Know an Incredible Woman Preserving the

Quality of Life During COVID-19?

Submit your story today!

Read More

Consulting & Branding Opportunities

Grant your business access to insider,

proven knowledge to improve the quality of your procured

services and maximize business performance.

If you need D&I

Contact Us!

A Team Focused on Bring Diversity and Inclusion to Every Level

Learn More

#1 Top Real Estate Influencer

Desiree Patno

Diversity & Inclusion, Quality of Life, Know the Rules of the Game ®

Your Next Event

Grow Your Business

NAWRB: An SBA Resource

NAWRB is listed as a women-owned business resource for the SBA.

Check It Out

NAWRB Aging Population

Help Protect Elders

from Financial Abuse

Over $36.5 billion a year is lost annually in the U.S.

Prevent Financial Abuse

Women's Homeownership:

Dream. Stability. Sanctuary.

Life often presents us

with unplanned disruptions.

AI Technology

with

a Human Touch

Is

The Perfect Balance

NAWRB Women's Global Resource Center

A women’s depository for vendors & clients to grow their diverse spend & increase women’s employment at all levels within the housing ecosystem.

Author Archives: NAWRB

Memberwide Midyear Dial-In

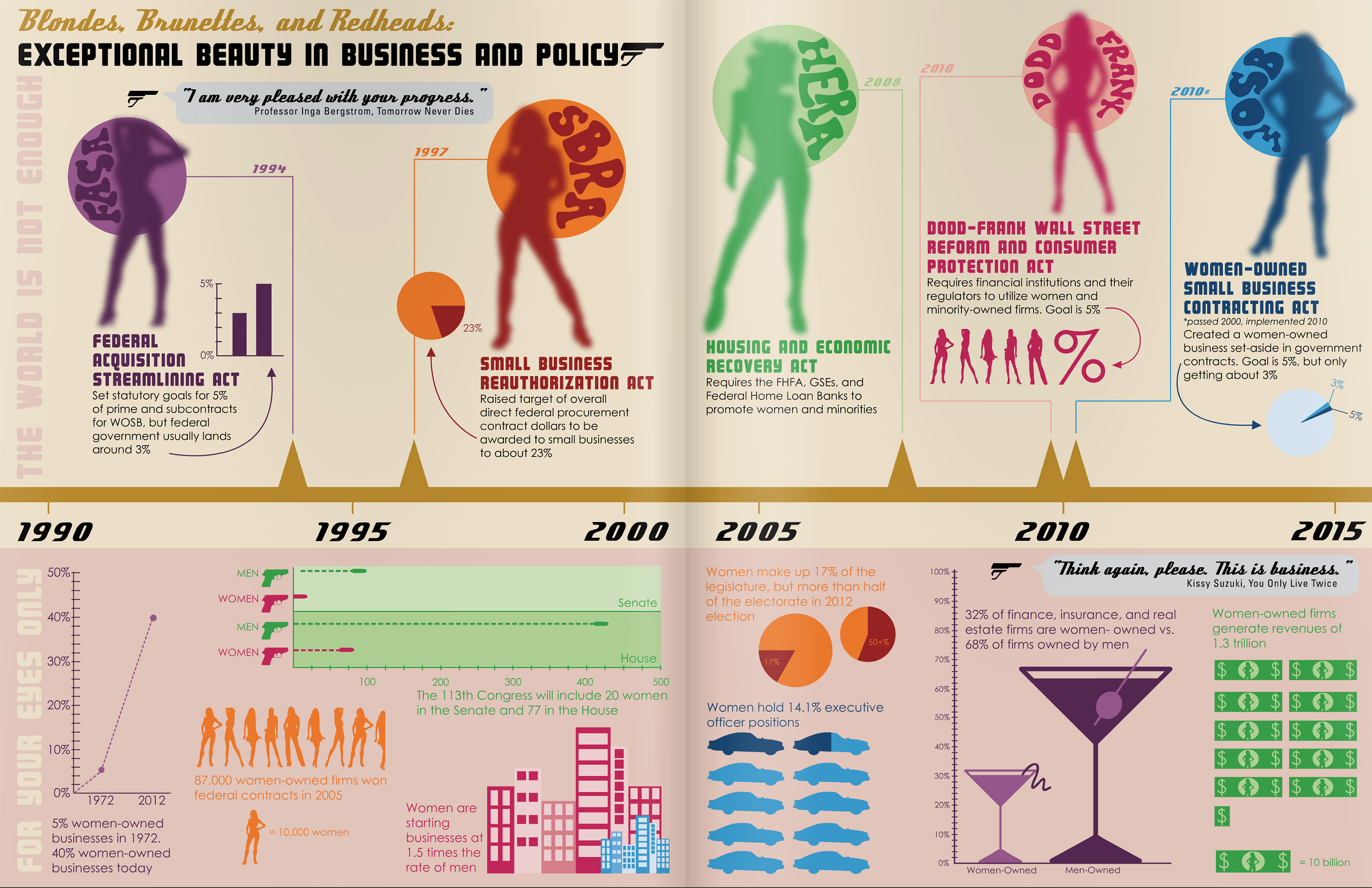

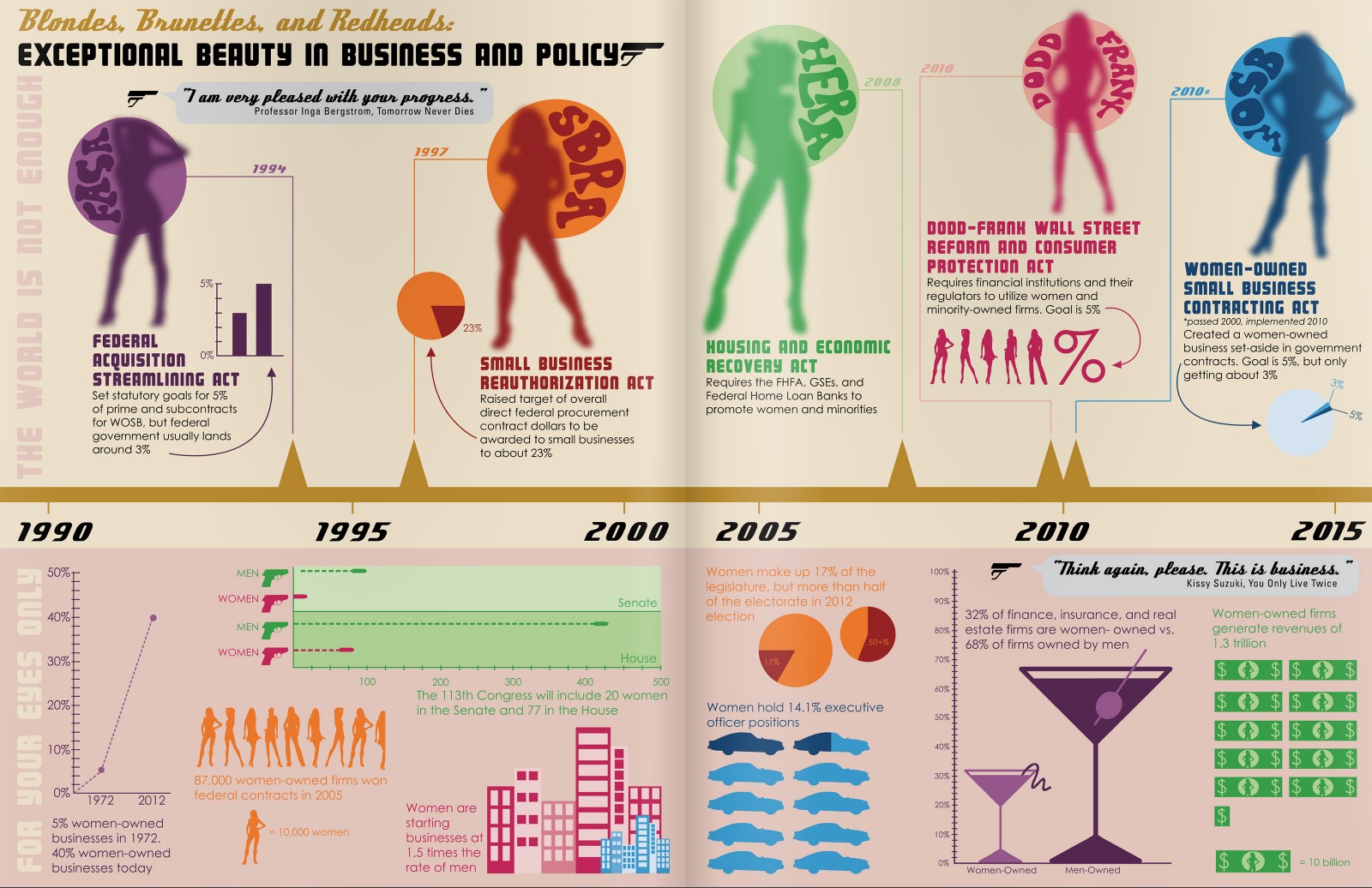

Exceptional Beauty in Business and Policy

Featured in NAWRB Magazine (Vol 1: Issue 6)

REO

Featured in NAWRB Magazine (Vol 1: Issue 3)

Glenda Gabriel

Glenda Gabriel

An industry change agent serving as a relentless champion for sustainable homeownership for underserved and multicultural customers

