The past decade has taught us a great deal about housing loss and preservation. Many of us were personally affected, or know someone affected, by the 2007-08 economic downturn period our country experienced.

There have been several lessons learned. Most of all, we learned that too many U.S residents have too much debt and lack the necessary reserves to weather the slightest bump in their financial lives.

History will argue about what went wrong and who to blame. There were lots of mistakes but there were several good lessons. One was the reminder of the value and need for nonprofit housing advocates, educators and counselors.

We learned that homeowners and homebuyers who took advantage of homeownership, credit and financial literacy counseling fared far better during the housing and economic crisis and avoided foreclosure and delinquency more than homeowners who did not. We learned that pre-purchase education, credit and budgeting courses prevented many homebuyers from buying more than they could afford and taught them to avoid the pitfalls of over leveraging their home and excessive debt.

Continue reading

Login

Login

NAWRB: What is your favorite characteristic of Washington, D.C.? What sets the nation’s capital apart from other cities in which you’ve lived?

NAWRB: What is your favorite characteristic of Washington, D.C.? What sets the nation’s capital apart from other cities in which you’ve lived?

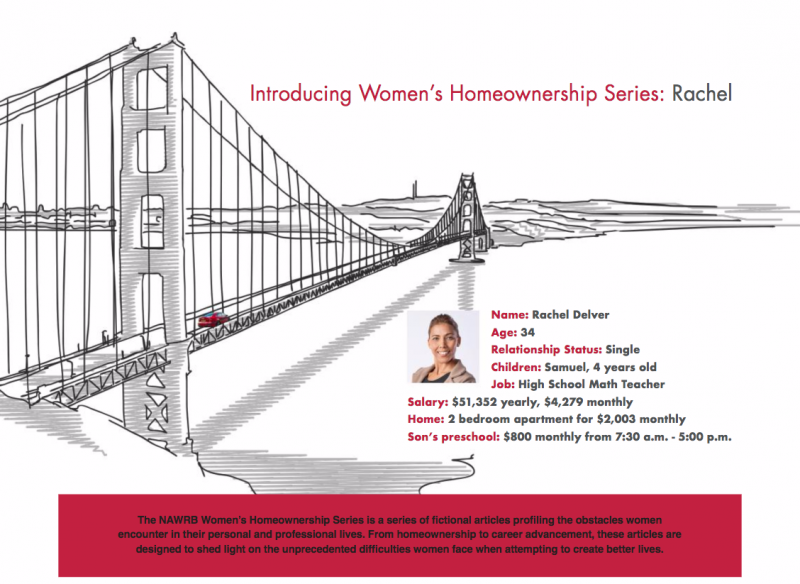

Commuting to San Francisco from her home is out of the question. A two-hour commute would mean having to leave home before 5:00 a.m. and moving closer, perhaps to Oakland, still results in a commute exceeding an hour.

Commuting to San Francisco from her home is out of the question. A two-hour commute would mean having to leave home before 5:00 a.m. and moving closer, perhaps to Oakland, still results in a commute exceeding an hour. Despite earning more than the median weekly income of $1,049 for women with a bachelor’s degree or higher, Rachel’s salary doesn’t go very far in the City by the Bay. In fact, after rent, Sam’s preschool tuition is more than all her other bills combined.

Despite earning more than the median weekly income of $1,049 for women with a bachelor’s degree or higher, Rachel’s salary doesn’t go very far in the City by the Bay. In fact, after rent, Sam’s preschool tuition is more than all her other bills combined. Rent for a two-bedroom apartment in San Francisco would run Rachel about $4,550 a month. Neighboring Oakland’s rent is much more affordable, but still averages a whopping $2,500 a month in addition to the commute. With rents averaging $3,330, Rachel wouldn’t even be able to afford downsizing to a one-bedroom in San Francisco.The difficulty in affording a move for her job is an unusual challenge for Rachel, a successful, independent person who has always earned her keep by the sweat on her brow. Her life has developed in line with her achievements. Now, though, Rachel’s efforts have landed her a dream job, but they cannot sustain the living expenses. The scale is tipped, the conditions imbalanced. She is qualified to teach students in San Francisco, but not capable of living in their city.

Rent for a two-bedroom apartment in San Francisco would run Rachel about $4,550 a month. Neighboring Oakland’s rent is much more affordable, but still averages a whopping $2,500 a month in addition to the commute. With rents averaging $3,330, Rachel wouldn’t even be able to afford downsizing to a one-bedroom in San Francisco.The difficulty in affording a move for her job is an unusual challenge for Rachel, a successful, independent person who has always earned her keep by the sweat on her brow. Her life has developed in line with her achievements. Now, though, Rachel’s efforts have landed her a dream job, but they cannot sustain the living expenses. The scale is tipped, the conditions imbalanced. She is qualified to teach students in San Francisco, but not capable of living in their city. Being priced out of certain neighborhoods has been a reality for Americans. This is a difficult situation, but could she make it work if she really wanted to? There’s options. Possible options range from having a roommate, maybe two, asking someone to borrow money, even just making do and enduring a long commute to the city.

Being priced out of certain neighborhoods has been a reality for Americans. This is a difficult situation, but could she make it work if she really wanted to? There’s options. Possible options range from having a roommate, maybe two, asking someone to borrow money, even just making do and enduring a long commute to the city.