Millennials are Driving the Trend in Real

Estate Investment

Many have been skeptical that Millennials are interested in homebuying, but various reports show Millennials’ growing interest in real estate investment. A RealtyShares report on Americans’ investment preferences indicates that 55 percent of Millennials are interested in real estate. This interest is mirrored in research from Fannie Mae that states 85 percent of Millennials see real estate as a good investment.

A recent Forbes article shows they are driving the trend of real estate investment and investing less in the stock market. A little over half of Americans were investing in the stock market last year, a decrease from almost two-thirds in 2007. In the report, Millennials were asked to choose the “best-performing investment since 2000.” While 40 percent reported uncertainty, 25 percent chose the stock market, and 20 percent of Millennials believed real estate performed the best since 2000.

Desirée Patno, NAWRB CEO &

President, Named Top 4 Real

Estate Influencer to Follow

“I am honored and humbled to be Ranked #4 amid the Top 10 Real Estate Influencers to Follow from Entrepreneur.com. As NAWRB continues our mission to advance women’s diversity and inclusion in the housing ecosystem, I am energized by the depths of conversations we are having to drive women to the forefront with accountability and results. Finding passionate, committed strategic partners and individuals in moving the needle in the right direction for women to have a seat at the table for economic growth is a dream come true.” -Desirée Patno

Women Entrepreneurs Make

Progress on the Policy Front

When I first began advocating for women entrepreneurs over 15 years ago, I was excited to take on the challenge. At that point the majority of meetings I went to on Capitol Hill consisted mostly of men, and no one was focusing on women business owners. For the first five years, I spent most of my time convincing the Congress that women business owners cared about economic issues that affected the growth of their business instead of the social issues “women” cared about. Not only was there a lack of understanding about women entrepreneurs, there was also a disparity between male-owned and women-owned businesses. The women’s business community’s favorite phrase was “we want a seat at the table.”

NAWRB Nexus Conference

2017: Early Bird Special Ends

May 31, 2017

The NAWRB Conference is the nucleus, the center, and the source of business sustainability. As a non-partisan organization, NAWRB still has a seat at the table. Our relationships at the forefront allow us an inside look at government contracting forecasts. What opportunities does the future hold? Millions of dollars in procurement contracts and vendor relations were secured from connections made at the 2016 NAWRB Conference. Unlock your business growth!

NAWRB Roaring Thirty Award Nominations! DEADLINE May 31

The NAWRB Roaring Thirty Awards honor the women leaders in the housing ecosystem making a difference with a seat at the table for women. These are trailblazers succeeding through unprecedented obstacles and demonstrating women’s power as influencers in business.

In the News!

In the News!

The Federal Government Achieves Small Business Procurement Contracting Goal for the 4th Consecutive Year

The federal government has reached its small business federal contracting goal for the 4th consecutive year, awarding 24.34% ($99.96 billion) in federal contract dollars to small businesses.

Census Bureau Highlights Travel Data

The U.S. Census Bureau released a series of travel-related products to highlight travel dataduring peak tourist seasons.

Upcoming Events

If an event involves women’s equality and supporting the women’s

movement, NAWRB strives to be there. Join us to take part in making

a better tomorrow!

May 25: InnovateHER Challenge 2017

NAWRB is excited to announce that we are once again co-sponsoring the InnovateHER Challenge 2017 with the U.S. Small Business Administration (SBA)! The InnovateHER competition aims at discovering women entrepreneurs with innovative ideas.

June 8: C.A.R. WomanUP! Conference

This one-day event dedicated to the empowerment of women will help you grow your business, develop your career and connect with other leaders in the California brokerage community.

June 8-9: IMN 2nd Annual Residential Mortgage Notes, Non- & Re-Performing Loans Symposium

With approximately $20 billion in non-performing loans already sold in 2016, the conference is well-timed for the industry to discuss the trading in the market.

June 20-21: MBA National Advocacy Conference 2017

The National Advocacy Conference is the largest advocacy event of the year focused solely on the issues facing real estate finance.

June 20-22: WBENC National Conference & Business Fair 2017

With three days of programming, the conference features lectures and presentations from today’s thought leaders, engaging panel discussions and more.

June 29: The Latino Coalition Economic Opportunity Summit

Guest speakers will delve into the most topical issues during a day that will cover TLC’s “four C’s” of business ownership: Capital, Capacity, Contracts and Cost.

