would allow women to get the tangible startup experience they need, the help with the business growth planning process and offer the added benefit of social networking—possibly resulting in team ownership.

Tackling the Problem on Both Fronts

Ultimately, it looks like there is both a demand-side and supply-side issue. It’s important for women business owners with high growth potential to set themselves up for success financially—but also for institutions and individuals offering financing to work with growth-oriented women to maximize their potential. The NWBC would like to see more women entering the investment side, as angel investors or as part of a screening committee at a venture capital fund.

There is no doubt that great strides have been made in the women’s entrepreneurship movement, but there is clearly more work to do. Change or action doesn’t happen without impetus. If we continue to build on the progress that has already been made women, women-business owners and the economy as a whole will benefit tremendously.

“New Research Shows Funding Challenges Persist for Women-Owned Businesses” was originally published on ProjecteEve.com.

The National Women’s Business Council continues to be a leading voice in advancing the women’s entrepreneurship agenda with a strong focus on providing key insights and solutions to increasing economic gains for women business owners. The NWBC has identified four priorities: Access to Capital, Access to Markets, Job Creation & Growth, and Data Collection. The NWBC will be highlighting the challenges and opportunities for women entrepreneurs through several research efforts, including: undercapitalization as a contributing factor to business failure; Supplier Diversity Initiatives and Supply Chain Analysis; and Women’s participation in accelerators and incubators.

Login

Login