As the United States becomes increasingly diverse, it is imperative that businesses build strategies and create outreach initiatives to connect with and better serve multicultural consumers and communities. It is also vital for businesses to understand the consumer dynamics that shape demand for their products and services, and to recruit the right talent to lead through an increasingly complex business environment. Glenda Gabriel as always been known in the industry as a strategic thinker with the ability to lead through complex business issues, and this underlying capability is why she was sought out by Bank of America.

As Bank of America’s Neighborhood Lending Executive, Gabriel leads a team dedicated to meeting the homeownership needs of low-to-moderate-income and multicultural customers, whether they are those with modest means or clients with substantial wealth. Gabriel and her team connect and build relationships with key real estate market influencers, including local and national non-profit housing organizations, multicultural real estate trade organizations and others to educate consumers and connect them to the products, programs, tools and resources that enable successful homeownership.

Continue reading →

2012 Outlook

How brokerages can diversify and prosper in the new year

For the typical REO brokerage, 2011 saw an increase in requirements and overhead but not necessarily inventory. Major changes occurred in the regulatory, legislative, and overall business climate but little of that translated into increased REO volume for brokerages. The industry will close the year with an estimated seventy percent drop in inventory levels.

Amidst the uncertainty surrounding future housing policy, 2012 will bring significant changes. HUD is on schedule to issue a new wave of contracts, known as M&M 3.5, and the agency has made significant changes to the size of their geographic regions that should lead to smaller contract areas and more overall contractors. Beginning in the new year, brokers in many states will have new opportunities to earn local listing broker (LLB) contracts with this new wave of asset management companies.

In late 2011, HUD, Treasury, and the Federal Housing Finance Agency (FHFA) issued a joint Request for Information (RFI) to explore a possible REO to rental strategy. This strategy-if carefully and selectively implemented-could buttress recovery in a number of markets and allow REO brokers to expand the scope of their businesses.

REO to rental is similar to what many brokers are already doing if they are managing a high volume of occupied properties or have had to manage an asset for a number of years. In our response to the RFI through the National Association of Women REO Brokerages (NAWRB), we suggested that REO to rentals could work in certain markets and should be explored as a possible “tool in the tool shed” to aid recovery.

Login

Login

What brokers have to understand is that their brokerages must follow the market. The next several years will require diversified default services businesses that can handle cradle to grave REO disposition, short sales, property management, and put homeowner outreach at the center of each of those areas of business.

This year has shown that REO brokerages need to diversify to prosper in this market and, more than likely, three to five years thereafter. For the brokers who can translate their skill set into well-rounded default services professionals, not just an REO agent or short sale expert, they will survive-and prosper-in 2012.