July 16-19: NAWRB 4th Annual Conference, Women’s Collaboration for the Future

The NAWRB Annual Conference will highlight actionable solutions to increase women’s gender equality in the American workplace. The only way to beat the competition tomorrow is by preparing today. Register to take your business to new heights!

Login

Login

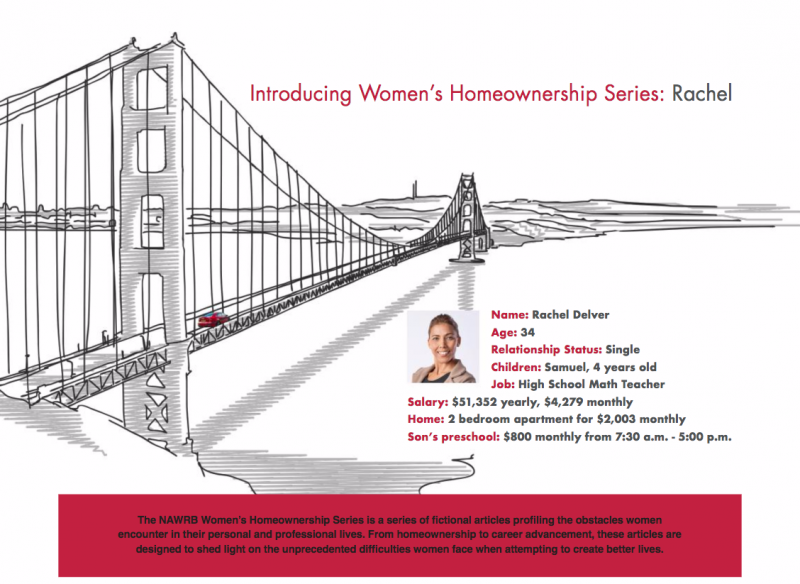

Commuting to San Francisco from her home is out of the question. A two-hour commute would mean having to leave home before 5:00 a.m. and moving closer, perhaps to Oakland, still results in a commute exceeding an hour.

Commuting to San Francisco from her home is out of the question. A two-hour commute would mean having to leave home before 5:00 a.m. and moving closer, perhaps to Oakland, still results in a commute exceeding an hour. Despite earning more than the median weekly income of $1,049 for women with a bachelor’s degree or higher, Rachel’s salary doesn’t go very far in the City by the Bay. In fact, after rent, Sam’s preschool tuition is more than all her other bills combined.

Despite earning more than the median weekly income of $1,049 for women with a bachelor’s degree or higher, Rachel’s salary doesn’t go very far in the City by the Bay. In fact, after rent, Sam’s preschool tuition is more than all her other bills combined. Rent for a two-bedroom apartment in San Francisco would run Rachel about $4,550 a month. Neighboring Oakland’s rent is much more affordable, but still averages a whopping $2,500 a month in addition to the commute. With rents averaging $3,330, Rachel wouldn’t even be able to afford downsizing to a one-bedroom in San Francisco.The difficulty in affording a move for her job is an unusual challenge for Rachel, a successful, independent person who has always earned her keep by the sweat on her brow. Her life has developed in line with her achievements. Now, though, Rachel’s efforts have landed her a dream job, but they cannot sustain the living expenses. The scale is tipped, the conditions imbalanced. She is qualified to teach students in San Francisco, but not capable of living in their city.

Rent for a two-bedroom apartment in San Francisco would run Rachel about $4,550 a month. Neighboring Oakland’s rent is much more affordable, but still averages a whopping $2,500 a month in addition to the commute. With rents averaging $3,330, Rachel wouldn’t even be able to afford downsizing to a one-bedroom in San Francisco.The difficulty in affording a move for her job is an unusual challenge for Rachel, a successful, independent person who has always earned her keep by the sweat on her brow. Her life has developed in line with her achievements. Now, though, Rachel’s efforts have landed her a dream job, but they cannot sustain the living expenses. The scale is tipped, the conditions imbalanced. She is qualified to teach students in San Francisco, but not capable of living in their city. Being priced out of certain neighborhoods has been a reality for Americans. This is a difficult situation, but could she make it work if she really wanted to? There’s options. Possible options range from having a roommate, maybe two, asking someone to borrow money, even just making do and enduring a long commute to the city.

Being priced out of certain neighborhoods has been a reality for Americans. This is a difficult situation, but could she make it work if she really wanted to? There’s options. Possible options range from having a roommate, maybe two, asking someone to borrow money, even just making do and enduring a long commute to the city.