Freddie Mac and Fannie Mae have strengthened their efforts to sell their high number of delinquent, non-performing loans (NPLs). From helping the taxpayer to providing opportunities for minority- and women-owned businesses, the reasons for the newfound auction fervor are several. Continue reading

Know an Incredible Woman Preserving the

Quality of Life During COVID-19?

Submit your story today!

Read More

Consulting & Branding Opportunities

Grant your business access to insider,

proven knowledge to improve the quality of your procured

services and maximize business performance.

If you need D&I

Contact Us!

A Team Focused on Bring Diversity and Inclusion to Every Level

Learn More

#1 Top Real Estate Influencer

Desiree Patno

Diversity & Inclusion, Quality of Life, Know the Rules of the Game ®

Your Next Event

Grow Your Business

NAWRB: An SBA Resource

NAWRB is listed as a women-owned business resource for the SBA.

Check It Out

NAWRB Aging Population

Help Protect Elders

from Financial Abuse

Over $36.5 billion a year is lost annually in the U.S.

Prevent Financial Abuse

Women's Homeownership:

Dream. Stability. Sanctuary.

Life often presents us

with unplanned disruptions.

AI Technology

with

a Human Touch

Is

The Perfect Balance

NAWRB Women's Global Resource Center

A women’s depository for vendors & clients to grow their diverse spend & increase women’s employment at all levels within the housing ecosystem.

Daily Archives: August 24, 2015

NWBC to Address Venture Capital Gender Gap

The National Women’s Business Council (NWBC)—a non-partisan federal advisory council that advises the President, Congress and the U.S. Small Business Administration on economic issues regarding women business owners—will host a panel discussion addressing the gender gap in venture capital on September 11, 2015 at 2PM EST. Continue reading →

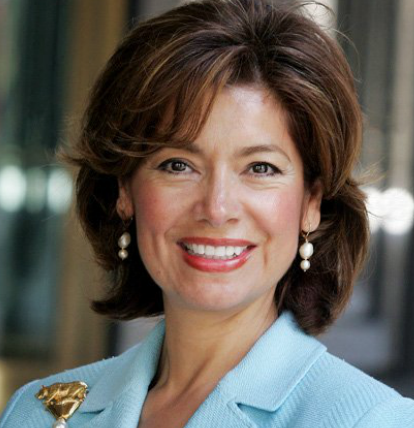

Maria Contreras-Sweet

The 24th Administrator of the U.S. Small Business Administration (SBA)

Maria Contreras-Sweet

From founding ProAmérica Bank to her appointment by President Obama as the 24th. Administrator of the SBA, Maria Contreras-Sweet has made incredible strides in her career. She divulges to NAWRB her personal role models, journey to the SBA, and what she’s doing to champion for small businesses.

NAWRB: You have an extensive background working in government with your first introduction as a secretary for the Speaker of the California State Assembly. Was it a long-time goal of yours to work in government?

Maria Contreras-Sweet: I always believed in public service but my career path took me into business. My time in government has been some of the most rewarding work of my life. Before I started my own bank, I spent five years running a large government agency back in California that had jurisdiction over Business, Transportation and Housing. When I say “large” – we had 44,000 employees, 14 departments and a $14 billion budget. We were able to do a lot of important things, such as creating the Department of Managed Health Care and its Office of Patient Advocate, passing a $2.1 billion bond for affordable housing, and initiating construction on the San Francisco-Oakland Bay Bridge – one of the largest infrastructure projects.

Continue reading →

Login

Login